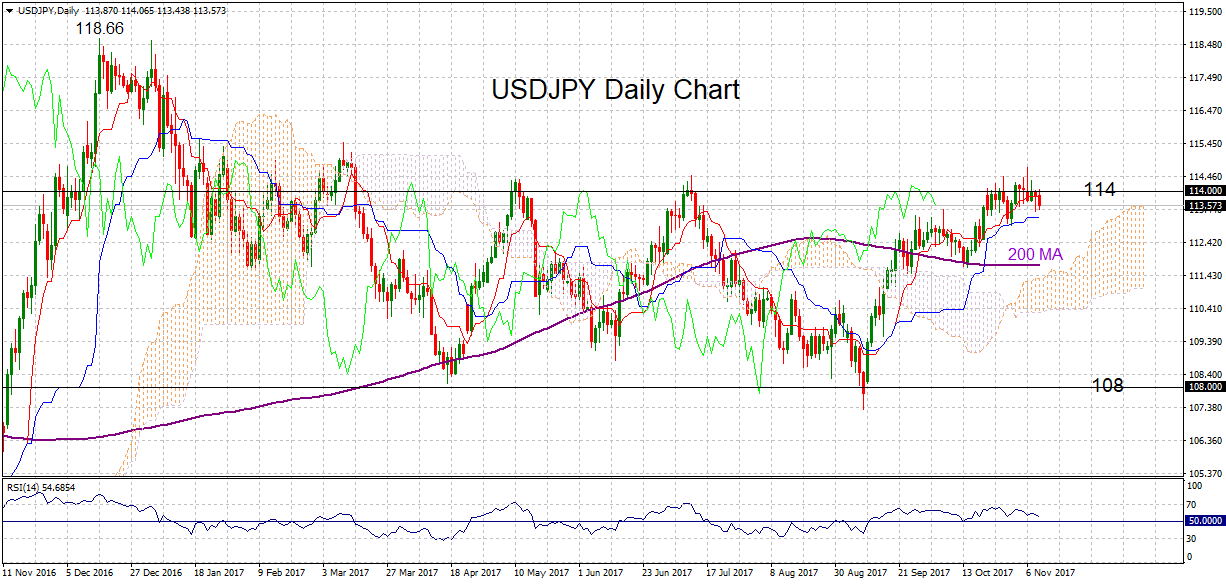

USDJPY has been range-bound during the past 2 weeks, trading at the top of a broader 7-month range. The short-term bullish phase has lost momentum as indicated by the RSI.

USDJPY has been range-bound during the past 2 weeks, trading at the top of a broader 7-month range. The short-term bullish phase has lost momentum as indicated by the RSI.

The pair has been trading within a range of 112.95 and 114.73 since October 23 following a steady rise off the 108.00 area. Ichimoku cloud analysis is showing that the Tenkan-sen and Kijun-sen lines are positively aligned but are shifting to neutral.

USDJPY is starting to come under pressure but immediate support is expected at 113.17. Failure to hold at this level would shift the market’s focus to the downside. A sustained break of the key 113.00 level could lead to an extension lower towards the 200-day moving average (111.72). From here the near-term outlook starts to look bearish with scope to fall towards the bottom of the range in the 108.00 area.

To the upside, immediate resistance lies at 114.00, which if broken, would see a re-test of Monday’s high at 114.73. Rising above this top would take prices to the next peak at 115.50 hit in March. From here there is little resistance until the 118.00 handle.

In the bigger picture, the trend is neutral but the short-term bullish phase has stalled and is at risk of reversing if there is continued rejection at the 114.00 area.

Origin: XM