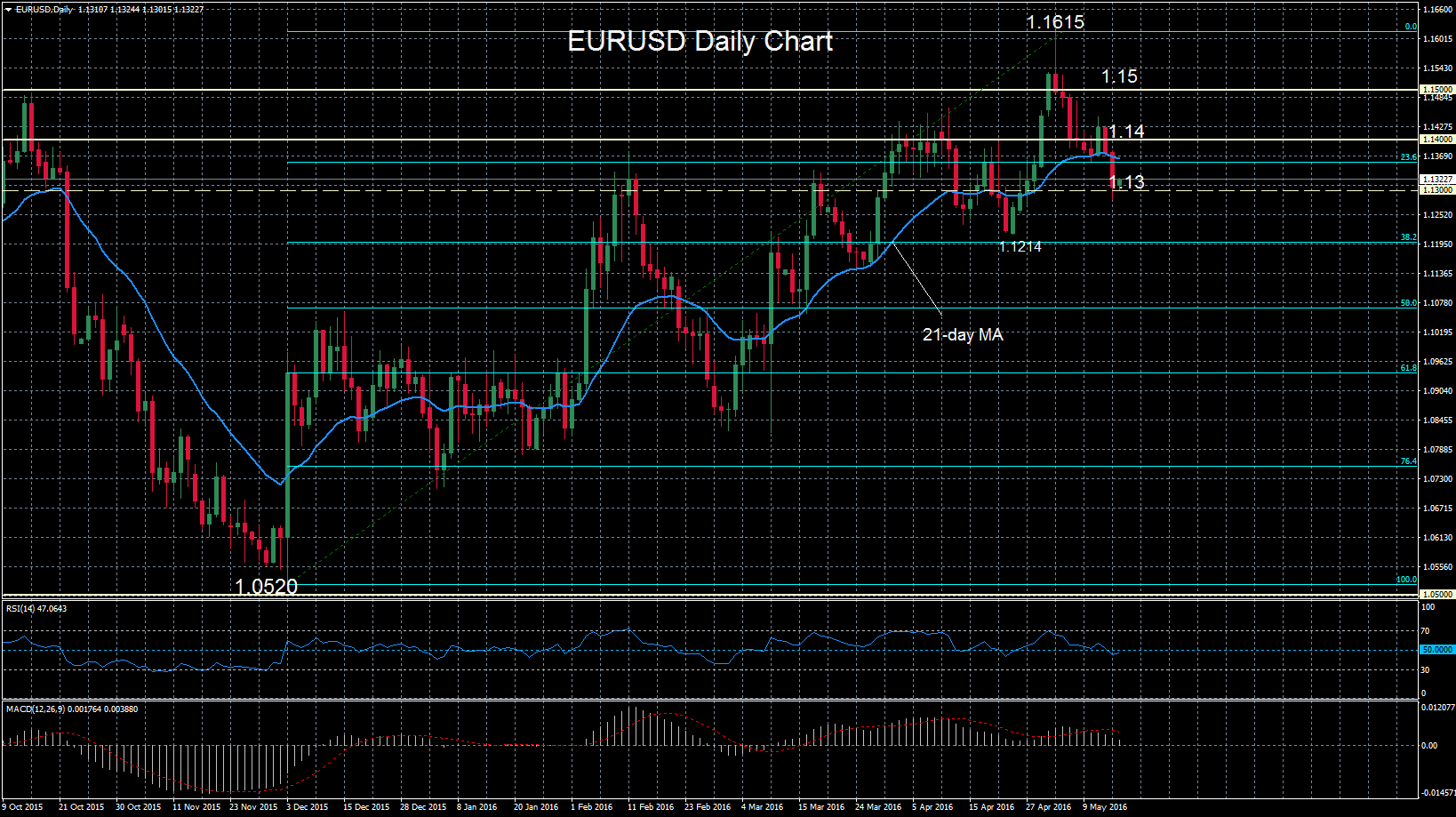

EURUSD is vulnerable to more downside in the near term after Friday’s big drop and dip below the key 1.13 level. On Monday the pair opened back above 1.13 and this level will act as immediate support. But the technicals suggest there is risk of further weakness. The break below the 21-day moving average is a bearish signal. Also, RSI has dipped below 50 into bearish territory.

EURUSD is vulnerable to more downside in the near term after Friday’s big drop and dip below the key 1.13 level. On Monday the pair opened back above 1.13 and this level will act as immediate support. But the technicals suggest there is risk of further weakness. The break below the 21-day moving average is a bearish signal. Also, RSI has dipped below 50 into bearish territory.

However, the big picture shows the EURUSD pair in an uptrend. There was a steady rise from 1.0520 to 1.1615, from December to May. More than 23.6% of this upleg has been retraced so far. It remains to be seen whether this is a correction of the uptrend. A break below the 38.2% Fibonacci retracement would start to weaken the bullish bias and open the way for a test of the 50% level at 1.1067. Below this would start to shift the bias to more bearish.

Alternatively, a move back above the 23.6% Fibonacci would keep the long term up trend intact. A move above the 1.14 level would see prices target 1.15 and then retest the 1.1615 high.

Origin: XM