Dollar strength prevails on Jobs Friday

Dollar strength prevails on Jobs Friday

The US dollar maintained its northward bound on Friday as investors awaited the hotly anticipated jobs report out of the United States for possible clues about Fed tapering. There have been subtle hints from Fed policymakers in recent weeks that the time to start talking about tapering is nearing and a strong NFP print for June would fuel expectations that discussions on how and when to begin withdrawing some of the pandemic stimulus will be held over the summer.

Although any move to taper the $120 billion a month in asset purchases would likely be gradual, it would still make the Fed among the first central banks to start the process. Moreover, the sooner the Fed begins to wind down bond purchases the sooner it can start raising interest rates and the recent jump in short-term yields is reflective of the growing belief among investors that the first rate hike will come in 2023 if not before.

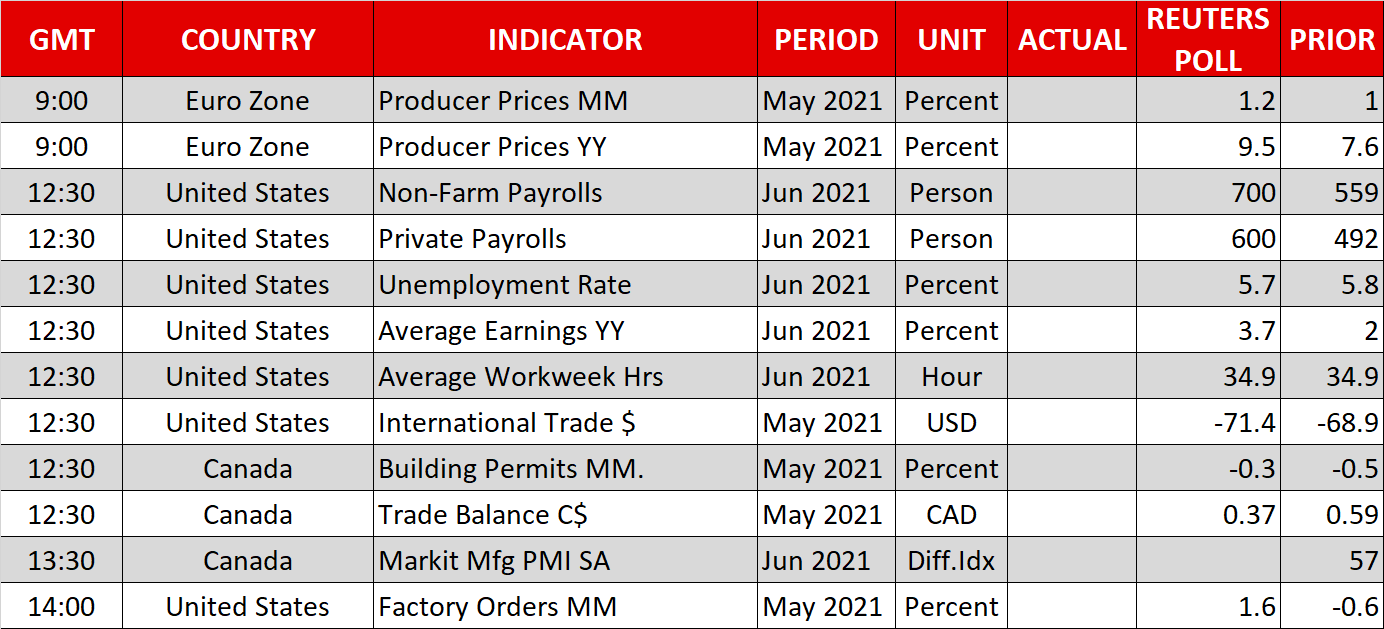

However, with the dollar having already surged significantly this week, there may be limited upside from a strong jobs print. Analysts are expecting nonfarm payrolls to have risen by 700k in June. Forecasts have nudged higher over the last couple of days even though businesses are still reporting difficulties in hiring due to the reluctance of many workers to rejoin the labour force.

The dollar is currently trading firmer on the day against a basket of currencies and has climbed to a fresh 15-month high of 111.65 versus the yen.

Stocks mostly positive, Asian jitters linger

Some safe-haven flows could also be supporting the greenback amid ongoing jitters about the fast spread of the Delta variant across Asia and the potential damage to the region’s recovery. However, there are also some concerns about tighter monetary policy in China as well as increased frictions between Beijing and Washington after Chinese President Xi Jinping warned that foreign forces that try to bully the country will “get their heads bashed”.

Shares in China closed sharply lower today, with the CSI 300 index plunging by 2.8%. But Tokyo stocks ended their four-day losing streak and the Nikkei 225 index closed up 0.3%. European bourses looked set for modest weekly gains after an initial poor start to the trading week.

On Wall Street, the S&P 500 had another record session on Thursday, finishing the day up 0.5%. US stock futures were last indicating a slightly higher open. However, how they end the week rests on the NFP report due at 12:30 GMT and specifically, how yields will respond to the jobs data, as a big positive surprise that causes a spike in the 10-year yield would be detrimental for growth and tech stocks.

Gold extends gains but oil struggles on OPEC+ uncertainty

Among the major currency pairs, the euro, pound and aussie slid to fresh multi-month lows against the bullish greenback, while the kiwi and loonie headed towards their June troughs.

Gold was on course for a third straight day of gains despite the advancing dollar. The precious metal may have found support in the renewed virus woes that have hurt sentiment in Asia, though subdued long-term Treasury yields may also be propping up gold prices.

But aside from the US jobs report and dollar, the other focus today is on oil as OPEC and its allies have yet to reach a decision on whether to raise production. Yesterday’s ministerial meeting of the OPEC+ alliance was postponed to Friday after the United Arab Emirates blocked plans for a gradual boost to output by the end of 2022.

Oil prices soared on Thursday on expectations that the major producers would agree on a modest easing of the supply curbs, but the reported disagreements have dampened the rally. WTI and Brent futures were last trading slightly down on the day within the $75/barrel handle.

Origin: XM