When it’s time to take a deep breath and replace your car, you’d never dream of buying a new one without test driving it first. And when you’re shopping for clothes, you’d never pay for them and leave the store without having tried them on.

Checking things out to see if they really are what we want, or are suitable for our individual needs, is in our nature. Why, then, would you ever sign up to a new broker and begin investing your cash without so much as a second glance?

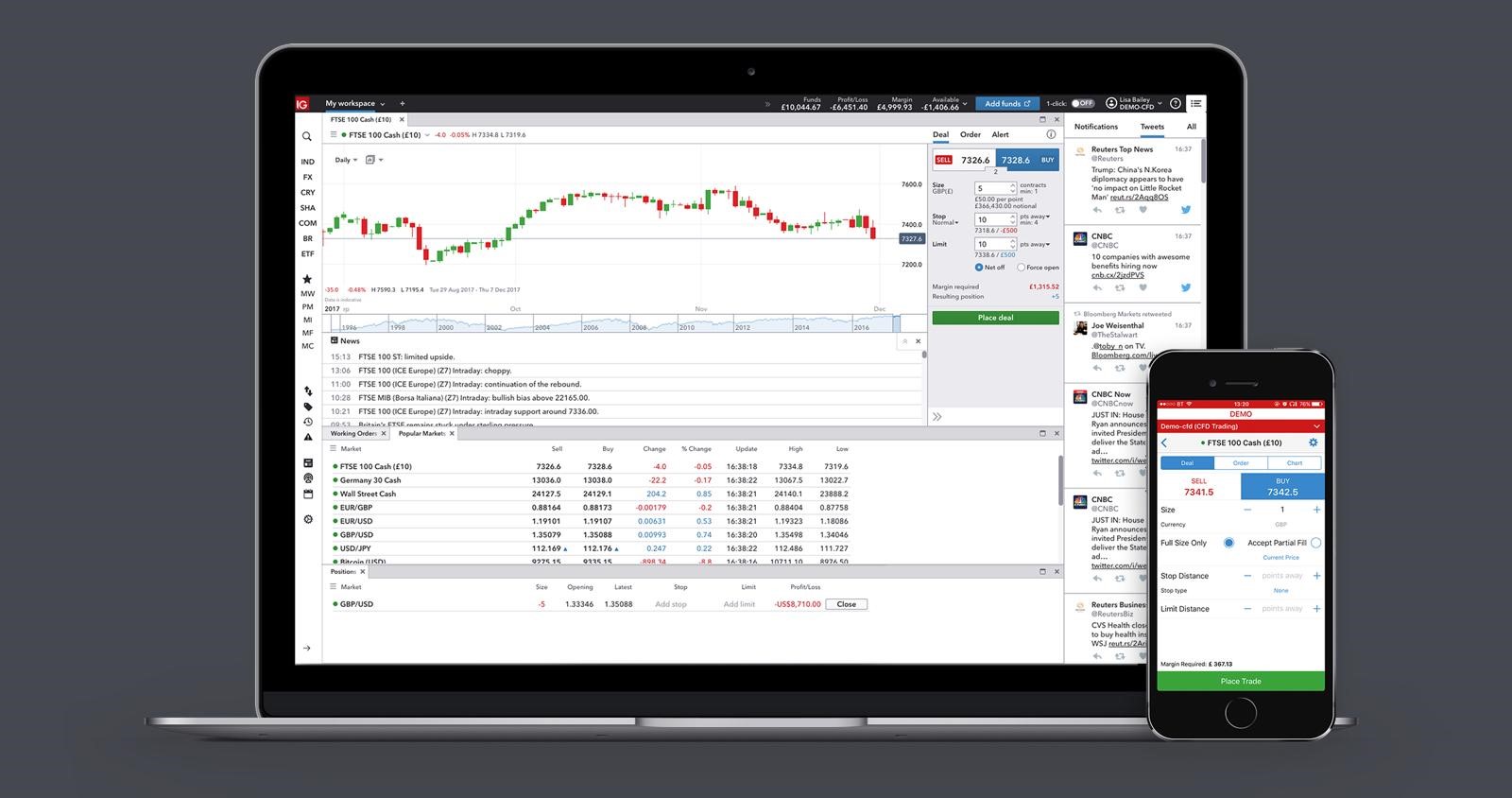

Demonstration accounts are available on all reputable Forex trading platforms for a reason: they let you experience everything the platform offers, including charting, analytical tools, and standard of service, for free. You don’t need to hand over a cent of your hard-earned money to be acting on the same financial market news as the professionals.

If you’re sensible, you’ll sign up to a few demo accounts to make sure you get the right fit. Just as you will likely try out a few cars instead of buying the first one you take on a test drive. Like many areas of business, not all brokers are trustworthy or even entirely legal. By searching for the best fit for you, and becoming confident on a demo account, you can be much more certain that your broker is above board.

Before you get started, it’s best to have an idea of what goals you want to achieve from trading, and which strategies and markets you’re likely to use. Most of the bigger, reputable brokers have a huge selection of individual stocks, indices like the Dow Jones or FTSE 100 you can trade on, commodities like gold, silver and oil, and currency trading, called FOREX.

You want to ensure you end up investing with a broker who offers you the services you want, rather than a load of options that realistically you’ll never use. If you’re never going to dabble in binaries, don’t put your money in a platform that specialises in those.

The only way you can properly understand if a broker is right for you is to test out its demo version. And if it doesn’t have one? Walk away just as you would if the car salesman refused to let you go for a test drive.

Another clear benefit of selecting demo accounts is that you can try out some strategies with play money. You’ll be using the real-time charts, the same technical analysis tools and margins as you would with a real money account, so this is how you can not only test the platform but try out some techniques without risking a penny.

Rather than just trying one trade, you might build a dummy portfolio, investing trades across a range of currency pairs, stocks and commodities to begin to understand how spreading your risk – even a play money risk – might be the most sensible course of action in the long term.

You can use your demo account to learn the fundamentals of technical analysis. Some tools are easier to get to grips with, like simple moving averages and the relative strength index, but you can try any of them and see if using one or better still a combination of them, can increase your chances of making a profitable trade.

After a while of carefree, non-cash trading, you might find you have the confidence to switch to a real-money account and see if you can transfer your early gains into a real profit.

However, be warned: the one thing a demo account cannot prepare you for is the psychology of trading. What do we mean by this? Well, how you react during trades when your actual money is on the line may well be different to how you did with play money. For example, you have to learn not to chase your losses, to let your winning trades “run”, meaning don’t take profit too early. It also means being able to cope with a losing trade, understanding you may lose more trades than you win. The trick is, so long as you make more money in your winning trades than you lose in your losing trades, you’ll be a net winner overall.

Getting freaked out over a losing trade, or a run of losing trades is a recipe for disaster. You have to understand you’re in this for the long-term. And remember, even if the financial market drops, you can still profit from it.

We haven’t mentioned promotions. Many brokers will offer you incentives to sign up and deposit your money. By spending time on their demo account, you’ll begin to get a feel for how genuine or beneficial these promotions can be. Don’t fall for the apparently “biggest offer” out there – do your research and understand if what’s being promised is at all achievable.

All in all, by sticking to the better-known trading platforms, like ETX Capital or IG Index, you’ll be in good hands, and you’ll get as much time as you want on a demo account to ensure you understand what you’re getting yourself into, and that the platform is as reliable and fair as it seems.