The Organized Trader

The Organized Trader

If you want be a top trader then making sure you are organized is paramount to achieving success. We have already publsihed an article detailing the 10 steps to learning binary trading, covering several key points that will help newcomers. However, in this article we’ll focus on one key aspect of being a successful trader, the organizational skills required.

If you want to get ahead in any part of market trading, or any career for that matter, then making sure you are on top of your workload and fully prepared is vital.

Set Goals

When starting out as trader it is important to know what you are working towards and what you want to achieve. On the website Investor Underground one key point to being an organized trader is setting goals using the S.M.A.R.T approach. The acronym stands for – Specific, Measurable, Assignable, Realistic, Time-oriented. Each one these goals are essential to becoming a top trader. The one we will focus on is time-oriented.

Time always seems to be running out, yet in many cases it is due to you not using it wisely. Set reasonable timeframe targets and make sure they get done to avoid work piling up. Setting a timeline for your goals is also a good way to stay motivated.

Be Consistent

To be organized means to stay consistent. It is recommended to have some idea of how you make decisions and execute trades before you start. This will help you to be prepared and to make the appropriate decisions. Staying consistent will also give you confidence in your ability as a trader. Knowing that your style works will give you an edge in the market. Traders who don’t work consistently often find themselves making poor transactions that lead to loss in profit.

Have a Strategy

When it comes to trading having a strategy is very important. Traders working without a strategy are gambling of the market and risk losing all of their investment. The worst thing an investor and trader and do is rely on luck. Luck might get you some great deals, but there is no safety net beneath luck and when a trade goes wrong it can lead to big losses. There are many types of strategy. Finance Magnates list them as fundamental analysis Strategy, technical analysis Strategy, basic options strategy, algorithmic and signals and co-integration trading strategy. Finding the best strategy for yourself may take time but once you find a few that work for you your trading capacity will increase.

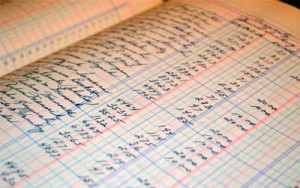

Write a Journal

Write a Journal

Keeping a trading journal is the best way to keep track of trade deals both good and bad. Leading market insight company FXCM states that it is one of the best ways in which a trader can learn from past success and failure. A trading journal is made up of several components including pre-market synopsis, a trading log, and a post-market recap. Keeping an accurate and organized record of past transactions will allow you to constantly review progress and spot any weaknesses. Trading is not defined and keeping a journal will help you with setting goals, staying consistent and keeping track of successful strategies.