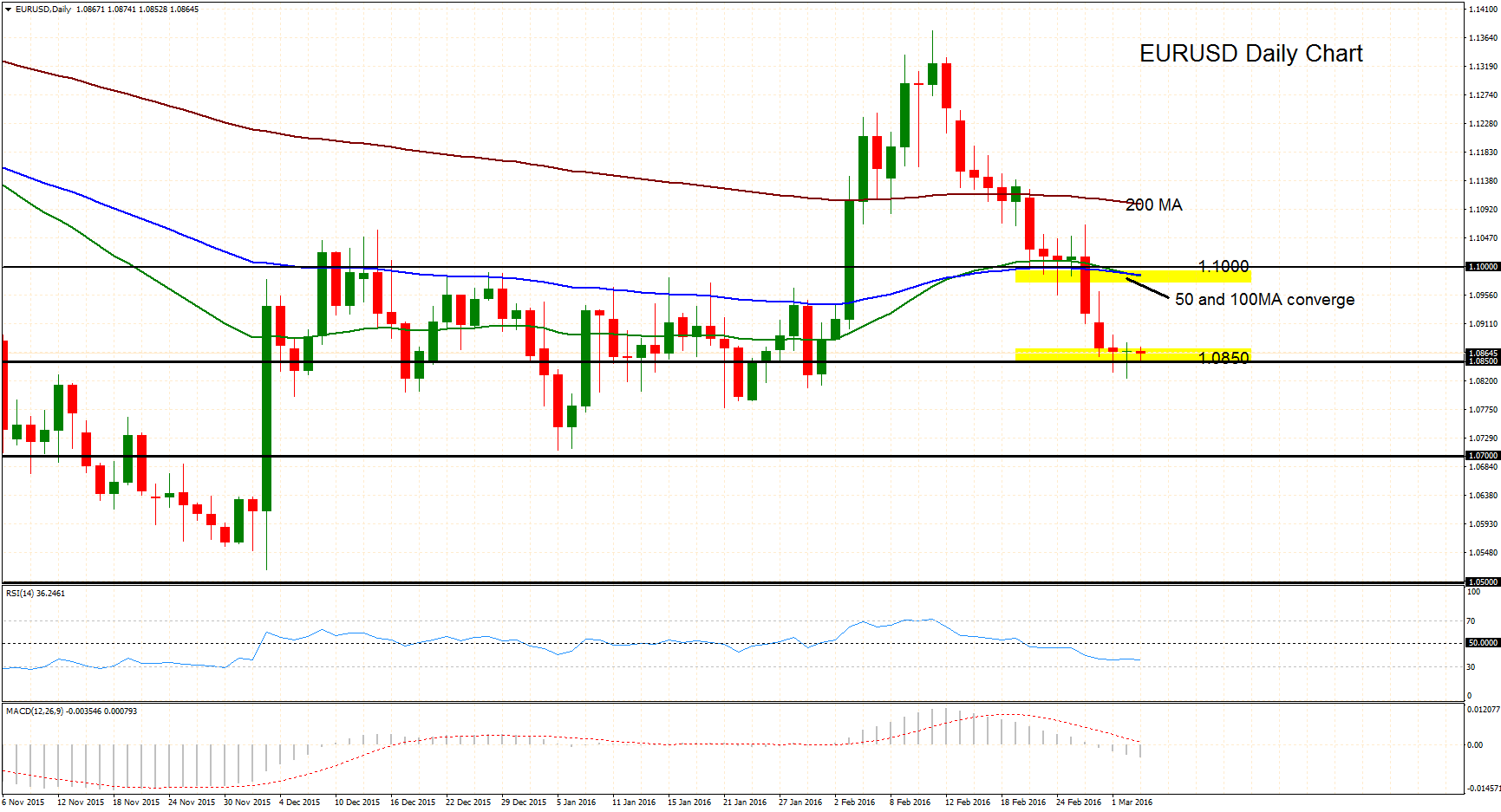

EURUSD has re-entered into the recent 1.07-1.10 range it has been trading in for the past three months. After rising above the 200-day moving average in early February, the market was unable to sustain the rally that took prices to 1.1375. A break below the 200MA accelerated a decline towards a key level at 1.0850 where the market has found support in the past three days. Failure for support to hold at this level would encourage a bearish view with scope for the market to target 1.0700, the bottom of the short-term range.

Meanwhile, any bounces higher from current levels will find resistance at the area around 1.10 and where the 50 and 100-day moving averages converge. Above this, the 200-day moving average will act as resistance. Failure to break above this resistance level would likely bring more bears into the market.

Upside momentum is looking very weak. RSI is below 50 and falling, while the MACD is trending down and approaching zero.

The long term outlook is bearish, with scope for the market to eventually trend down towards 1.0500. This is the lower bound of the one year range that EURUSD has been trading in.

Source: XM Broker