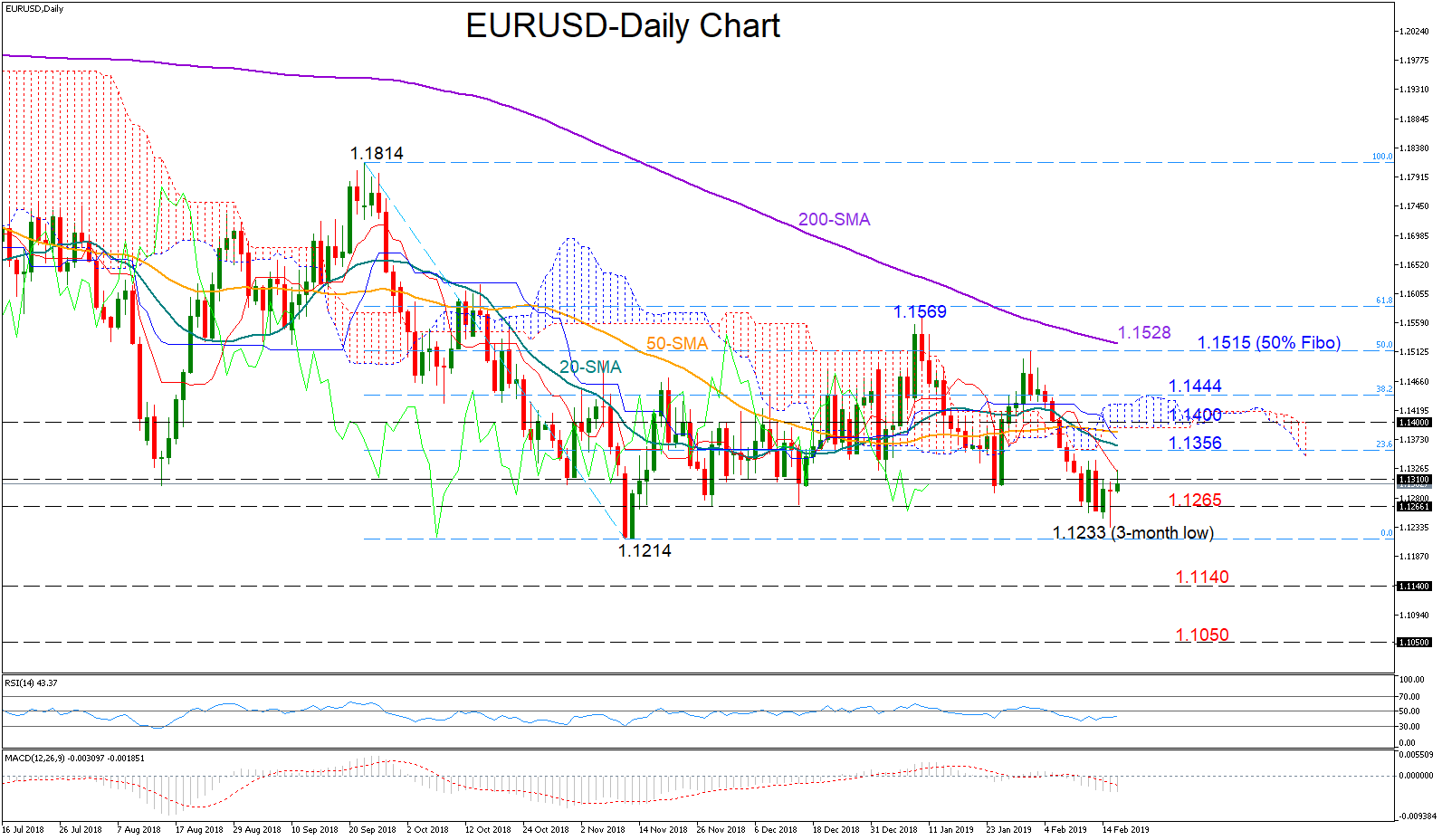

EURUSD registered a three-month low at 1.1233 on Friday before closing negative for the second consecutive week. On Monday the pair managed to rise back above the 1.1300 level, with momentum indicators shaping a bearish-to-neutral picture for the short term; the RSI is recovering towards its 50 neutral mark, the MACD seems to be showing easing negative momentum, while the red Tenkan-sen line continues to lose ground below the blue Kijun-sen line.

EURUSD registered a three-month low at 1.1233 on Friday before closing negative for the second consecutive week. On Monday the pair managed to rise back above the 1.1300 level, with momentum indicators shaping a bearish-to-neutral picture for the short term; the RSI is recovering towards its 50 neutral mark, the MACD seems to be showing easing negative momentum, while the red Tenkan-sen line continues to lose ground below the blue Kijun-sen line.

Support around 1.1265 should be in focus if bearish action resumes, while more importantly, a significant beat of the 1.1214 bottom would activate the long-term downtrend started from 1.2554 (January 2018), turning the medium-term outlook from neutral to negative. In such a case, the price could fall deeper to meet support around 1.1140, a frequently tested area during 2016-2017. If the sell-off continues then the next stop could be somewhere near 1.1050.

Alternatively, an extension higher could find immediate resistance from the 23.6% Fibonacci of 1.1356 of the downleg from 1.1814 to 1.1214. Should buyers drive the price above 1.14, the rally could pause near the 38.2% Fibonacci of 1.1444 before a crucial battle around the 200-day moving average which currently stands 1.1528 and slightly above the 50% Fibonacci. Further up and above the 1.1569 top, the market could experience fresh buying pressure.

Summing up, the short-term bias looks bearish-to-neutral, while the medium-term outlook holds neutral as long as the price trades below 1.1569.

Origin: XM