It’s a bank holiday in the US. As a result, no important data will be released. The US dollar index is falling. It has declined to $93.90 from the Friday’s high of $94.20. The next line of support is at $93.50. Tomorrow traders will take into consideration CB Consumer Confidence. If data is higher than anticipated, the greenback will have chances to rebound.

It’s a bank holiday in the US. As a result, no important data will be released. The US dollar index is falling. It has declined to $93.90 from the Friday’s high of $94.20. The next line of support is at $93.50. Tomorrow traders will take into consideration CB Consumer Confidence. If data is higher than anticipated, the greenback will have chances to rebound.

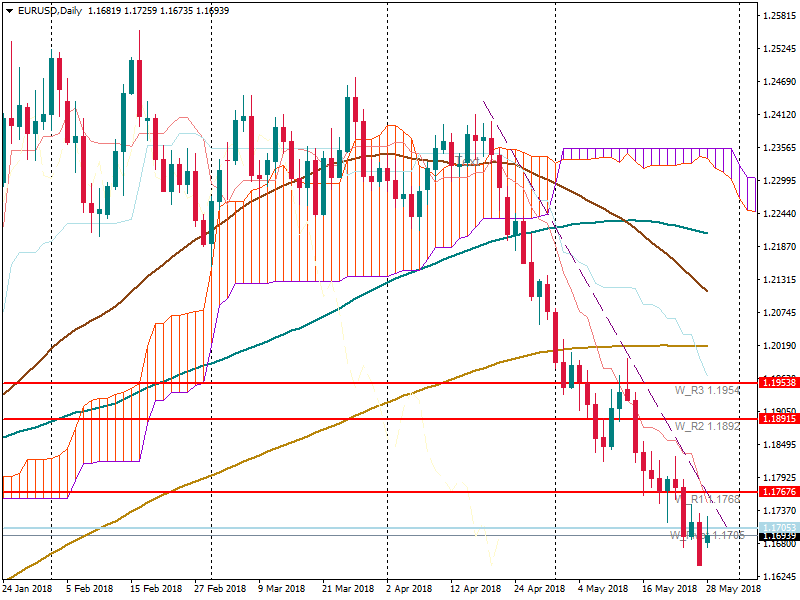

Euro is recovering on Italian news. A new Italian government failed to be formed as a president rejected a eurosceptic finance minister. As a result, the populist prime minister, Giuseppe Conte, resigned. The Five Star Movement is considering proposing impeachment of the President.

The euro is in the environment of uncertainties. On the on hand, the Eurosceptic finance minister was rejected, on the other hand, it’s unclear what will happen to Italy. EUR/USD has tested the pivot point at 1.17, however, didn’t stay above the level and declined. The trading is still bullish, however, it’s not extensive. If EUR/USD is able to close above the pivot point, there is a chance of the further rise. However, the trendline is an additional resistance for the pair. Tomorrow traders should pay attention to M3 Money Supply’s data. If it is greater than the forecast one, the euro will be supported. However, if the US dollar manages to recover tomorrow, the euro will turn around.

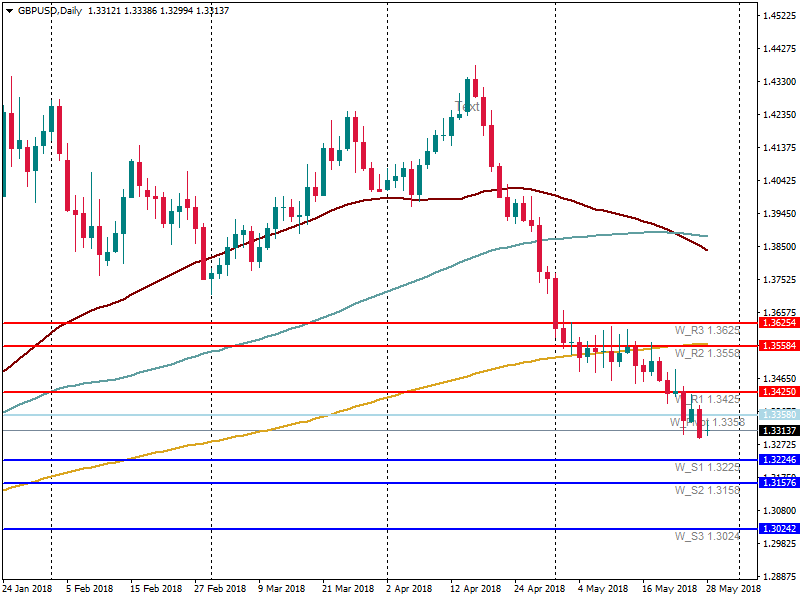

- The Brexit deal becomes more unclear. A British government invested $1.1 million in a European parliament’s election in May 2019. It seems like the UK doesn’t want to leave the EU. The UK’s exit is supposed to take place in March 2019, so, why did the country invest money in May’s elections? The pound is rising, however, the rise is not strong. The pair is still below the pivot point at 1.3360. It’s a UK bank holiday today. As no important data are anticipated, there is a risk that the pound will go downside. The support is at 1.3225.