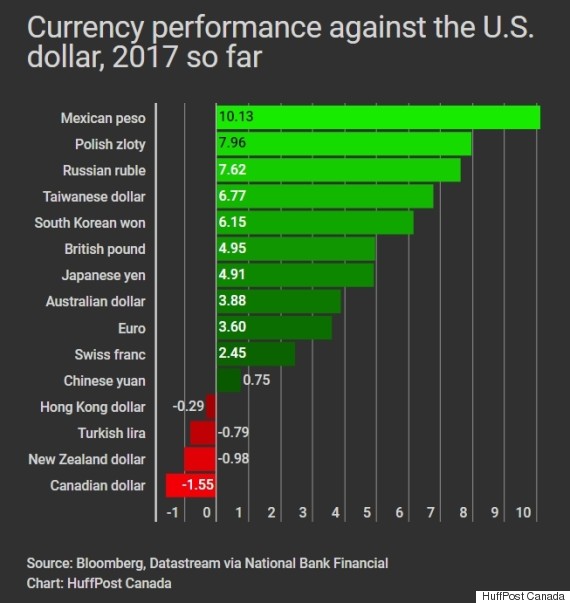

Comparatively speaking, the Canadian dollar has a similar performance in correlation with the USD in most years. It seems that the first half of 2017, however, doesn’t look like most years as the currency hit its lowest level in 14 months. A graph published by Huffington Post Canada listed the rates of various currencies against the USD and it’s clear that the CAD is heading in the wrong direction.

(image: Huffpost CA)

A combination of political and financial issues has been viewed as the main cause behind the poor performance of the CAD. Problems in mortgage lending and the housing market bred fear amongst citizens leading to a less volatile market and new policy proposals of the Bank of Canada involving reduced interest rates which resulted in negative sentiments that affected the currency.

Moreover, a report from BNN specified that increased oil production in the US means that Canada, a major oil supplier, manages fewer exports to its southern neighbour. Furthermore, the trade sanctions imposed by President Trump are making things worse.

On the contrary, the decision of other global oil exporters such as Russia and Saudi Arabia to prolong cuts with other producers has worked in Canada’s favour and allowed it to offset the losses in energy shipments to the US. The trade deficit in March has gone down as opposed to the month before due to a record-high on oil exports worldwide.

For Forex traders, this ongoing slump with the CAD is a cause for concern especially as it’s one of the world’s major currencies. Given the popularity of currency pairs trading, the most important markets including Canada are crucial for expanding investments, according to trading platform Teramusu.com, hence, it’s wiser to wait for the CAD to bounce back. A poll conducted by Reuters projects that the currency will strengthen after weathering the current ‘perfect storm’ and experts are convinced that it will happen over the next few months.

In hindsight, it appears there’s an underlying plan behind the steps taken by financial institutions such as the Bank of Canada. A weaker Canadian dollar might impact consumers, business owners and investors negatively, but on the bright side, it gives the country’s exports and labour more edge in the global markets. Looking past the fierce winds that batter the currency, it seems the eye of the perfect storm lies in the products and manpower that’s operated by the nation. In fact, economists who’ve analysed the gross domestic product (GDP) rates of Canada state that it grew by as much as 4% in the first quarter of this year.

All in all, the CAD may have hit its rock bottom in more than a year, but that leaves it with only one direction from here on – upwards. Stay updated with the latest about USD/CAD as well as other currency pairs through our Forecasts section.