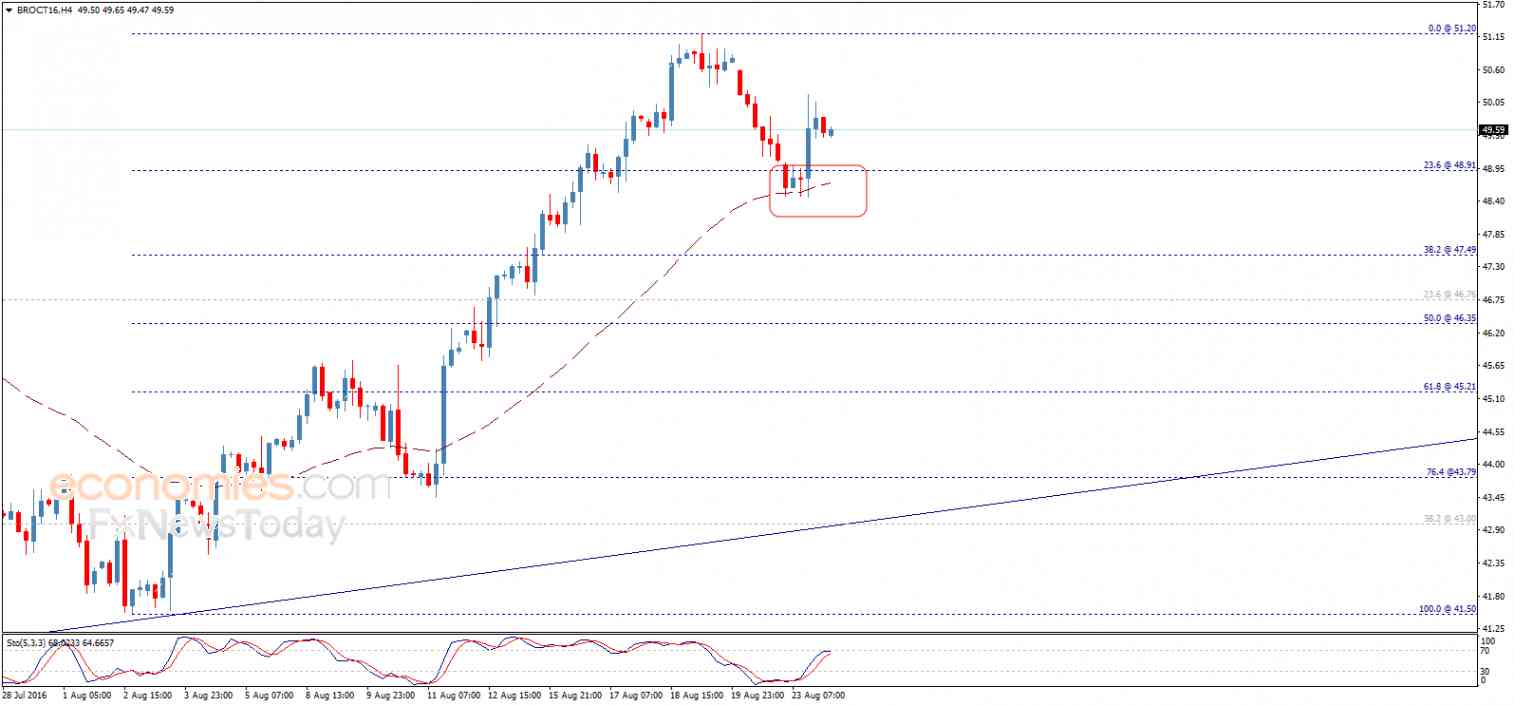

Brent oil price bullish rally stopped at 50.20, to show some bearish bias and settle around 49.50, sticking between the recently recorded top at 51.20 and 23.6% Fibonacci level that forms key support at 48.91, noting that the past two days’ high volatility makes us prefer staying aside until the price takes clear path on the intraday and short term basis.

Brent oil price bullish rally stopped at 50.20, to show some bearish bias and settle around 49.50, sticking between the recently recorded top at 51.20 and 23.6% Fibonacci level that forms key support at 48.91, noting that the past two days’ high volatility makes us prefer staying aside until the price takes clear path on the intraday and short term basis.

Stochastic provides negative overlapping signal that contradicts the positive support provided by the EMA50, and to get clearer signals for the next trend, the price needs to breach one of the key levels represented by 48.50 support and 51.20 resistance, noting that breaking this support will push the price for more bearish correction that targets 47.49 followed by 46.35 levels mainly, while breaching 51.20 level will lead the price to return to the main bullish track that its first main target located at 52.83.

Expected trading range for today is between 47.00 support and 52.00 resistance.

Expected trend for today: Depends on the above mentioned levels

Origin: Economies