The US dollar continues to lose ground against the euro on Wednesday. The European Central Bank meeting may bring about some changes.

The US dollar continues to lose ground against the euro on Wednesday. The European Central Bank meeting may bring about some changes.

Will the ECB meeting help strengthen the euro?

Today’s European Central Bank meeting on non-monetary policy issues may change the EURUSD rate. In anticipation of the ECB’s monthly and meeting reports, the euro may slightly strengthen against the US dollar.

Wednesday is rich in news with a weak economic effect, and this news typically does not significantly impact the quotes individually. The eurozone and US news may positively affect the EURUSD forecast, but this influence will be short-lived. When the news for 19 June 2024 is released, the EURUSD pair may slightly strengthen before further losing ground.

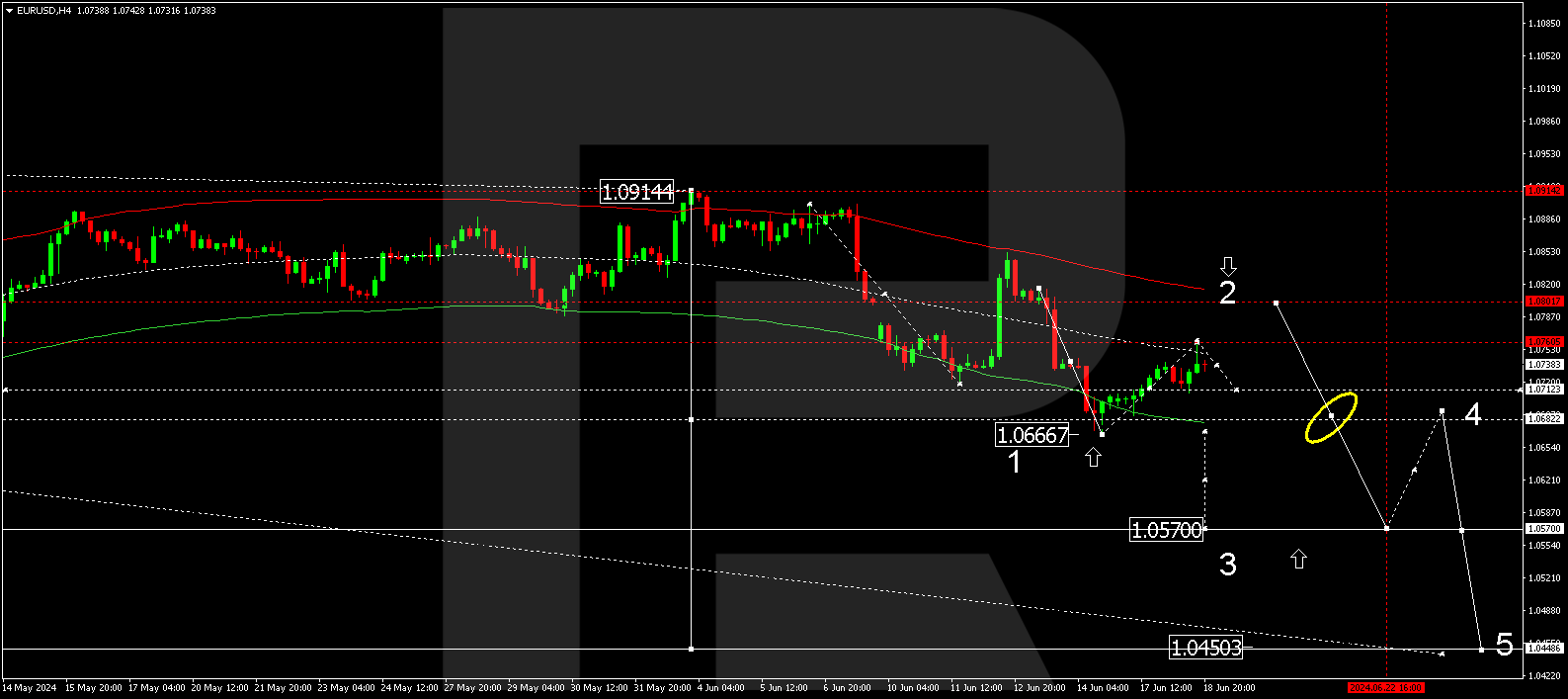

EURUSD technical analysis

The EURUSD 4Н chart analysis for 19 June 2024 shows a corrective wave towards 1.0760. A decline structure is expected to start, aiming for 1.0711. A new consolidation range might practically develop within these levels. With an upward breakout of the range, a correction might continue towards 1.0800. Subsequently, the EURUSD price could decline to 1.0660. A downward breakout will open the potential for a decline wave directly towards 1.0660, potentially continuing towards the local target of 1.0570.

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. This level is considered crucial for a downward wave in the EURUSD pair. The market has received a downward rebound from the Envelope centre. If the market gains a foothold above the 1.0760 level, the corrective wave might continue towards the Envelope’s upper boundary at 1.0800. If the market fails to secure above the 1.0760 level, the wave could expand towards 1.0630, potentially continuing to 1.0570, with another touch of the Envelope’s lower boundary.

Summary

The EURUSD technical analysis points to a potential corrective wave towards 1.0800 with an onward decline to the targets of 1.0570 and 1.0450. Collectively, the news factor may contribute to this scenario.

Origin: RoboForex