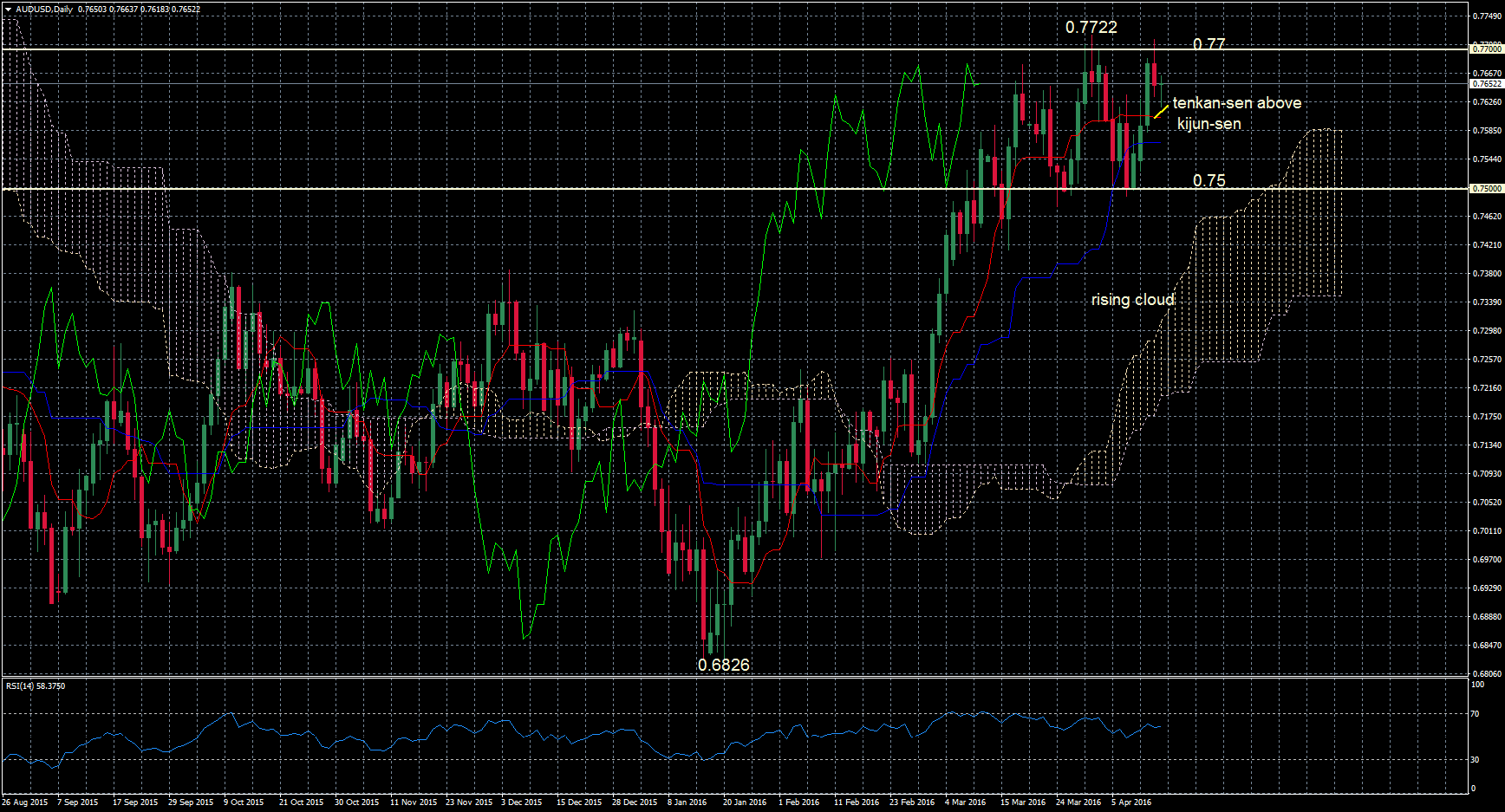

AUDUSD has a neutral bias. The pair has been trading in a broad range of 0.7500 – 0.7700 since early March. After a decent rally from 0.6826 to 0.7722, the market approached overbought levels (RSI reached 70) and consequently there was consolidation after this move.

AUDUSD has a neutral bias. The pair has been trading in a broad range of 0.7500 – 0.7700 since early March. After a decent rally from 0.6826 to 0.7722, the market approached overbought levels (RSI reached 70) and consequently there was consolidation after this move.

After several tests of the key 0.77 level, prices have failed to make a daily close above this level, which is acting as strong resistance. A high of 0.7715 was hit on Wednesday before prices fell back down. Short-term upside momentum has weakened. Support at 0.75 needs to hold otherwise a drop below this would see a shift in the recent bullish bias. But a clear break above the Mach 31 high of 0.7722 is needed in order to see a resumption of the uptrend that started from 0.6826.

Looking at the bigger picture, with the Ichimoku cloud rising and the market being above the cloud, this highlights the underlying bullish market structure. Also the tenkan-sen line is above the kijun-sen line and this is a bullish signal.

Origin: XM