A potential improvement in Germany’s CPI and increased US initial jobless claims may drive growth in EURUSD to 1.0345. Find out more in our analysis for 16 January 2025.

EURUSD forecast: key trading points

- Germany’s CPI in December: previously at -0.2%, projected at 0.4%

- The release of the ECB monetary policy meeting minutes

- US initial jobless claims: previously at 201 thousand, projected at 210 thousand

- EURUSD forecast for 16 January 2025: 1.0345 and 1.0220

Fundamental analysis

Germany’s CPI reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A higher-than-forecast reading typically has a positive effect on the national currency.

The forecast for 16 January 2025 suggests that the index may rise to a positive reading of 0.4% from the previous -0.2%. Fundamental analysis for 16 January 2025 indicates that Germany’s CPI growth could positively impact the euro, while a weaker-than-forecast reading will cause the euro to lose ground against the US dollar further.

Today, 16 January 2025, the European Central Bank (ECB) will publish the minutes of its latest monetary policy meeting. Investors and analysts expect these to provide insights into the ECB’s interest rate-cutting plans amid slowing economic growth and inflation approaching the 2% target. ECB Governing Council member Mário Centeno recently noted that inflation in the eurozone remained under control and expressed the opinion that interest rates should be lowered gradually to 2%.

The minutes’ release may shed light on the degree of agreement among Governing Council members regarding the future monetary policy trajectory and provide additional signals for financial markets, which, could, in turn, impact the EURUSD rate.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market conditions, with increased claims indicating rising unemployment. The previous reading was 201 thousand; the forecast for 16 January 2025 is not optimistic, suggesting an increase to 210 thousand.

According to past statistics, changes of less than 35 thousand tend to have no significant impact on the USD. Given high data volatility, a delta of less than this level may be considered a margin of error, which does not always affect the EURUSD rate.

EURUSD technical analysis

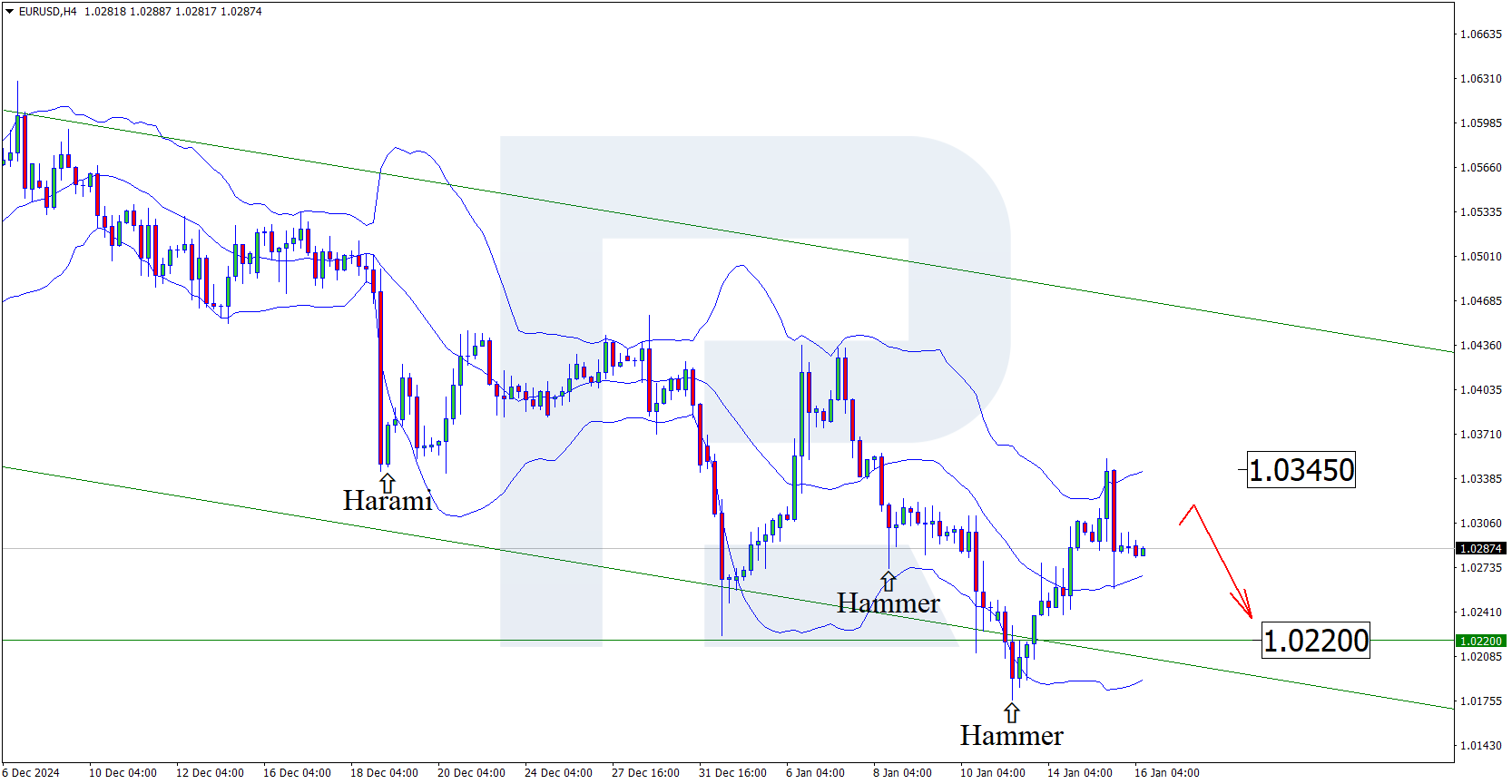

Having tested the lower Bollinger band, the EURUSD price has formed a Hammer reversal pattern on the H4 chart. At this stage, it continues to form a corrective wave following the signal received. Since the price remains within a descending channel and with upcoming releases of US and EU fundamental data, the corrective wave will likely develop to the nearest resistance at 1.0345, with prices rebounding and maintaining their downward trajectory.

The downside target is currently the 1.0220 support level. A breakout below it could open the potential for a more substantial downtrend.

Summary

The EURUSD pair may continue to correct amid news from the European Union and the US. The EURUSD technical analysis suggests growth to the 1.0345 resistance level.