The USDCAD rate is rising for the fifth consecutive trading session, with buyers poised to test the 1.4465 resistance level. Discover more in our analysis for 13 January 2025.

USDCAD forecast: key trading points

- US jobs increased by 256 thousand in December, marking the most significant gain in nine months

- Positive US labour market data heightened expectations of a slower pace of Federal Reserve interest rate cuts

- Canada’s unemployment rate decreased to 6.7% in December, surpassing the forecast of 6.9%

- USDCAD forecast for 13 January 2025: 1.4465 and 1.4515

Fundamental analysis

The USDCAD rate is strengthening within an ascending channel. The pair’s growth is supported by the increase in US job numbers, which stood at 256 thousand in December, marking the most substantial growth in nine months. The unemployment rate decreased from 4.2% in November to 4.1% in December, exceeding analysts’ expectations of a 165-thousand job increase. This data has boosted expectations of a slower pace of Federal Reserve interest rate cuts.

According to preliminary data, the US Consumer Price Index declined to 73.2 points in December, down from 74.0 in November. Analysts had forecast a less significant decline to 73.8. A year earlier, in January 2024, the index was 79.0.

Meanwhile, Canada’s unemployment rate stood at 6.7% in December, exceeding the expected 6.9%. However, the figure remains the second highest since September 2021, reflecting the softening labour market conditions noted by the Bank of Canada. The economy faces additional pressures from political and fiscal uncertainties, including budget deficit risks and Prime Minister Justin Trudeau’s resignation.

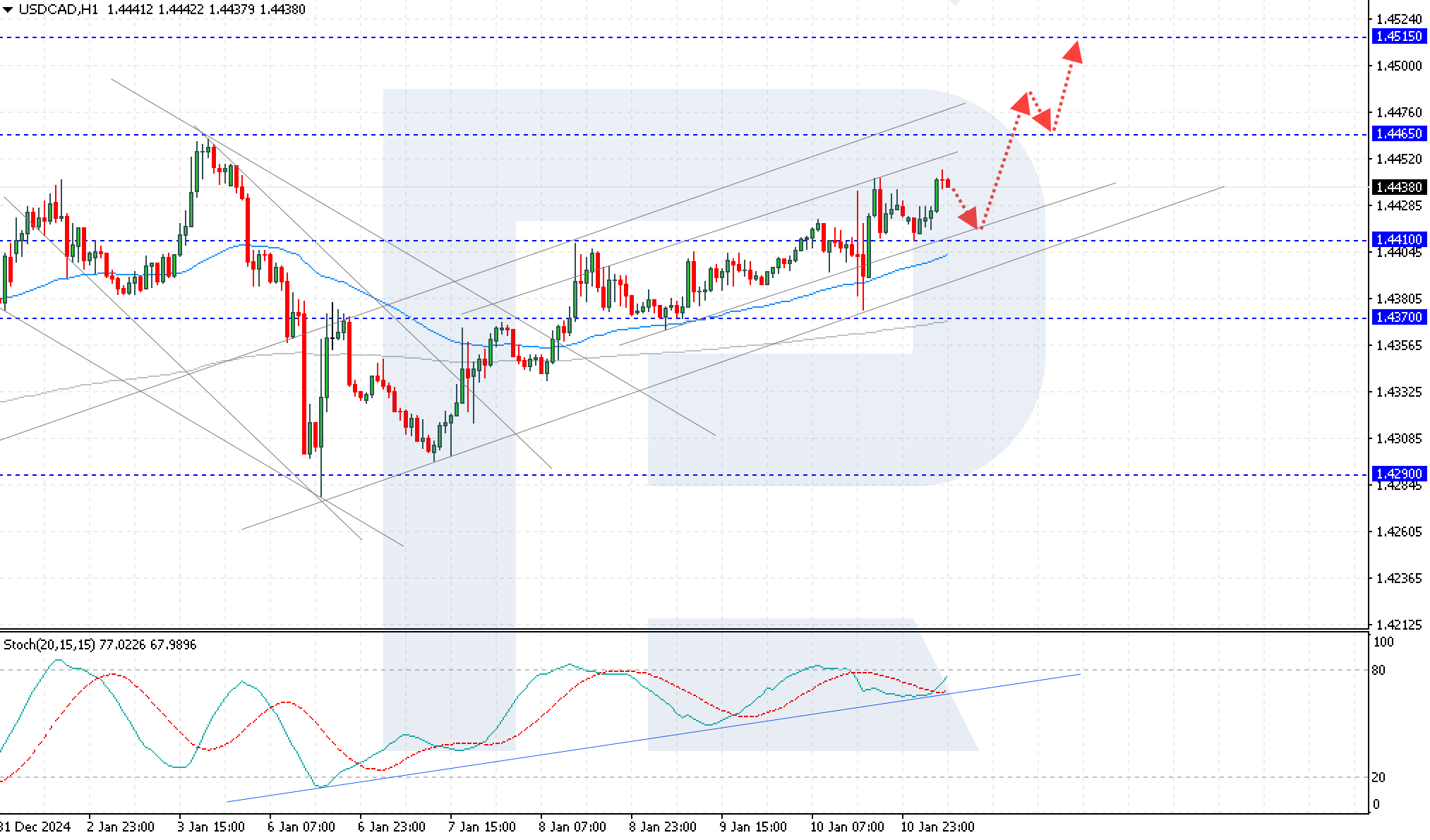

USDCAD technical analysis

USDCAD quotes are rising after rebounding from the EMA-65 line. Buyers are keeping the currency pair within the ascending channel. Today’s USDCAD forecast predicts a bearish correction, with the price expected to test the channel’s lower boundary at 1.4415 before potentially rising to the 1.4465 resistance level.

A rebound from the support level on the Stochastic Oscillator will provide an additional signal for growth. If the price firmly holds above the 1.4465 resistance level, this will pave the way for further movement to the next target of 1.4515. However, a consolidation below the 1.4385 support level will invalidate the bullish scenario, increasing the likelihood of a deeper bearish correction to 1.4295.

Summary

Lower unemployment and increased jobs in the US have raised expectations of Federal Reserve monetary policy easing, driving growth in the US dollar despite declining consumer confidence. The USDCAD technical analysis suggests persisting upward momentum. If the price firmly holds above the 1.4465 resistance level, it will strengthen bullish sentiment, targeting the next level at 1.4515. Conversely, a breakout below the 1.4385 level would indicate increased risks of a decline to 1.4295.