The USDJPY rate is slightly correcting, with buyers targeting a breakout above the 154.25 resistance level. Find out more in our analysis for 17 December 2024.

USDJPY forecast: key trading points

- USDJPY continues to rise due to pressures on the yen caused by expectations that the Bank of Japan will maintain its current interest rate

- The markets anticipate that the BoJ will refrain from raising the interest rate at the current meeting due to the need for clarity on wage growth

- Weaker market expectations regarding Federal Reserve monetary policy easing stem from inflation concerns, which supports the current US dollar growth

- USDJPY forecast for 17 December 2024: 152.92

Fundamental analysis

The USDJPY rate is gaining for the eighth consecutive trading session as the yen remains under pressure amid expectations that the Bank of Japan will keep the interest rate unchanged at the upcoming meeting. More than 90% of market participants expect the regulator to pause changes and focus on assessing external risks and wage dynamics next year.

Meanwhile, the Federal Reserve is expected to lower the interest rate by 25 basis points tomorrow. However, traders will focus on updated economic forecasts, especially the outlook for further rate cuts in 2025. Market expectations have weakened in recent weeks due to concerns about inflation growth, which, according to today’s USDJPY forecast, supports the US dollar’s upward momentum.

Japan’s domestic data also contributes to the yen’s weakness. Economy Minister Ryosei Akazawa reaffirmed the Bank of Japan’s and the government’s intention to work closely to develop an effective monetary policy. The markets increasingly presume that the regulator will refrain from raising the interest rate at the upcoming meeting, maintaining a cautious stance on further policy tightening. According to traders, the Bank of Japan does not see an urgent need for a rate hike and will likely prefer to wait for fresh wage growth data before taking new actions.

USDJPY technical analysis

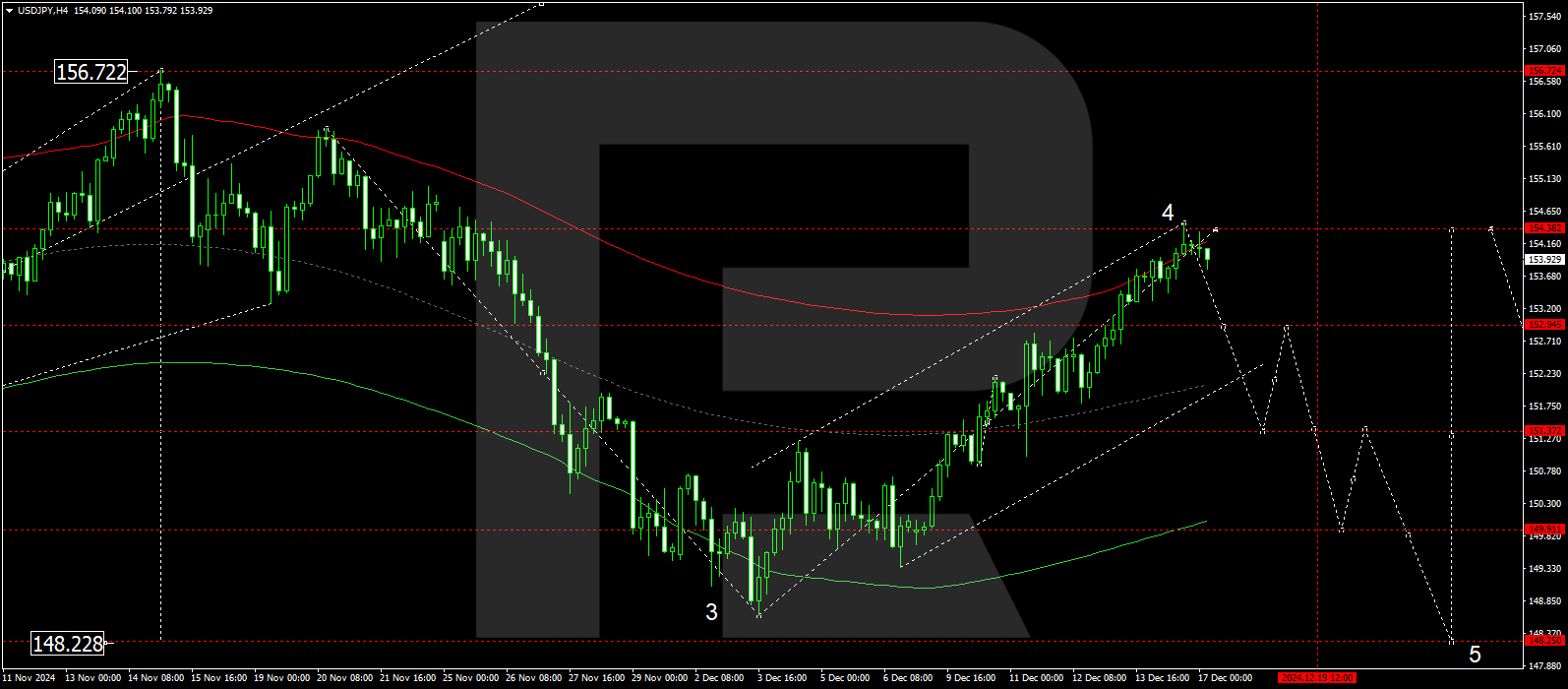

The USDJPY H4 chart shows that the market has completed an upward wave, reaching 154.46. Today, 17 December 2024, a new consolidation range is expected to form below it. A downward breakout might lead to a downward wave towards 152.92 and potentially further to 151.51. After reaching this level, the price could rise to 152.90.

The Elliott Wave structure and growth wave matrix, with a pivot point at 151.51, technically support this scenario for the USDJPY rate. The market has reached the upper boundary of a price envelope at 154.46, with the growth wave’s potential now considered exhausted. A consolidation range is forming below this level today. The price is expected to break below the range, continuing its downward trajectory towards the envelope’s central line at 152.92. Subsequently, another downward wave may target the envelope’s lower boundary at 151.51.

Summary

The USDJPY rate is rising due to mounting pressure on the yen, driven by expectations that the Bank of Japan will keep the interest rate unchanged and adopt a cautious approach to tightening monetary policy. The upcoming Fed decision and persistent concerns about inflation growth in 2025 provide additional support for the US dollar. Technical indicators for today’s USDJPY forecast suggest a potential decline to the 152.92 level.