The EURUSD pair remains stable at around 1.0510 on Tuesday. The market seeks signals from the Federal Reserve. Find out more in our analysis for 17 December 2024.

EURUSD forecast: key trading points

- The EURUSD pair consolidates ahead of the Federal Reserve’s decision

- Investors are keen to know how the regulator will act in 2025

- EURUSD forecast for 17 December 2024: 1.0475

Fundamental analysis

The EURUSD rate is neutral, hovering around 1.0510.

Market activity is subdued ahead of the US Federal Reserve’s December meeting, which begins today and concludes on Wednesday evening with an interest rate decision. The likelihood of a 25-basis-point rate cut is estimated at 94%, despite services sector activity rising to a three-year high.

Investors eagerly await signals on the Federal Reserve’s potential decisions for 2025. The market assigns a 37% probability to a scenario where the Fed lowers interest rates only once or keeps them unchanged throughout the next year, reflecting a relatively broad range of expectations.

The EURUSD forecast appears neutral.

EURUSD technical analysis

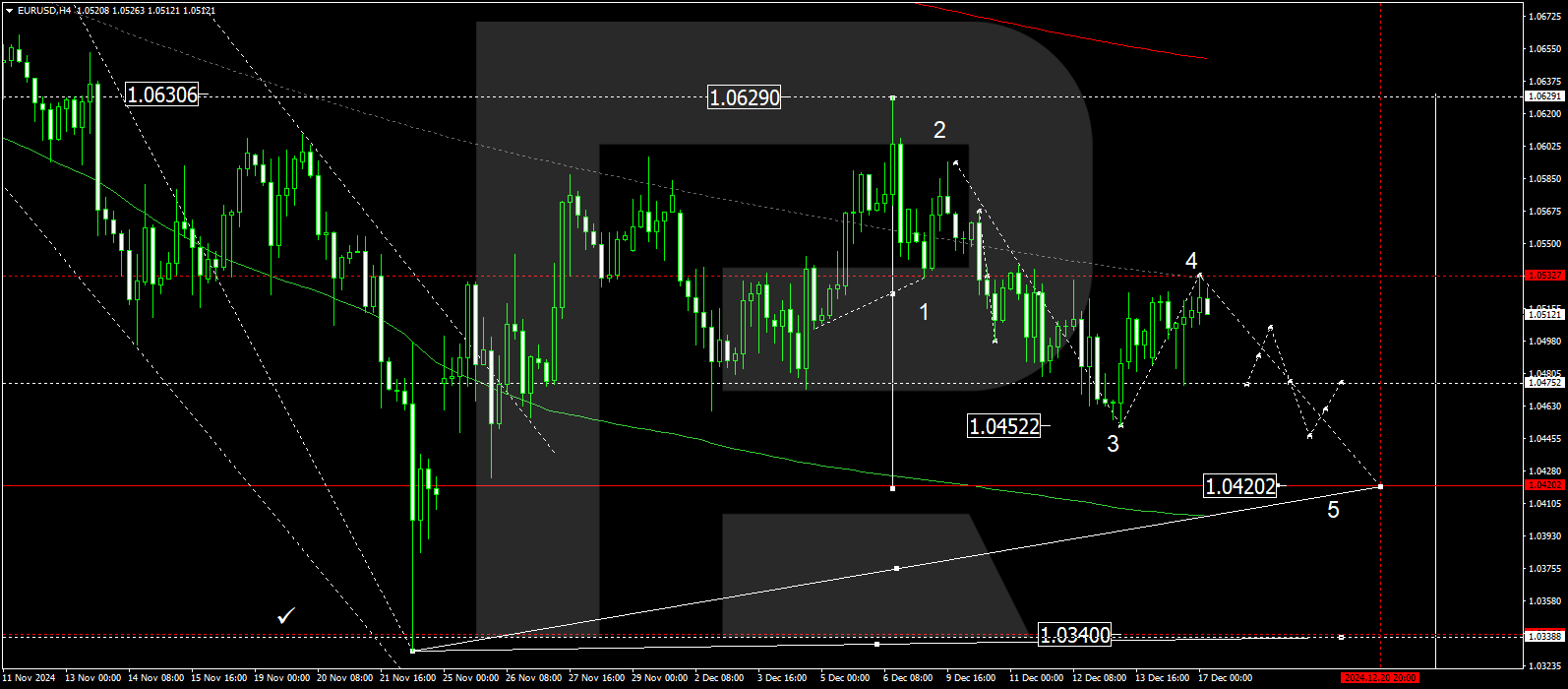

The EURUSD H4 chart shows the market has completed a corrective structure, reaching 1.0533. Today, 17 December 2024, a new downward wave may develop, aiming for 1.0420. The first key level is projected at 1.0475. Once reached, the price could rise to 1.0500 before resuming its decline to 1.0450, potentially continuing towards 1.0420.

The Elliott Wave structure and matrix for the fifth downward wave, with a pivot point at 1.0475, technically support this scenario. This level is considered crucial for the downtrend in the EURUSD rate. The market has reversed downward from the central line of a price envelope at 1.0533. The downward wave is expected to continue towards the envelope’s lower boundary at 1.0420.

Summary

The EURUSD pair shows little movement ahead of the Federal Reserve meeting. Technical indicators for today’s EURUSD forecast suggest a potential decline to the 1.0475 level.