The USD/JPY pair has begun to rise, reaching 147.33. This shift follows five consecutive sessions of yen appreciation without interruption.

Firstly, the US dollar has halted its rapid decline and shows signs of strengthening. This shift has led to a “pause” in the rally on the currency market. Secondly, investors have already priced in the full range of news and comments regarding the Bank of Japan’s interest rate.

A report from Capital Economics suggests that the yen could transition to steady strengthening this year, supported by several factors.

On one hand, the unions’ ongoing demands for higher wages indicate a stable trend towards price increases while the economy remains relatively stable. On the other hand, the interest rate differential is expected to shift in favour of the yen shortly.

This is probable as the interest rates of G-10 countries are projected to decrease in the second quarter. Japan will likely end its “ultra-loose” monetary policy in April, laying the groundwork for the yen’s long-term strengthening.

Recent statistics reveal that Japan’s GDP in Q4 2023 grew by 0.1% quarter-over-quarter and 0.4% year-over-year, significantly exceeding forecasts and surpassing Q3 2023 figures. Notably, the capital expenditure component for Q4 saw a 2.0% quarter-over-quarter increase, contrary to the expected 0.1% decrease.

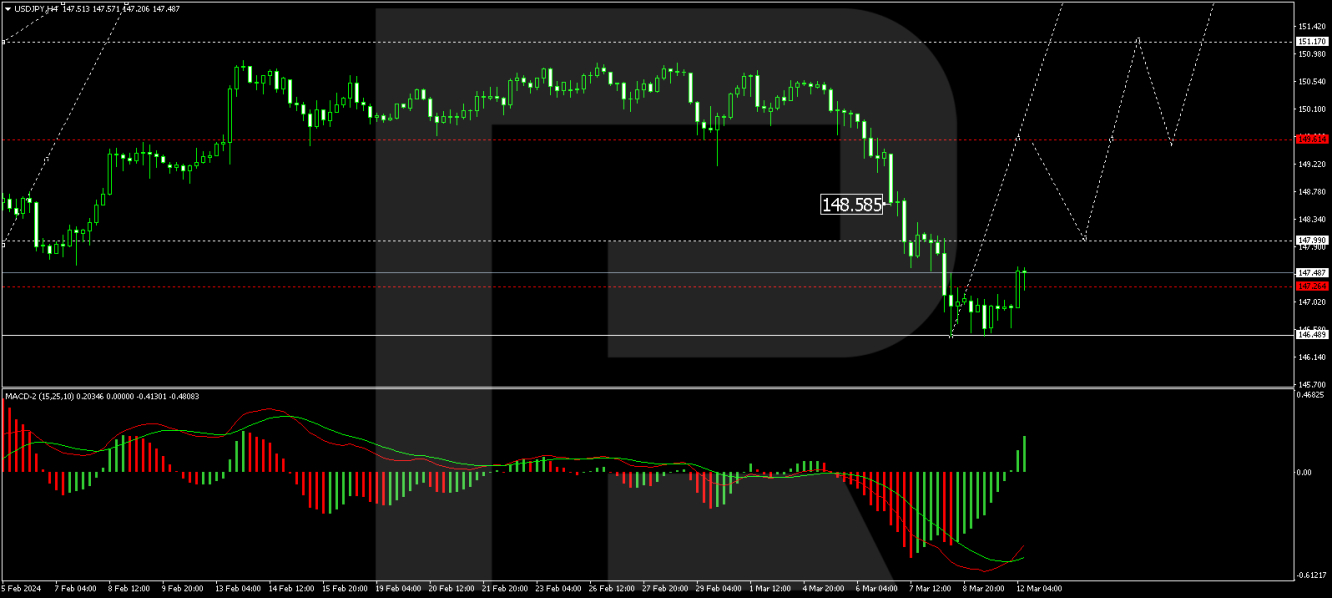

Technical analysis of USD/JPY