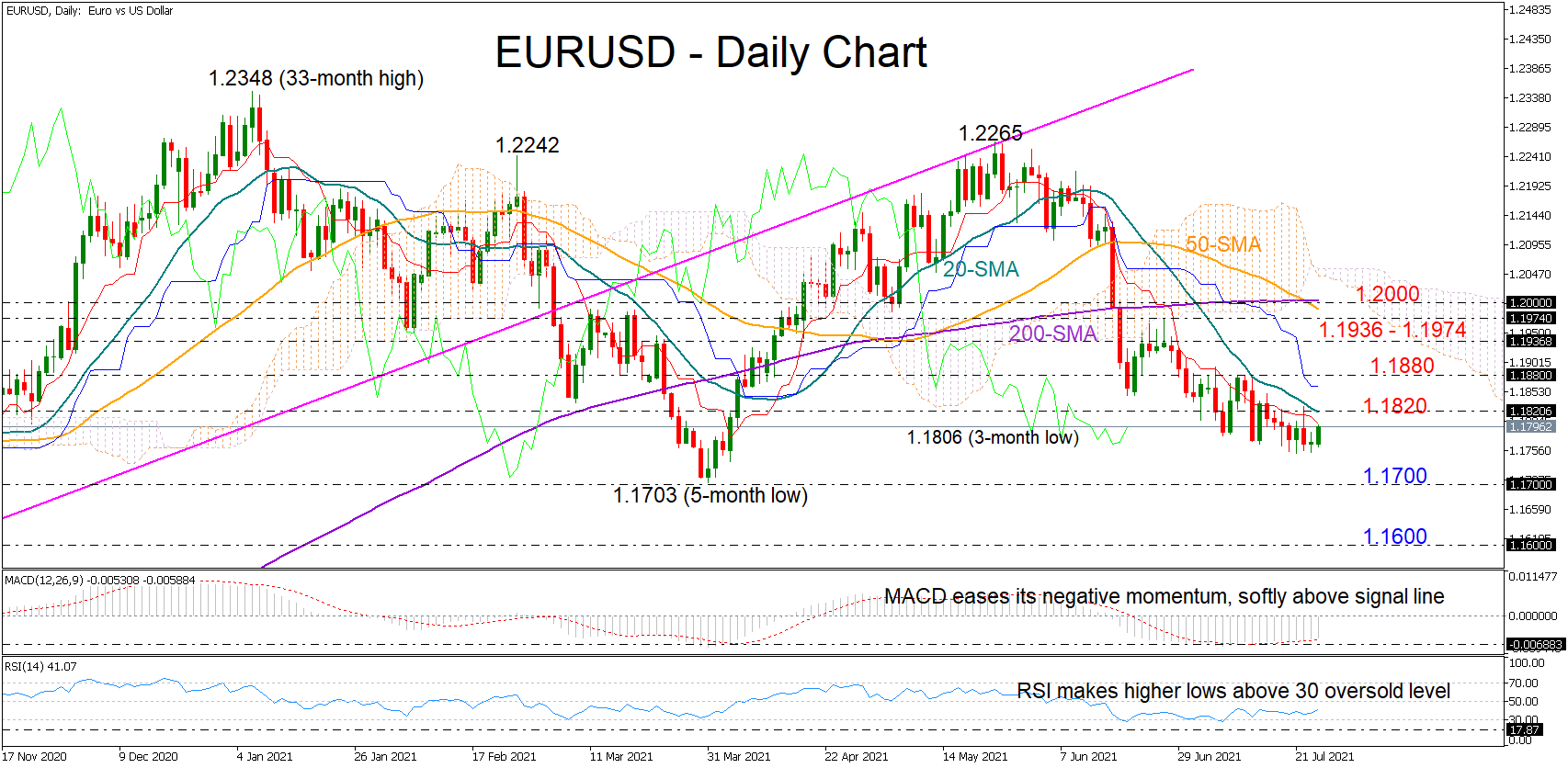

EURUSD kicked off the week with soft performance and barely above last week’s low of 1.1751, maintaining a downward direction below the 20-day simple moving average (SMA).

EURUSD kicked off the week with soft performance and barely above last week’s low of 1.1751, maintaining a downward direction below the 20-day simple moving average (SMA).

While the gentle upward trajectory in the RSI and the MACD, which coincides with a weakening price action, reminds of a bullish divergence, and hence raises some optimism that an upside reversal could soon take place, some caution is still required as the former continues to trade below its 50 neutral mark and the latter has yet to grow in the positive area. The negative slope in the red Tenkan-sen line is another discouraging signal.

A sustainable break above the 20-day SMA at 1.1820 could ease precautionary thinking, helping the price to revisit its previous resistance territory of 1.1880. Running higher, the 1.1936 – 1.1974 zone may add stronger downside pressures, deterring any move towards the crucial 1.2000 level, where the 200-day SMA is currently placed.

Alternatively, the pair could head for the March low of 1.1703, a break of which may cause a more aggressive sell-off towards the 1.1600 level and an outlook deterioration in the medium-term picture. Lower, the door would open for the former resistance area of 1.1455.

In brief, EURUSD seems to be facing a weakening bearish bias in the short-term picture. A decisive close above the 20-day SMA and the 1.1820 number is expected to trigger the next bullish wave.

Origin: XM