Delta blues fade

Delta blues fade

There was no shortage of volatility in financial markets this week. The week started with investors losing their cool over a slowdown in global growth as the rampaging Delta variant left its marks on several economies, but those worries soon faded into the rear-view mirror.

Markets seem to have concluded that this variant is a bigger problem for emerging economies with low vaccination rates, not so much for advanced countries. As such, US tech stocks came back in fashion as investors regained exposure to companies insulated from virus restrictions, pushing the Nasdaq 100 to a new record close yesterday.

Traders are working on the assumption that if the global health situation gets bad enough to hamstring US economic growth, then the Fed could keep the liquidity taps open for longer, limiting any downside in tech stocks especially. Monetary policy is essentially a free put option for equity investors, which helps explain the wild valuations many companies trade at.

Euro slides after ECB, stabilizes on PMIs

The European Central Bank moved towards a more dovish regime yesterday, committing not to raise interest rates for an even longer period of time. The underlying message was that the ECB will not join the tightening cycle that other major central banks like the Fed or the Bank of England might embark on over the next few years.

In the markets, the euro was little changed during the meeting but moved lower in the aftermath. It is now clear that the ECB along with the Bank of Japan will likely be the last central banks to normalize monetary policy this cycle, if they do at all. This implies that the dollar and the pound could outperform the euro and the yen moving forward as central bank divergence plays out.

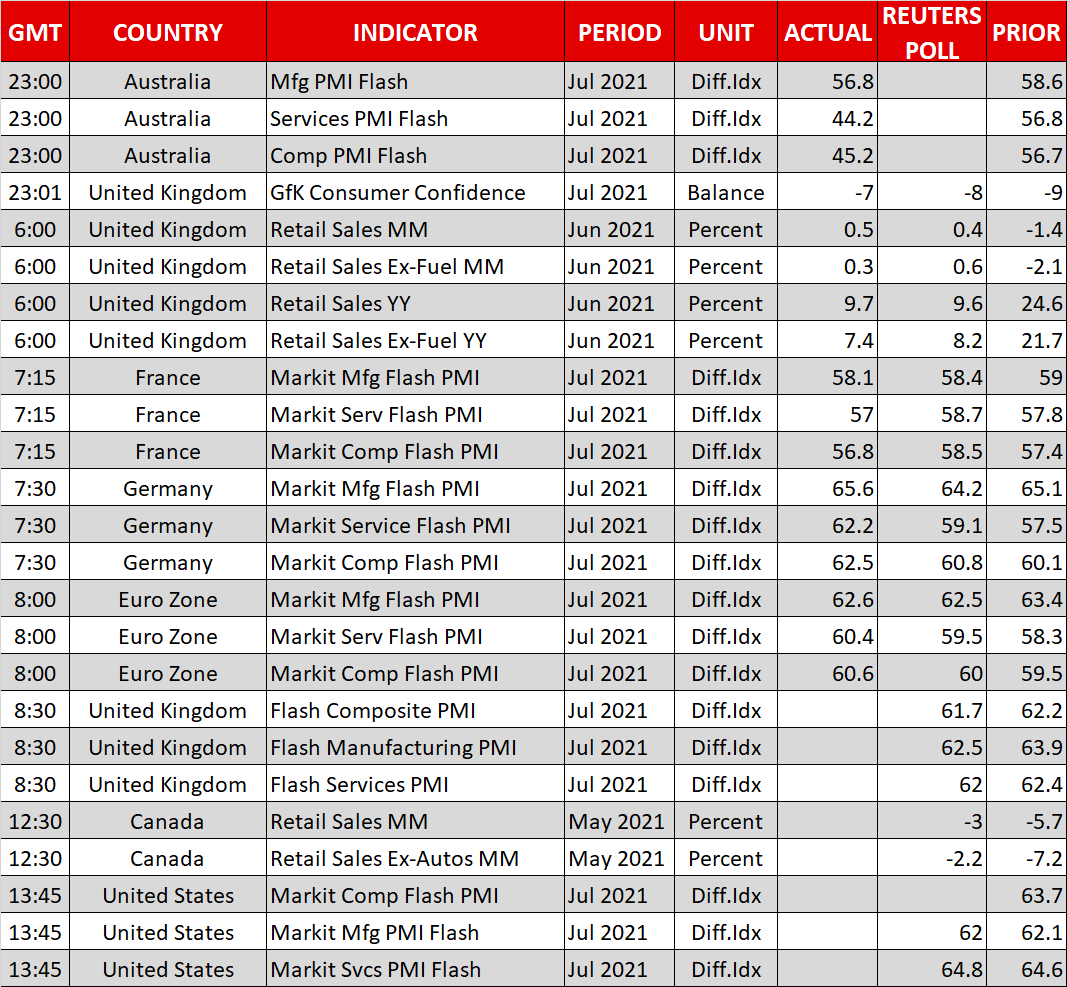

That said, the euro found some solace in the Eurozone’s latest PMI surveys. Widespread vaccinations and the reopening boom continued to fuel economic activity in July, with the surveys suggesting growth is running at the fastest pace in two decades. The bad news is that businesses are becoming worried about the Delta variant and the risks it poses to the economy, hence the limited upside in the euro.

British and American PMIs coming up

We will also get a look at the latest PMIs from Britain and the US today. The story so far has been that everyone is recovering but America is at the tip of the spear. And with Congress getting ready to unleash another massive round of infrastructure spending in the coming years, the US economy could continue to outperform.

As for the dollar, the focus now turns to next week’s Fed meeting. The question is whether the central bank will plant the seeds for a tapering announcement at the Jackson Hole symposium in August, or whether it will play it slow and buy time to examine more employment data before making any decisions.

If markets sense that tapering is imminent, that could put the wind back into the dollar’s sails. Otherwise, any further dollar strength will likely have to wait until autumn.

The earnings season will also kick into full gear next week, with most of the tech titans reporting their quarterly results. Apple, Microsoft, Facebook, Google, Tesla, and many others will be under the microscope. These could decide whether the latest rally continues or cools down.

Origin: XM