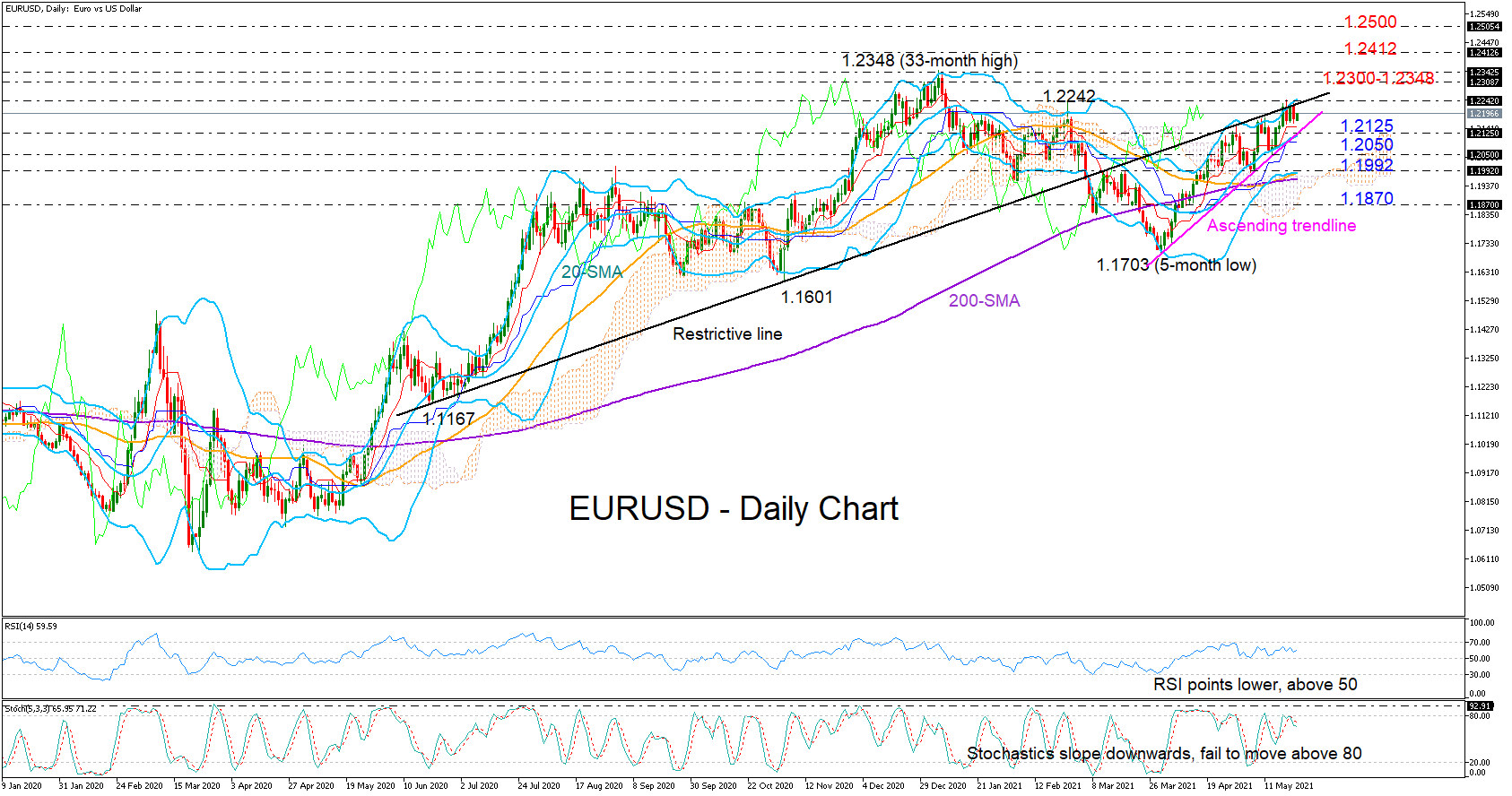

EURUSD is indecisive around February’s peak of 1.2242 and a long-term restrictive line, a break of which is expected to open the way towards the top of a broader uptrend which started in March 2020.

EURUSD is indecisive around February’s peak of 1.2242 and a long-term restrictive line, a break of which is expected to open the way towards the top of a broader uptrend which started in March 2020.

The RSI and the Stochastics could not resume upward direction during the previous couple of days, while the price itself has been trading around the upper Bollinger band, increasing the odds for a downside correction in the near term.

That said, an ascending trendline has been protecting the market against sharp downside movements in the short-term picture with the help of the 20-day simple moving average (SMA) at 1.2125. Hence, the bears should successfully breach this bar to motivate stronger selling activities towards the 1.2050 swing low, where the 200 SMA lies on the four-hour chart. Moving lower, the 1.1992 region could be of greater importance given the presence of the longer-term SMAs, the surface of the Ichimoku cloud, and the lower Bollinger band in the neighborhood. A clear violation here could trigger a steeper decline towards the 1.1870 supportive area.

On the flip side, should the bulls claim the 1.2245 barrier, the door would open for the crucial resistance zone of 1.2300 – 1.2348. A sustainable move higher from here would re-activate the paused uptrend from the March bottoms, sending the price up to the 1.2412 and 1.2500 levels taken from the 2018 highs.

In brief, EURUSD is facing a fading bullish bias in the short term. A drop below 1.2125 could confirm additional losses, while a close above 1.2245 may attempt to bring the previous uptrend back into play.

Origin: XM