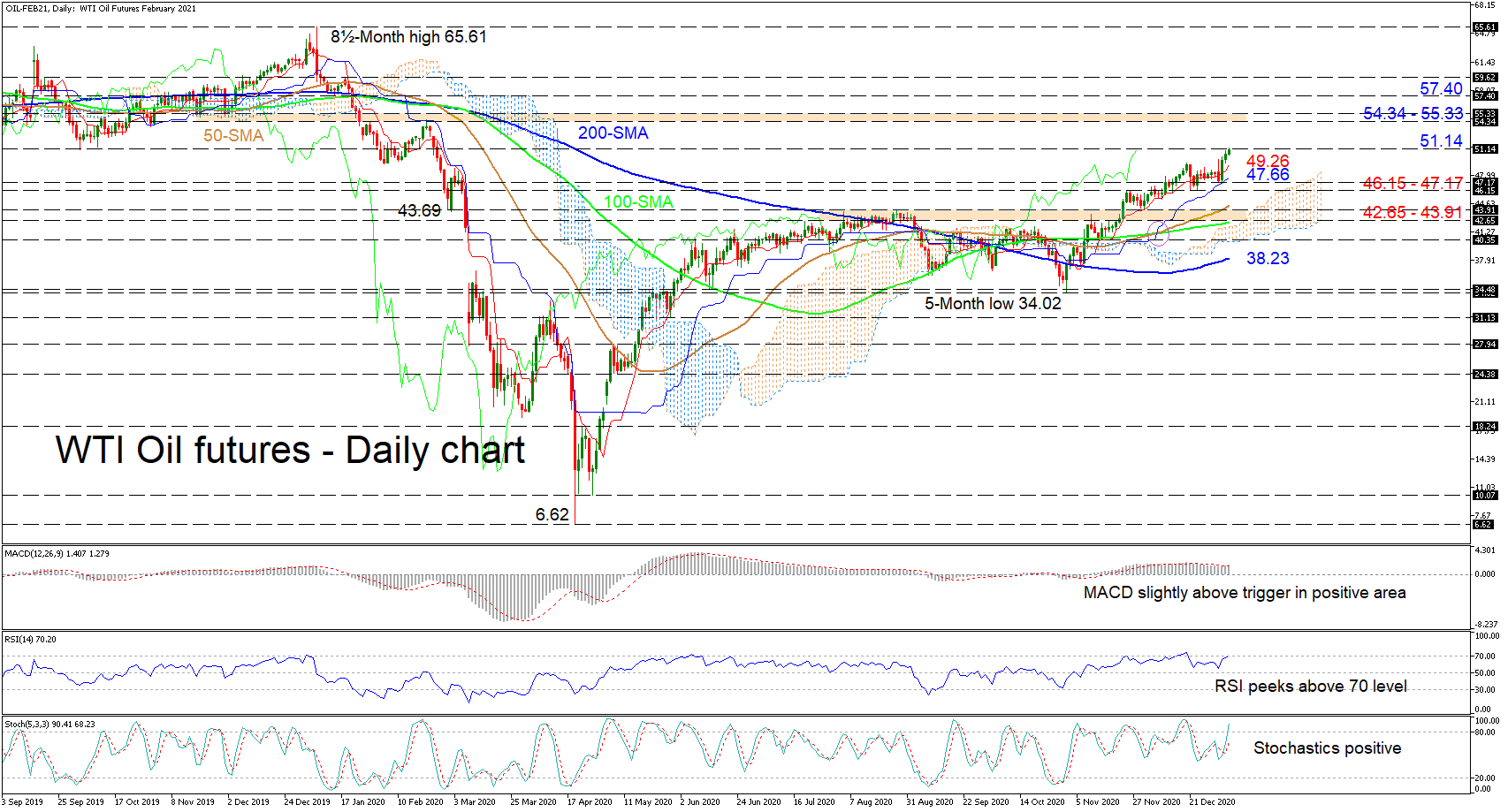

WTI oil futures are currently pushing up against the 51.14 resistance, after a bounce off the blue Kijun-sen line boosted the commodity’s price. The progressing Ichimoku lines are suggesting additional advances are on the table as positive price action is strengthening. Likewise, the increasing upturn in the simple moving averages (SMAs) is safeguarding the price’s growing bullish bearing.

WTI oil futures are currently pushing up against the 51.14 resistance, after a bounce off the blue Kijun-sen line boosted the commodity’s price. The progressing Ichimoku lines are suggesting additional advances are on the table as positive price action is strengthening. Likewise, the increasing upturn in the simple moving averages (SMAs) is safeguarding the price’s growing bullish bearing.

The short-term oscillators are also demonstrating strengthening positive momentum. The MACD, some distance above zero, has returned back above its somewhat horizontal red trigger line, while the rising RSI has pierced above the 70 level. The positive stochastic oscillator and its %K lines’ propulsion above the 80 mark are endorsing the commodity’s bullish tone.

If buyers manage to decisively step above the 51.14 resistance, this could enhance the climb and reaffirm its recent rebound. Generating this positive impetus may then send the price towards the resistance section of 54.34-55.33, which encapsulates the 54.62 critical peak, where oil’s crucial collapse escalated back on February 20. Should even further gains transpire, the commodity may then target the 57.40 resistance from January 15.

Otherwise, if sellers retake the reins, initial downside hindrance may occur at the red Tenkan-sen line at 49.26. Pulling underneath it, support may then develop from the blue Kijun-sen line at 47.66 and the adjacent support band below of 46.15-47.17. However, should an extended retracement unfold, the 43.91 to 42.65 tough section, which is surrounded by the 50- and 100-day SMAs could defend the positive structure.

Summarizing, oil futures appear to be upgrading their positive demeanour above the 46.15-47.17 zone and the SMAs.

Origin: XM