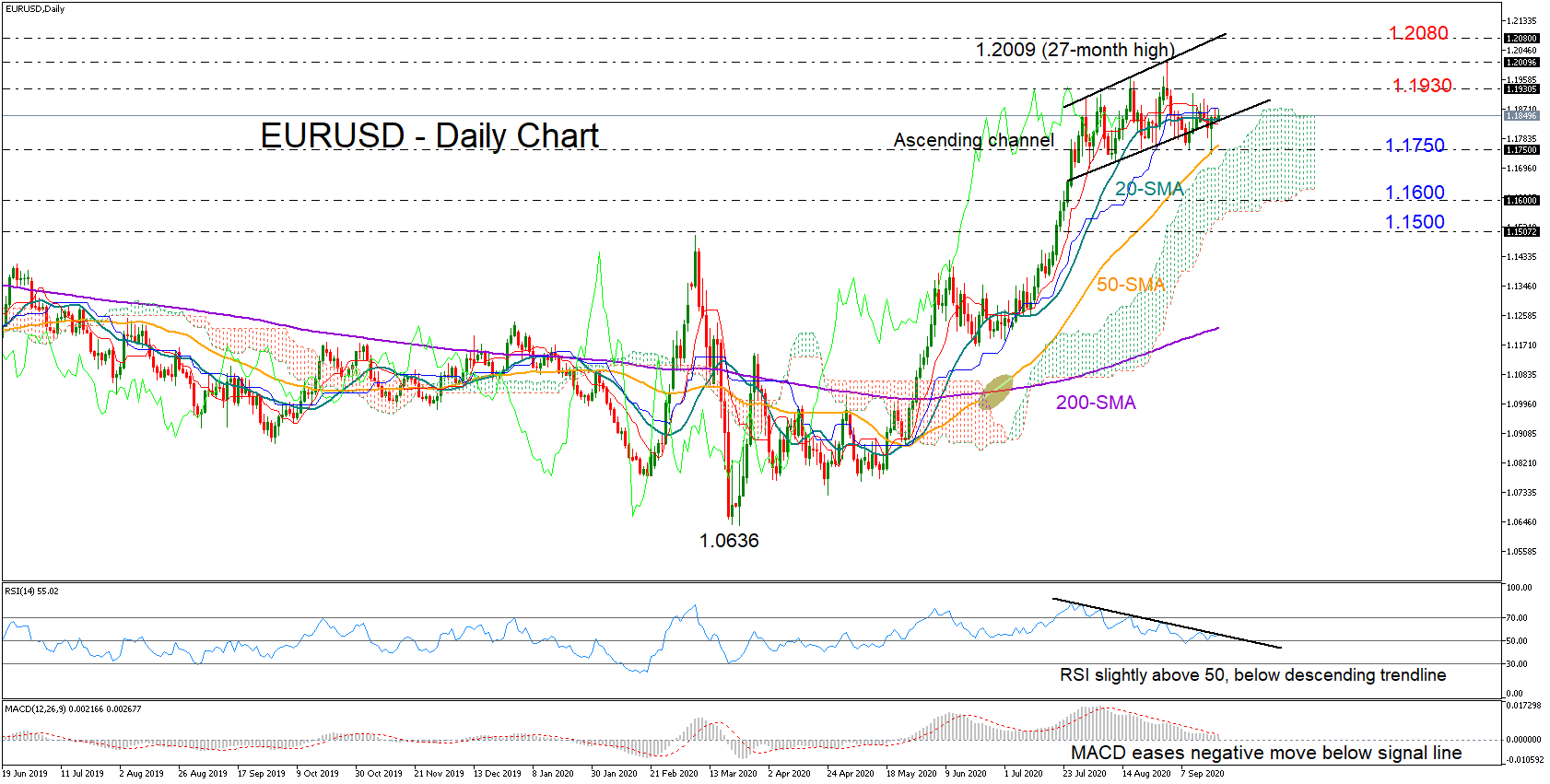

EURUSD opened with a soft positive tone on Monday, refusing to abandon the ascending channel that directed the price to a fresh 17-month high of 1.2009 earlier this month.

EURUSD opened with a soft positive tone on Monday, refusing to abandon the ascending channel that directed the price to a fresh 17-month high of 1.2009 earlier this month.

The rebound near the 50-day simple moving average (SMA) and the 1.1750 level last week signaled that the bulls are still in play, but the momentum indicators have yet to show strength. The RSI, although above its 50 neutral mark, remains around a descending trendline, while the MACD continues to weaken below its red signal line though at a slower pace. Moreover, in Ichimoku indicators, the red Tenkan-sen line has paused its decline immediately after crossing below the blue Kijun-sen. Hence, technically, the short-term bias is currently looking neutral.

A close above 1.1930; a level which could not be overcome earlier this month, may bring the 1.2000 mark under examination. Should the bulls jump that wall, the rally may continue until it touches the roof of the channel around 1.2080.

On the other hand, a clear drop below the 50-day MA and the 1.1750 support area could trigger a steeper decline towards 1.1600, shifting the neutral short-term outlook to bearish. Lower, the door would open for the 1.1500 hurdle, a break of which is expected to downgrade the medium-term picture to neutral.

Summarizing, EURUSD is facing a neutral bias in the short-term, where a break above 1.1930 or below 1.1750 may determine the next move in the market. A cross beneath the 1.1500 number would also downgrade the positive medium-term outlook to neutral.

Origin: XM