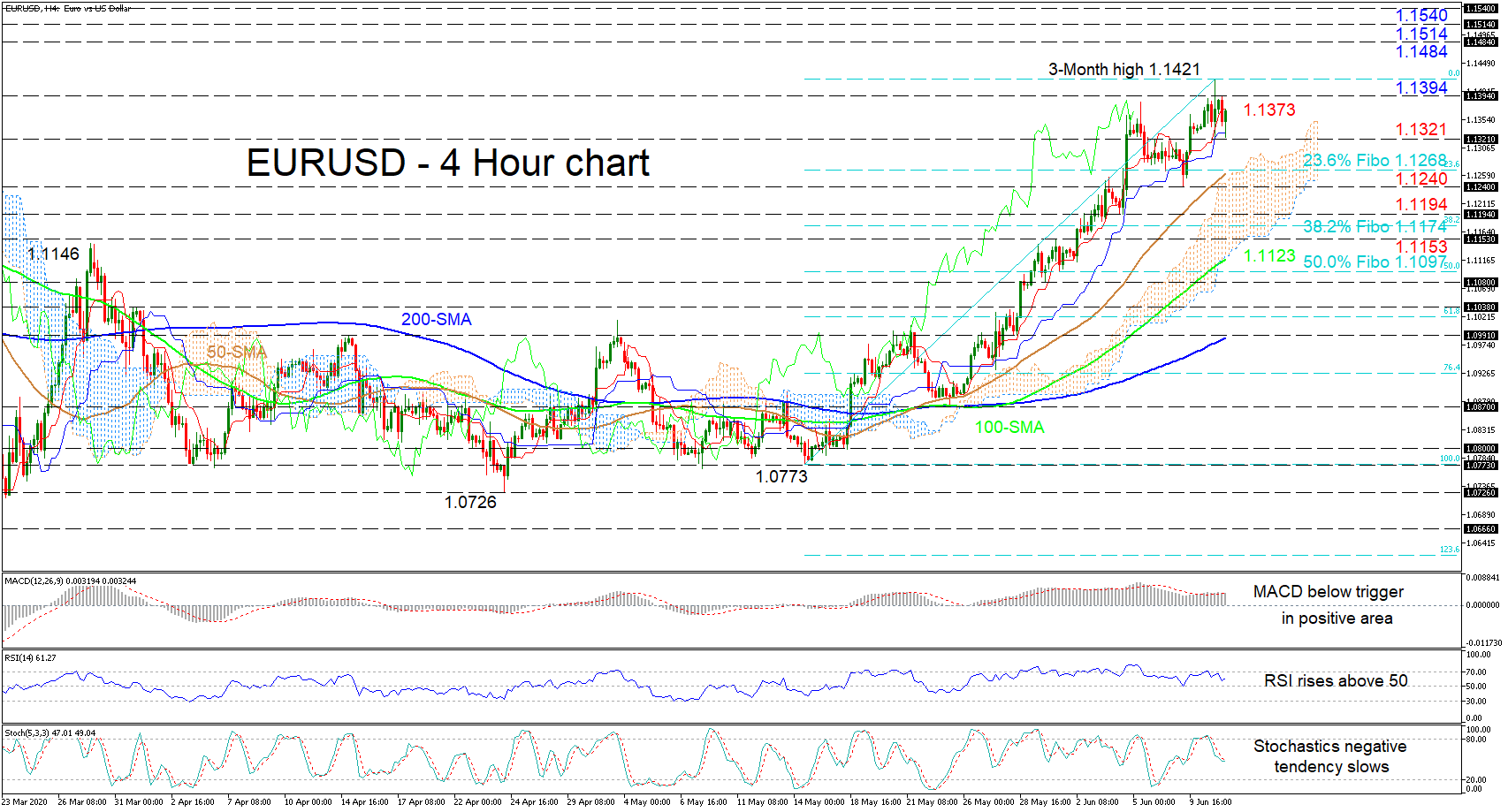

EURUSD’s pullback from the fresh three-month high of 1.1421, looks to be reloading around the 1.1321 swing low. The nearly one-month climb from the 1.0773 mark remains intact, assisted by the Ichimoku lines and the positively charged simple moving averages (SMAs).

EURUSD’s pullback from the fresh three-month high of 1.1421, looks to be reloading around the 1.1321 swing low. The nearly one-month climb from the 1.0773 mark remains intact, assisted by the Ichimoku lines and the positively charged simple moving averages (SMAs).

Glancing at the short-term oscillators, they suggest that positive momentum is strengthening. The MACD, in the positive zone, barely below its red signal line looks to move back above it, while the RSI is improving above the 50 level. Moreover, in the stochastic oscillator, the %K line’s downward slope is weakening as it nears the %D line, increasing the odds for a turn back up, which would promote additional advances.

If the positive tone continues, the red Tenkan-sen line at 1.1373 and the 1.1394 nearby high could deter the price from revisiting the three-month peak of 1.1421. A run above 1.1421 could boost bullish sentiment towards the 1.1484 high from early March, while extended gains could challenge the 1.1514 and 1.1540 barriers from January of 2019.

Should the price retrace under 1.1321, limitations could originate from the upper surface of the Ichimoku cloud ahead of the 50-period SMA just beneath the 1.1268 level, that being the 23.6% Fibonacci retracement of the up leg from 1.0773 – 1.1421. Not far below, if the essential trough at 1.1240 fails to halt the decline, the pair could meet the 1.1194 low ahead of the 38.2% Fibo of 1.1174. Steeper losses past 1.1153 could see the 100-period SMA currently at 1.1123 and the 50.0% Fibo of 1.1097 underneath.

Summarizing, in the very short-term timeframe, the pair maintains a strongly bullish mode above the SMAs and the 1.1240 trough, and a break above 1.1514 could accelerate this outlook.

Origin: XM