Stocks head south as virus panic returns

Stocks head south as virus panic returns

It was a poor start to the second quarter for stock markets around the world as the growing coronavirus pandemic shows no sign of slowing, with the number of cases globally shooting past 800,000 yesterday. Stocks in the US were unable to hold onto earlier gains, closing sharply lower and adding to the quarter’s losses, making it the worst quarterly performance since 1987.

The Dow Jones closed down by 1.8% overnight and the Nikkei 225 in Japan tumbled by 4.5% today. Shares in China also reversed into negative territory, while London’s FTSE 100 slumped more than 4% at the open. US futures were pointing to losses of up to 3% on Wall Street today.

A big jump in the number of new infections in the United States has revived fears of a steep recession, with President Trump warning that the next two weeks will be “very very painful”. New York, which saw the number of deaths pass the 1,000 mark on Tuesday, is the worst affected state in the US. But there are worries that the virus could be spiralling out of control again in some countries such as Japan, while in Europe, it is too soon to predict that the infection rate is peaking.

The grim situation worldwide makes it inevitable that major economies will suffer a severe downturn and the prospect of a prolonged period of business shutdowns is likely to weigh on equity markets for at least the next few weeks, if not months.

Sharp drop in manufacturing PMIs

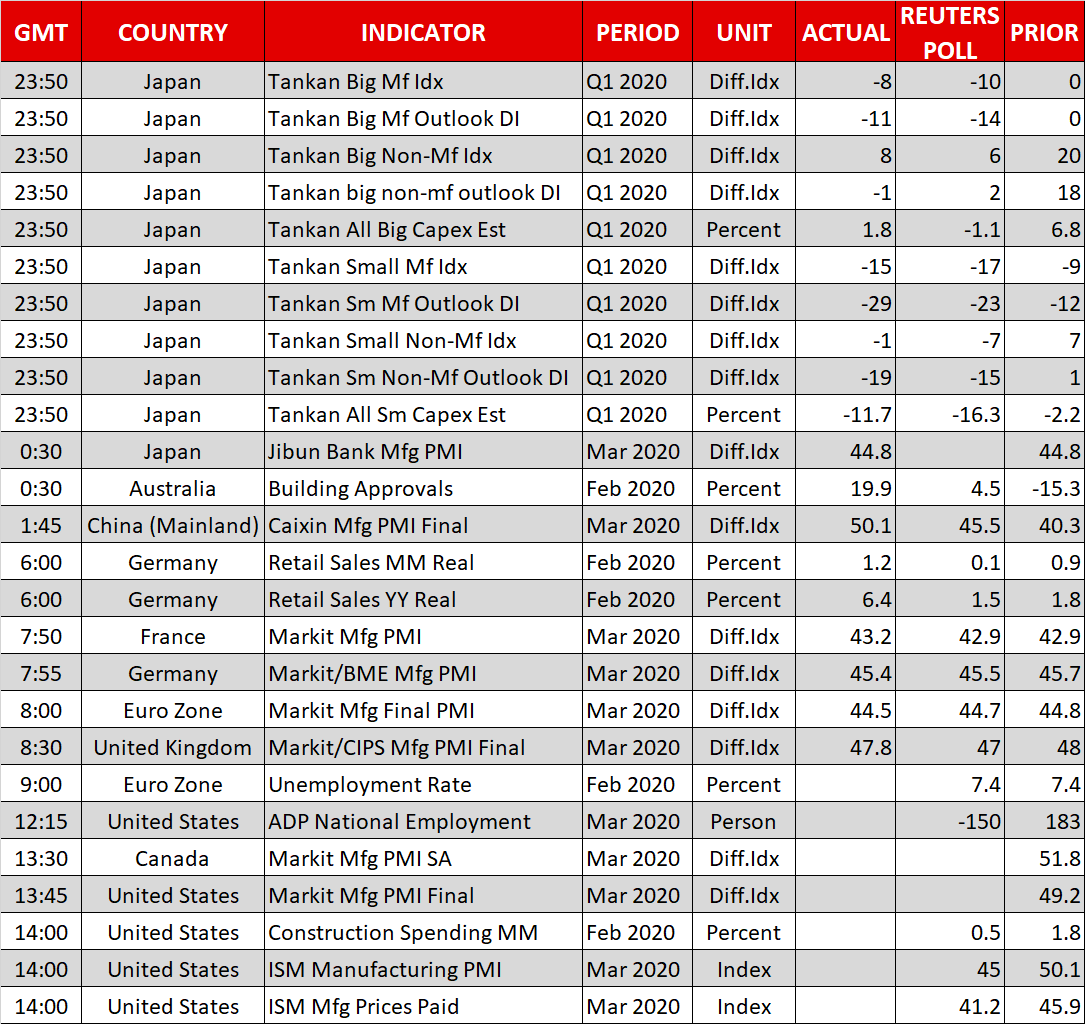

Worries that the global economy may already be in a recession were magnified by today’s dismal manufacturing PMIs for March. The closely watched gauges showed factory activity plummeted in March in Europe and in Asia and the focus is now on the US ISM manufacturing PMI due later today. Forecasts are for the index to drop to its lowest since 2009 during the financial crisis, underlining the significant hit to manufacturing output, though some investors are likely to wait until Friday’s nonfarm payrolls report and the ISM’s non-manufacturing print to assess the wider impact on the US economy from the virus fallout.

It wasn’t all bad news, however, as China’s Caixin/Markit manufacturing PMI rose to 50.1 in March, supporting the official government survey from earlier in the week that pointed to a recovery in output. But with most countries outside of China still having a big mountain to climb before declaring to be virus-free, optimism remained scarce among investors.

Fed can’t keep dollar down despite liquidity boost

The renewed concerns about the economic impact from the virus outbreak have put the US dollar back in the spotlight this week. While yesterday’s moves were somewhat distorted by quarter-end flows, it was evident today that demand for liquidity and the safety of the dollar remains elevated.

The Federal Reserve has been actively attempting to alleviate dollar shortages by establishing swap lines with other central banks and yesterday went a step further and launched a temporary repo facility as well. The new liquidity measure triggered a pullback in the greenback, but only temporarily as the currency has turned upwards today.

The dollar index was last up 0.5%, pushing the euro back below the $1.10 level and the pound below $1.24. Against the safe haven yen, however, the dollar was unable to reclaim the 108 handle and was only marginally higher at 107.75.

The Australian and Canadian dollars were also on the backfoot, not helped by a fall in commodity prices, with the exception of gold, which climbed more than 1% to around $1,590 an ounce on the back of the increased risk-off tone.

Origin: XM