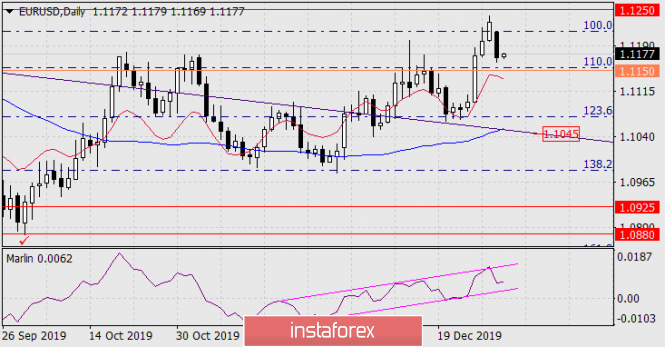

The euro fell by 57 points on the first trading day of the new year amid a release of macroeconomic statistics. The European Manufacturing PMI in the final assessment for December was raised to 46.3 from 45.9, the US Manufacturing PMI, on the contrary, was revised down from 52.5 to 52.4. This fact confirms the speculative nature of the euro growth in the new year. With the signal level of 1.1150 being overcome below the Fibonacci level of 110.0% on the daily chart, we are waiting for the price to support the embedded line of the price channel in the region of 1.1045. By the time the price goes below the specified signal level, the Marlin oscillator line will exit down its own channel.

The euro fell by 57 points on the first trading day of the new year amid a release of macroeconomic statistics. The European Manufacturing PMI in the final assessment for December was raised to 46.3 from 45.9, the US Manufacturing PMI, on the contrary, was revised down from 52.5 to 52.4. This fact confirms the speculative nature of the euro growth in the new year. With the signal level of 1.1150 being overcome below the Fibonacci level of 110.0% on the daily chart, we are waiting for the price to support the embedded line of the price channel in the region of 1.1045. By the time the price goes below the specified signal level, the Marlin oscillator line will exit down its own channel.

On the four-hour chart, the signal line of the Marlin oscillator has fixed in the zone of negative values – in the decreasing trend zone. With price consolidating under the MACD line, a full-fledged signal for a decline will take place. Note that the MACD line coincides with the signal level of the higher timeframe (1.1150), this increases the significance of the level.

Taking into account that current euro quotes are at the peaks of October and November, preliminary price consolidation (about a day) is possible before continuing the decline.

Origin: InstaForex