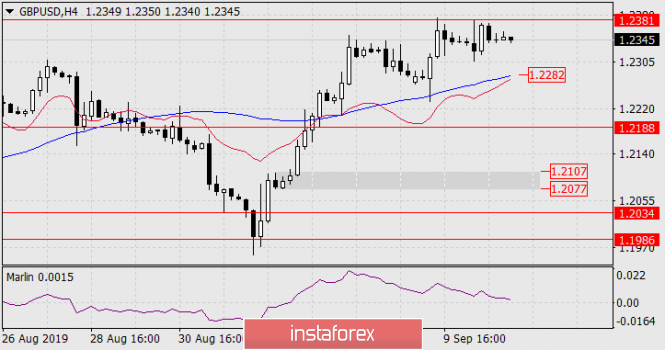

Yesterday, the British pound again touched the control level of 1.2381 with declining technical indicators, primarily ahead of the Marlin oscillator. On the one hand, this could be a sign of a price reversal downward, the movement to support the price channel line and the MACD line on the daily chart, to the level of 1.2188, on the other hand, the price exit above 1.2381 opens the way for further growth with the target at 1.2548 – Fibonacci level of 161.8%, and then the decline of Marlin automatically becomes a mere discharge of the indicator in front of a new wave of growth.

Yesterday, the British pound again touched the control level of 1.2381 with declining technical indicators, primarily ahead of the Marlin oscillator. On the one hand, this could be a sign of a price reversal downward, the movement to support the price channel line and the MACD line on the daily chart, to the level of 1.2188, on the other hand, the price exit above 1.2381 opens the way for further growth with the target at 1.2548 – Fibonacci level of 161.8%, and then the decline of Marlin automatically becomes a mere discharge of the indicator in front of a new wave of growth.

However, the declining scenario remains basic. The pound’s first task in implementing this scenario will be to consolidate the price below the MACD line on the four-hour chart (1.2282), after which it is possible to achieve important support of the daily scale 1.2188. Leaving the price below opens the subsequent target at 1.2077-1.2107.

Origin: InstaForex