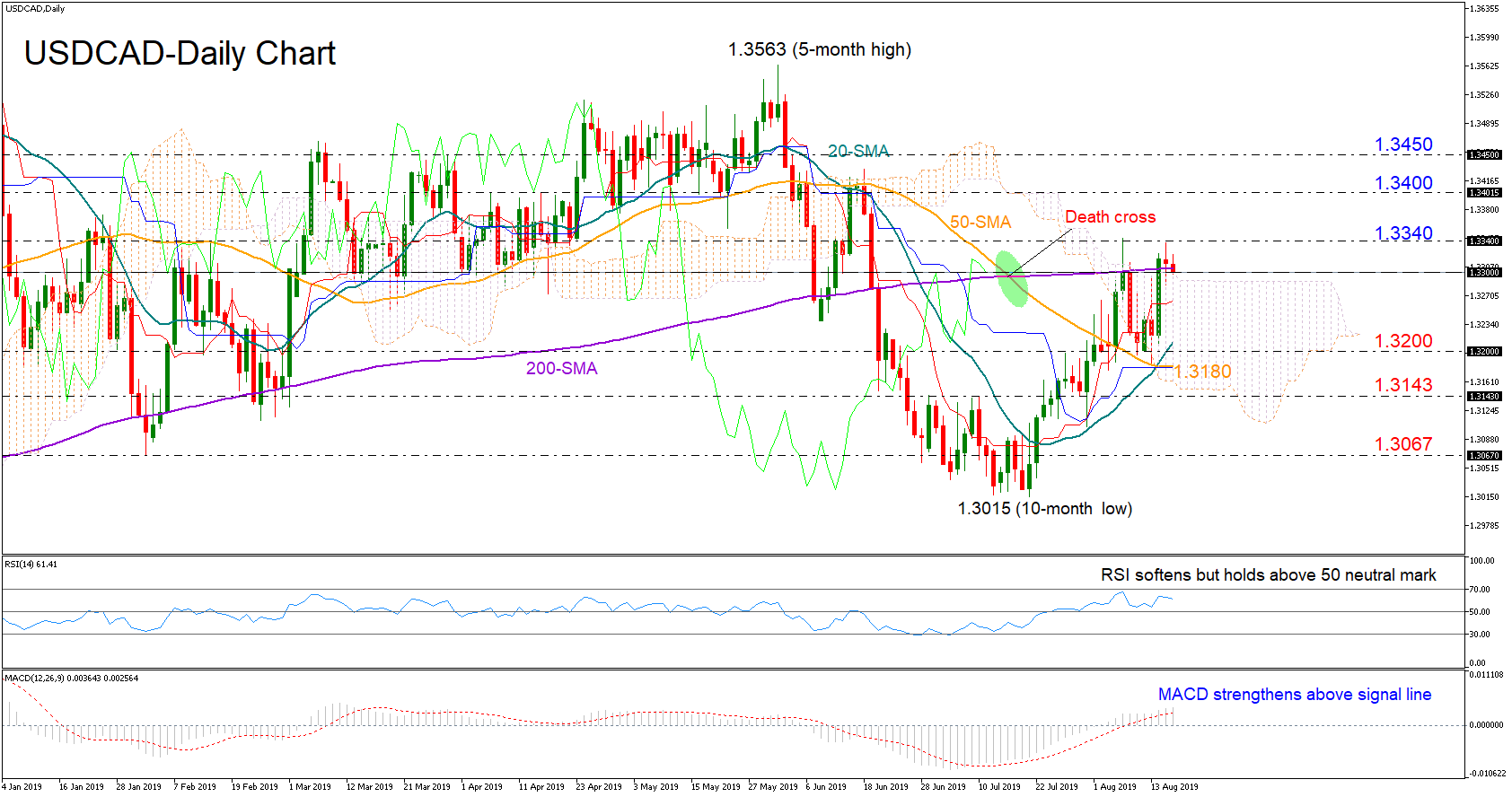

In the fifth consecutive week of having risen , USDCAD managed to close slightly above the 200-day simple moving average (SMA) and the Ichimoku cloud, increasing the likelihood for an up-trending market. The bullish cross between the 20- and the 50-day SMA is also a positive trend signal.

In the fifth consecutive week of having risen , USDCAD managed to close slightly above the 200-day simple moving average (SMA) and the Ichimoku cloud, increasing the likelihood for an up-trending market. The bullish cross between the 20- and the 50-day SMA is also a positive trend signal.

In terms of momentum, the rising MACD accompanied with the improving Tenkan-sen and the softening RSI suggest a bullish-to-neutral session for the short-term. Yet to stage another rally, the bulls should overcome the 1.3340 barrier that kept upside movements under control this month. Beyond that, resistance could appear within the 1.3400-1.3450 congested area, a break of which would shift the spotlight towards May’s peak of 1.3563.

Should the price pull back into the cloud, the 20-day SMA currently near 1.3200 could come first into view. Moving lower and under the 50-day SMA, support could be next found around the 1.3143 obstacle, while in case of a deeper decline below the February low of 1.3067, the bearish wave may continue until the 1.3000 mark.

Regarding the medium-term picture, the market holds in a downward move since early May and only a climb above 1.3400 would officially resume a neutral profile. However, with the 50-day SMA showing no sign of correcting its bearish cross with the 200-day SMA, the odds for an outlook reversal currently appear minimal.

In brief, USDCAD holds a bullish-to-neutral bias in the short-term, while in the medium-term the outlook remains negative.

Origin: XM