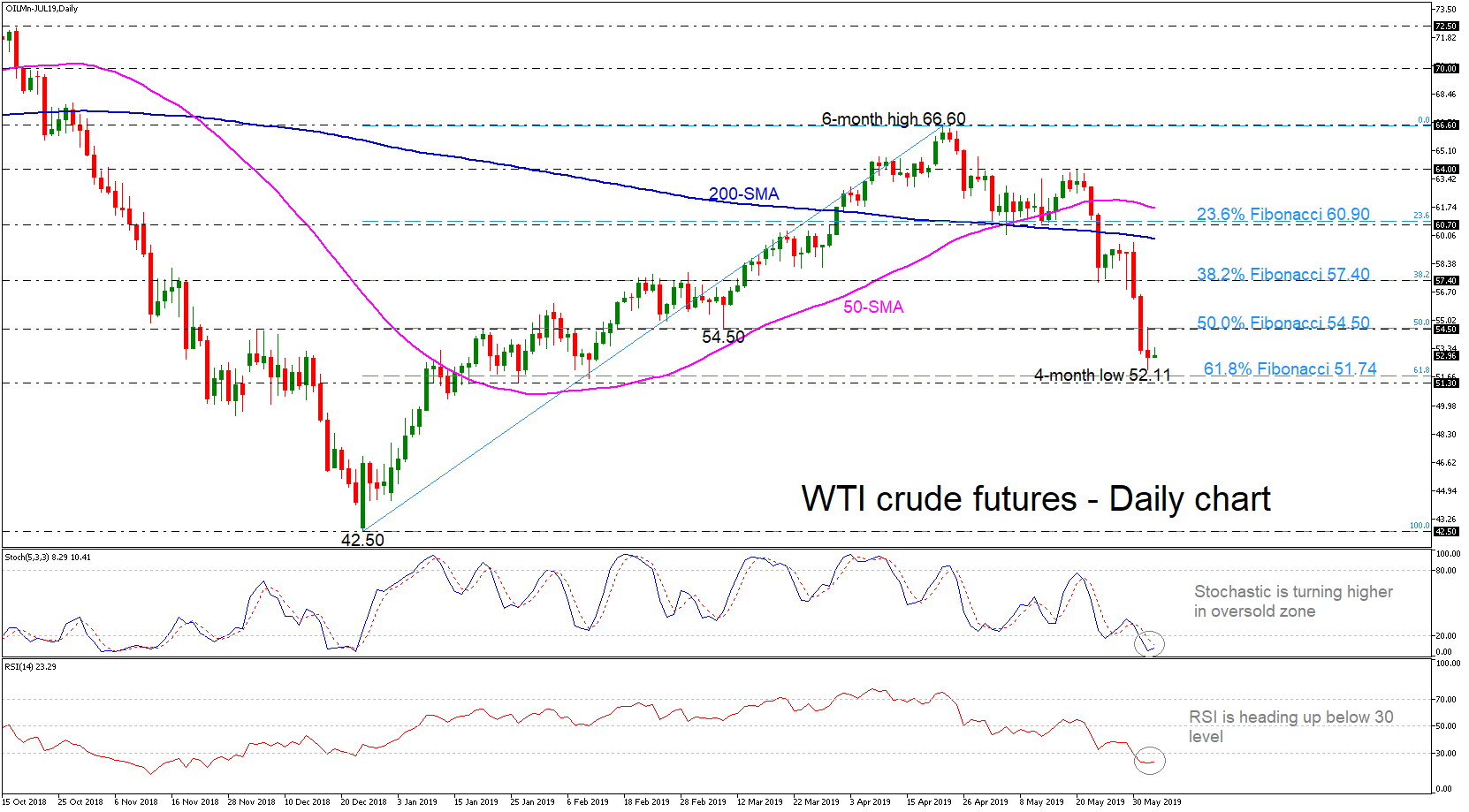

WTI crude oil futures declined considerably towards a fresh four-month low of 52.11 on Monday, erasing the medium-term ascending movement in the daily chart.

WTI crude oil futures declined considerably towards a fresh four-month low of 52.11 on Monday, erasing the medium-term ascending movement in the daily chart.

However, the downside momentum appears to have run out of steam as prices have been attempting and failing to close below the 61.8% Fibonacci retracement level of the upleg from 42.50 to 66.60 near 51.74. The stochastic oscillator is returning higher in the oversold zone, while the RSI is trying to gain ground below the 30 level.

Should oil prices manage to strengthen the positive momentum, the next resistance could come around the 50.0% Fibonacci mark, which overlaps with the 54.50 barrier. A break above this region would shift the short-term bias to slightly bullish and open the way towards the 38.2% Fibonacci of 57.40. Above this level, the next target could come from the 200-day moving average currently at 59.86.

On the other hand, if prices tumble below the 61.8% Fibonacci (51.74) and the 51.30 support could drive the market until the next support, which is appearing at the 42.00 psychological level. A potential downside violation could increase negative pressure until the 42.50 barrier, identified by the low on December 26.

In the near-term, the bias remains negative since prices hold below all the moving average lines, but momentum indicators signal that this rally may came to an end. So, traders should be waiting for a jump above 50.0% Fibonacci for positive orders, or a drop below 61.8% Fibonacci for more downside movement.

Origin: XM