Volatility eases as Trump keeps trade deal hopes alive

Volatility eases as Trump keeps trade deal hopes alive

After a day of turmoil in financial markets, things got off to a steadier start on Tuesday with the help of more upbeat comments by US President Trump. Global equities plunged on Monday, along with the US dollar, while gold soared after China retaliated to Trump’s tariff hike by raising the levies on more than 5,000 US imports, amounting to $60 billion. In addition to the tariff increases already announced, the Trump administration is studying the possibility of slapping duties on all remaining imports from China.

Stocks in the US suffered their biggest one-day loss since early January, with all three main indices ending the day more than 2% lower. However, stock futures are suggesting Wall Street will open around 0.5% higher today as markets bet that China and the US will find a way to work through their differences.

There was some relief yesterday after Trump said no decision had been taken yet on the remaining tariffs. Sentiment was further boosted later in the day when Trump was quoted as saying “I have a feeling it’s going to be very successful” with regards to the trade talks.

Gold retreats from highs as risk assets recover

The turnaround in risk sentiment dragged the safe-haven gold away from one-month highs, having only just managed to break above the $1300 level. Though, technicals for the precious metal remain bullish in the short term, pointing to plenty of caution still in the markets.

The risk-sensitive Australian and New Zealand dollars edged higher on Tuesday but only marginally, while the Chinese yuan reversed its earlier gains to fall to fresh 4½-month lows against the US dollar.

The greenback was able to make a more notable rebound, however, rising from 3-month troughs below the 109-yen level to climb to around 109.65 yen in early European trading as US Treasury yields pulled away from their lows. On a broader level, the dollar index was steady around 97.35.

With the US data schedule looking relatively light until tomorrow’s April retail sales report, trade headlines are expected to continue to be the main driver for the dollar as well as for overall market sentiment.

Pound under pressure on falling Tory support for cross-party Brexit talks

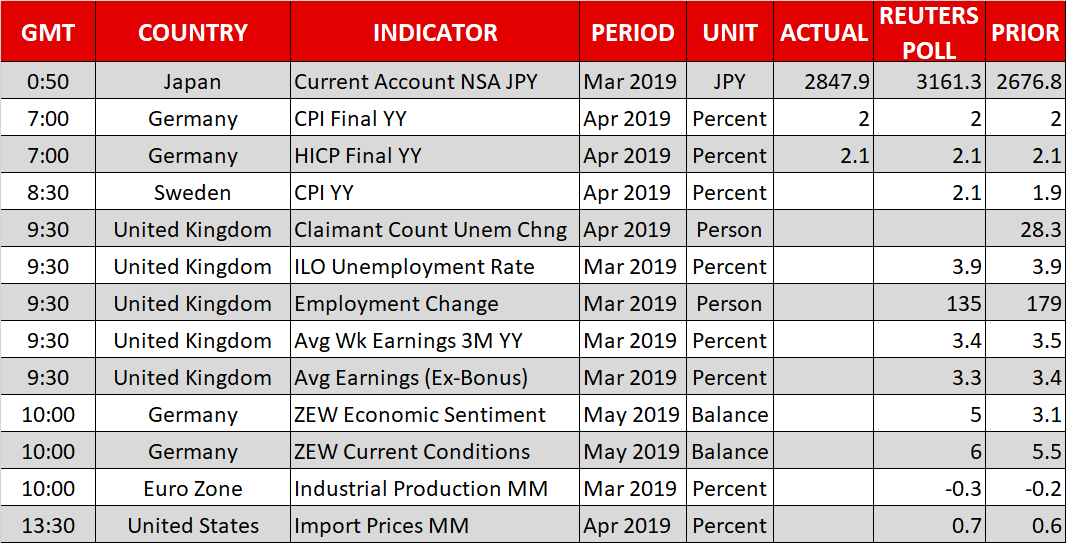

The euro continued to breeze its way through the current turbulence, holding steady in the $1.1215-1.1265 range. Traders will be watching Eurozone industrial output numbers for March and the German ZEW economic sentiment gauge for May due later in the session for the latest clues about the health of Europe’s economy amid some tepid signs of a turnaround.

The pound remains on the backfoot, however, slipping below the $1.30 on growing doubts about whether Prime Minister May will be able to strike an agreement with the opposition Labour party to win cross-party support for her Brexit deal.

There is growing opposition from within her Conservative party for May to ditch talks with Labour as she faces calls to resign, while Labour MPs are unlikely to back the deal unless it’s attached with a promise to hold a second referendum. May is reportedly planning to reopen talks with the European Union to discuss possible changes agreed with Labour to the political declaration on the future relationship. However, markets remain unconvinced and there could be further losses in store for cable now that it’s once again breached its 200-day moving average.

Origin: XM