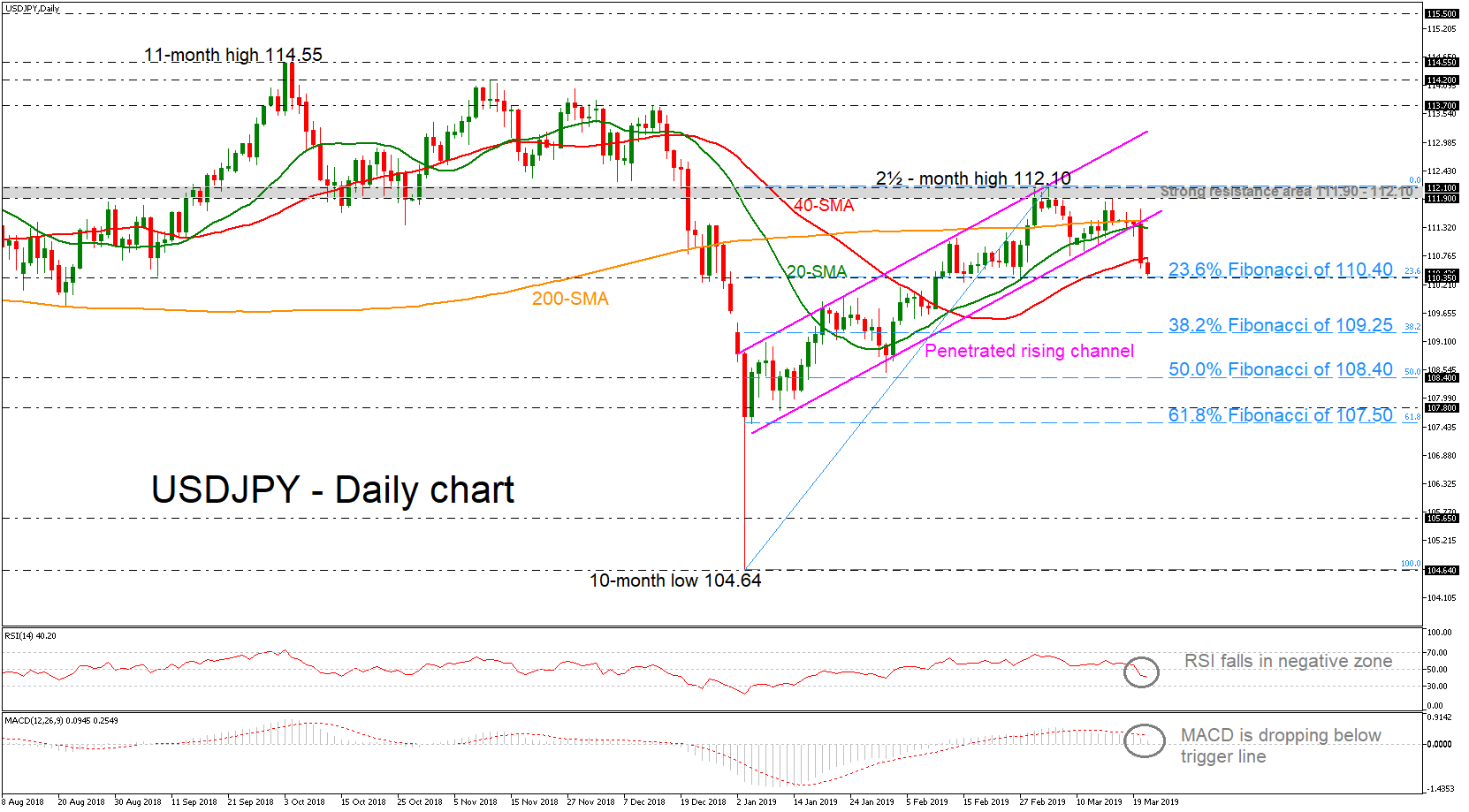

USDJPY is looking strongly bearish in the short-term after plunging below its daily simple moving averages (SMAs) on Wednesday. The price found significant obstacle near the 200-SMA, dropping beneath the ascending channel to challenge the 23.6% Fibonacci retracement level of the upleg from 104.64 to 112.10, around 110.40.

USDJPY is looking strongly bearish in the short-term after plunging below its daily simple moving averages (SMAs) on Wednesday. The price found significant obstacle near the 200-SMA, dropping beneath the ascending channel to challenge the 23.6% Fibonacci retracement level of the upleg from 104.64 to 112.10, around 110.40.

Prices hit a one-month low of 110.40 and the technical indicators are all pointing to further negative momentum in the near term. The RSI indicator has slipped below the 50 level with aggressive mode and is currently approaching the 30 oversold level, while the MACD oscillator is losing momentum below its trigger line.

Additional losses could find support around the 38.2% Fibonacci of 109.25, confirming the recent neutral bias in the daily timeframe. If there is a successful break beneath this area, the next stop could be at the 108.40 barrier, which overlaps with the 50.0% Fibonacci.

If, however, the strong downside momentum was about to stall, with the pair reversing higher, resistance could initially come from the 200-day SMA and the 20-day SMA around 111.40. Rising above this level could take prices towards the 111.90 – 112.10 resistance zone which previously acted as a critical hurdle for the bulls. A failure to hold below this area would switch the focus back to the upside and towards 113.70, taken from the high on December 13.

To conclude, the short-term bias currently looks neutral-to-negative, while in the medium-term the neutral outlook is still intact.

Origin: XM