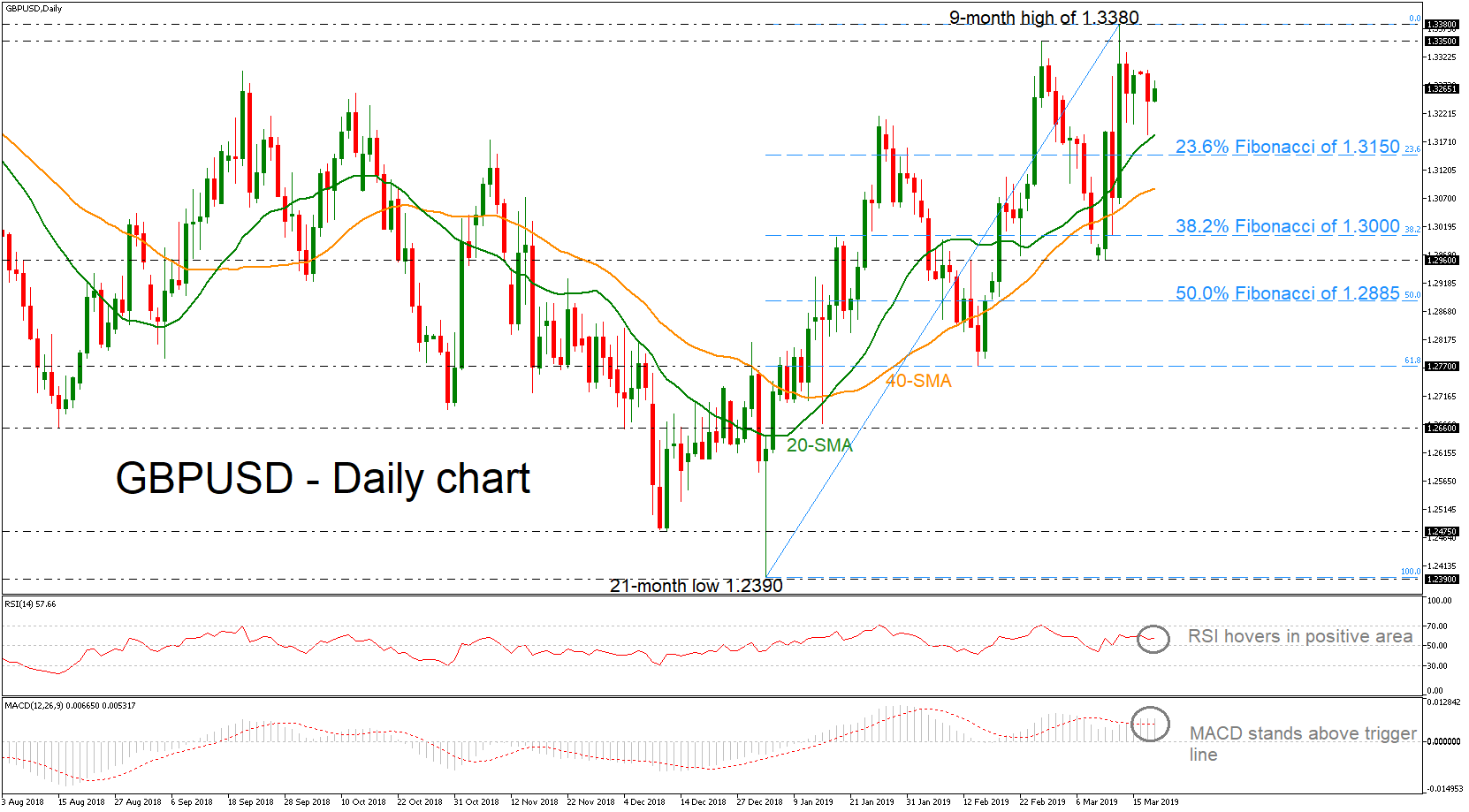

GBPUSD has been moving higher since the rebound on the 21-month low of 1.2390 on January 3, creating a bullish tendency in the daily timeframe. After touching the nine-month high of 1.3380, cable returned lower but is hovering above the 20- and 40-simple moving averages (SMAs). The market could maintain upside momentum as the RSI remains in a positive area and the MACD has jumped above its trigger line in the bullish zone.

GBPUSD has been moving higher since the rebound on the 21-month low of 1.2390 on January 3, creating a bullish tendency in the daily timeframe. After touching the nine-month high of 1.3380, cable returned lower but is hovering above the 20- and 40-simple moving averages (SMAs). The market could maintain upside momentum as the RSI remains in a positive area and the MACD has jumped above its trigger line in the bullish zone.

An extension to the upside and above the 1.3350 – 1.3380 key area could meet the 1.3475 resistance level, taken from highs on June 7. Another successful upside break could bring 1.3600 into view, identified by the peaks on May 2018.

Otherwise, the pair could slip below the 20-day SMA to challenge the 23.6% Fibonacci retracement level of the upleg from 1.2390 to 1.3380 around 1.3150. Under this line, immediate support would come from the 40-day SMA, currently at 1.3090 before heading towards the 1.3000 psychological level which is the 38.2% Fibonacci.

Summarizing, GBPUSD has been trading in an upside tendency over the last two-and-a-half months, while looking at the long-term picture, the price seems to be neutral, creating a wide trading range within 1.2475 – 1.3380.

Origin: XM