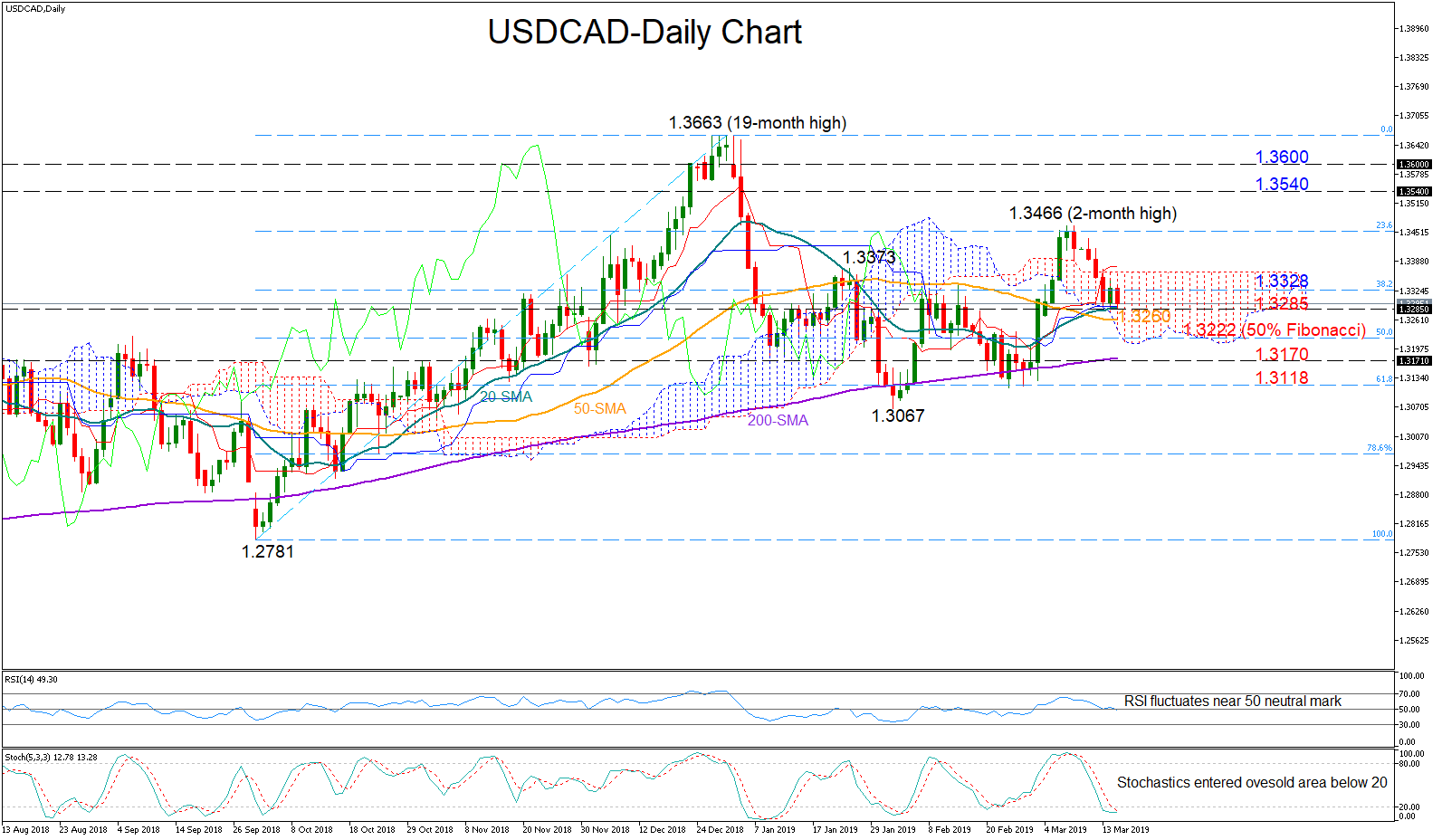

USDCAD has been trading to the downside this week but the 1.3285 level appeared a hurdle for the bears to overcome over the past two sessions. The RSI is hovering around 50, framing a neutral picture for the short term. Yet with the fast-stochastics set for a bullish cross below the 20 oversold mark, chances for an upside reversal are considerably increasing.

USDCAD has been trading to the downside this week but the 1.3285 level appeared a hurdle for the bears to overcome over the past two sessions. The RSI is hovering around 50, framing a neutral picture for the short term. Yet with the fast-stochastics set for a bullish cross below the 20 oversold mark, chances for an upside reversal are considerably increasing.

If the 1.3285 key number successfully stops negative pressure, sending the price higher, immediate resistance is expected to be found around 1.3328, where the 38.2% Fibonacci of the upleg from 1.2781 to 1.3663 is placed. Clearing this area, the next target could be the 2-month high of 1.3466, which if beaten could enhance buying confidence towards 1.3540-1.36, a crucial resistance area during 2016.

Should bearish forces retake control, the 50-day moving average (MA) at 1.3260 and the 50% Fibonacci of 1.3222 could curb downside movements before the 200-day MA at 1.3170 comes into view. A drop below the latter and more importantly a decisive close under the 1.3118 support could wind down interest for the pair.

In the medium-term timeframe, the market is in a range, trading between 1.3663 and 1.3067. Any violation of these boundaries could change the outlook accordingly.

Origin: XM