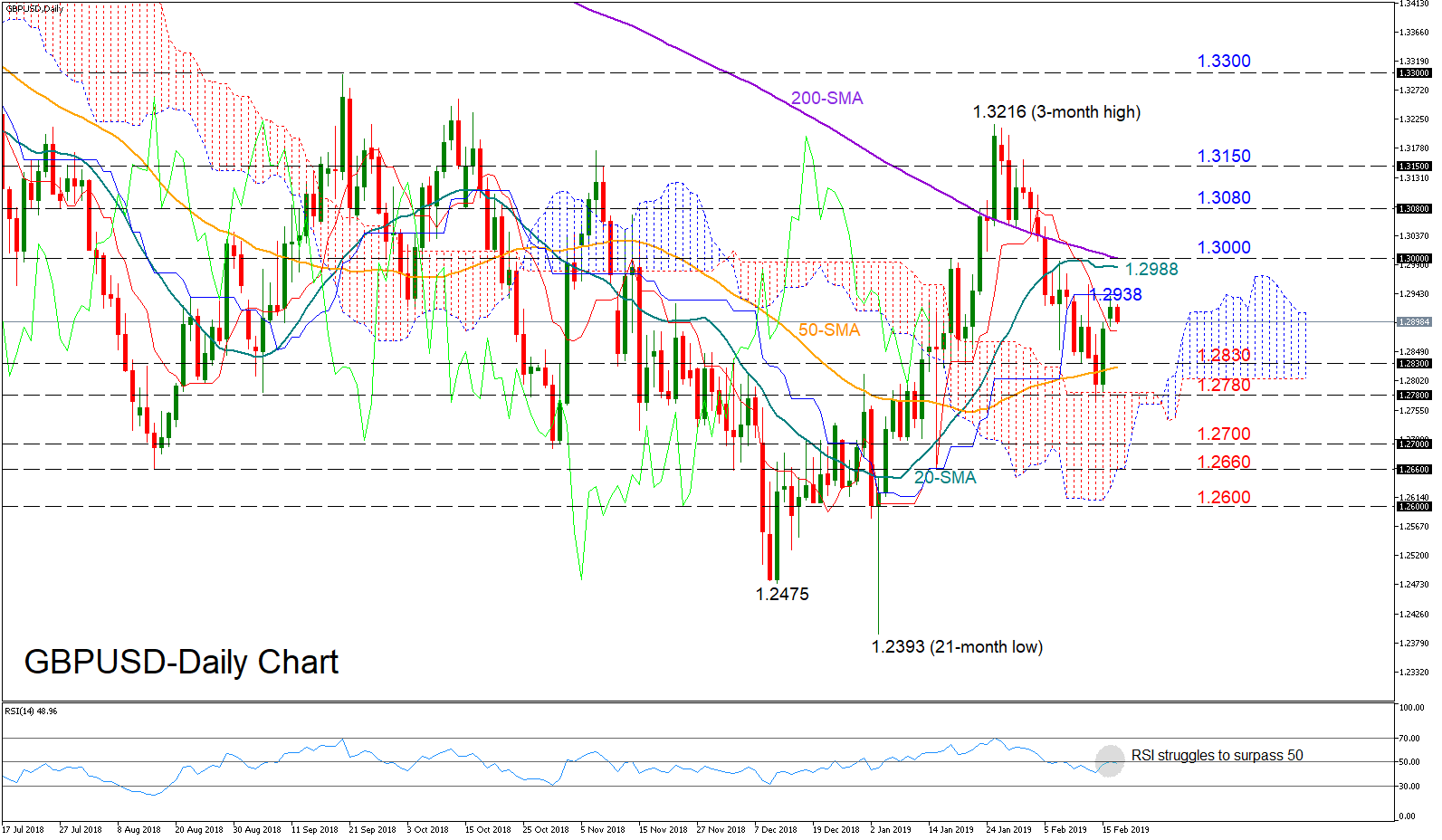

GBPUSD passed through the 1.29 level on Monday but early on Tuesday the bears blocked the way, sending the pair lower. In momentum indicators, the red Tenkan-sen line seems to be flattening, while the RSI is struggling to surpass its 50 neutral mark, both suggesting a sideways market for the short term.

GBPUSD passed through the 1.29 level on Monday but early on Tuesday the bears blocked the way, sending the pair lower. In momentum indicators, the red Tenkan-sen line seems to be flattening, while the RSI is struggling to surpass its 50 neutral mark, both suggesting a sideways market for the short term.

The 1.2830-1.2780 area could provide immediate support in case bearish action picks up steam. Falling lower and below the 1.2700 round level, support could run towards the 1.2660 barrier before the 1.2600 psychological mark comes into focus. If the latter fails to hold, all eyes will shift to the 1.2475 bottom, where any close under that barrier would activate fresh selling pressure.

Alternatively, a break above yesterday’s peak of 1.2938 would shift attention towards the 20-day moving average (MA) which currently stands at 1.2988 and slightly below the 200-day MA. Should the pair jump above those lines and higher to the 1.3000 level, resistance could next be found between 1.3080 and 1.3150.

In the medium-term picture, GBPUSD remains neutral within the 1.3300-1.2393 boundaries. The decreasing distance between the 50- and the 200-day MAs is a positive sign that GBPUSD could turn bullish once the lines clearly cross each other.

Origin: XM