Dollar drops alongside stocks as retail sales plunge, trade optimism fades

Dollar drops alongside stocks as retail sales plunge, trade optimism fades

The dollar retreated in tandem with US equity markets yesterday, both giving back some of their recent gains, following disappointing US data and signs that the trade talks won’t produce much of substance after all. Specifically, US retail sales for December were abysmal, with the retail control group – which is used in GDP calculations – falling by a shocking 1.7% on a monthly basis, instead of rising by 0.4% as per consensus. This implies that growth was likely much weaker than projected in Q4, playing into the narrative that downside risks are accumulating and vindicating the Fed’s go-slow approach.

On the trade front, several reports suggest that little progress has been made during the talks in Beijing. China has reportedly only offered solutions to reduce the bilateral trade deficit, concessions which are likely miles apart from the deep structural reforms – like curbing industrial subsidies and protecting IP rights – that the US is pushing for. Thus, the risk of tariffs being raised after the March 1 deadline seems to have risen, and any hints towards that in the coming days may spell some more trouble for US markets.

Neither the dollar nor US stocks lost a lot of ground though, in a classic case of “bad news is good news”, as the soft retail sales caused market pricing to tilt back in favor of Fed rate cuts this year, providing a cushion for risky assets like equities. Meanwhile, the souring sentiment on trade likely fueled some haven demand for the greenback, limiting greater losses.

Cable drops despite soft dollar as May’s hand weakens

The British pound was the worst performer on Thursday, after the UK Parliament voted down the government’s approach to the Brexit talks, marking another defeat for PM May. Although the vote was not legally binding and hence merely suggestive, it was seen as weakening May’s negotiating hand even further as she can no longer claim she has Parliament’s full backing when trying to squeeze out more concessions from Brussels.

Euro/dollar stabilizes, with yield differentials providing support

The world’s most traded currency pair rebounded yesterday, after finding fresh buy orders near the 1.1250 area. It’s interesting to note that there has been some divergence lately between spot FX price action and the relative EU-US interest rate differentials. While euro/dollar has fallen markedly in February, the yield spread between short-dated Germany bunds and US Treasuries has remained stable and even rose a little.

This suggests that relative interest rates are providing some support for the pair, and that sellers may therefore have a difficult time piercing below the November lows near 1.1215. That said, so long as Eurozone’s data pulse remains this weak, any meaningful rebound seems unlikely either.

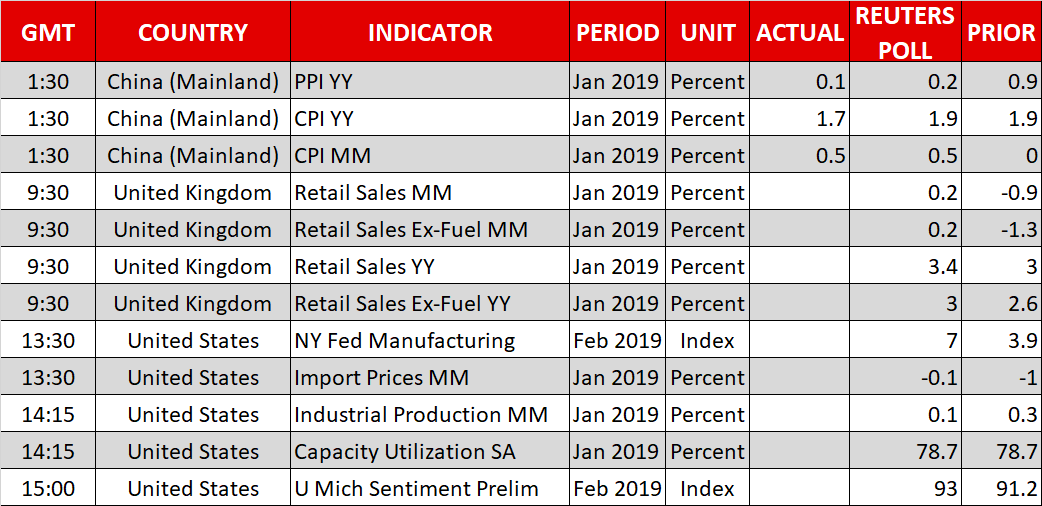

Coming up: UK retail sales and tier-two US data

The economic calendar is relatively light on Friday, with the only tier-one release being the UK retail sales for January. Forecasts point to a rebound in monthly terms, and although that may help the pound recover a little on the news, all eyes remain on Brexit developments – or the lack thereof.

China’s inflation data for January have already been released, and producer prices slowed by even more than expected, pushing the aussie and kiwi a little lower during the early Asian session.

In the US, the Empire State manufacturing and the preliminary U of M consumer sentiment indices, both for February, may attract some attention.

Atlanta Fed President Raphael Bostic will speak at 14:55 GMT.

Origin: XM