Euro inches lower despite Draghi trying his best not to seem dovish

Euro inches lower despite Draghi trying his best not to seem dovish

The European Central Bank (ECB) officially announced the end of its crisis-era QE program yesterday, as expected. The Bank revised down its growth and inflation forecasts, though that was largely anticipated given the recent streak of soft data and the fall in oil prices. What was surprising, was a slight downgrade in the assessment of risks. President Draghi tried his best to downplay this shift in language, noting that although the risks to growth are still “broadly balanced”, they are “moving to the downside” as a result of geopolitical concerns, trade protectionism, and financial market volatility.

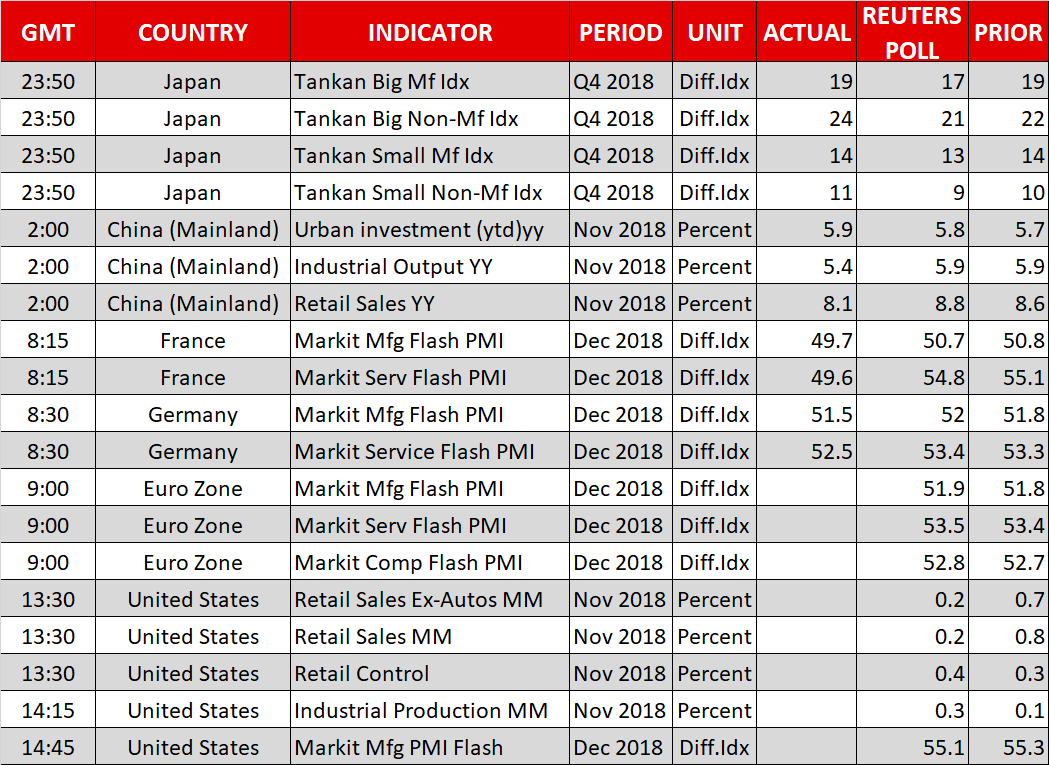

The euro tumbled, albeit only modestly, and managed to recover most of its losses after the meeting concluded. The key message was that the ECB remains on track to normalize, but is becoming increasingly cautious amid external risks and a domestic economy that is returning to “potential” after a period of surprisingly strong growth. Hence, the timing of the next tightening move, namely a rate hike, remains data-dependent. In this respect, attention now turns to the release of Eurozone’s preliminary PMIs for December today, to determine whether the economy continues to bleed momentum or is stabilizing; the euro will react accordingly.

Aussie and kiwi tumble after key Chinese data disappoint

Global risk appetite faltered overnight, following the release of a disappointing batch of Chinese economic data for November. Both industrial production and retail sales missed their forecasts by a wide margin, fueling concerns that the world’s second largest economy may slow by more than previously thought, in the midst of massive deleveraging efforts and the US trade dispute. Accordingly, the aussie and the kiwi are the worst performers on Friday, given the close trading ties Australia and New Zealand have with China, while futures tracking Wall Street stock indices are pointing to a lower open today.

EU denies Brexit deal renegotiation; back to square one?

Theresa May’s visit to Brussels yesterday failed to produce any encouraging Brexit headlines. The EU made it abundantly clear that the Brexit withdrawal deal is not open for renegotiation, and that the best it can do is provide “clarifications” on the deal – the implication being that any such clarifications will not be legally binding. Recall however that across the Channel, most MPs that had opposed the deal also stated that any non-legally binding assurances would be worth very little, and thus wouldn’t be enough for them to change their minds.

Therefore, there’s still no obvious or plausible route for May to win over enough lawmakers to pass her deal through Parliament. The pound was little changed, but considering that political uncertainty is set to stay elevated, any rallies in the currency may remain short-lived.

US retail sales the highlight on today’s calendar

Besides the Eurozone’s preliminary PMIs, the other key release today will be the US retail sales figures for November. This will be the final piece of first-tier data before the Fed’s policy decision next week, hence amplifying its importance for the dollar. As for the Fed, market pricing implies a 75% probability for a quarter-point rate hike next week, and assuming no surprises there, market attention will quickly turn to the rate projections for 2019 to either confirm or deny that a “pause” is on the cards next year.

US industrial production for November and the preliminary Markit PMIs for December, are also due out.

In terms of public appearances, ECB Vice President de Guindos (0815 GMT) and Executive Board member Lautenschlager (0930 GMT) will deliver remarks.

Origin: XM