Pound soars as May survives, but odds of a sustained rally slim

Pound soars as May survives, but odds of a sustained rally slim

Sterling surged on Wednesday, as it became increasingly clear throughout the session that PM May would survive the no-confidence motion, amid a plethora of Tory lawmakers publicly stating their support for her. Hence, investors “bought the rumor”, and sure enough, May won the confidence vote of the Conservative Party by 200 – 117. The pound interestingly pulled back on the news, partly due to traders locking in profits and “selling the fact”, and partly because the margin of her victory wasn’t impressive.

Indeed, one has to question whether the surge in the pound was justified, as looking past the triumphant headlines, the Brexit process remains in exactly the same uncertain stage as it was two days ago. If anything, considering that more than a third of her party is against her, one has difficulty envisioning a scenario under which the PM manages to command a majority in Parliament to push her deal through, even if the EU does grant backstop assurances. The bottom line is that any rallies in sterling may remain relatively short-lived as uncertainty is set to stay elevated. Today, all eyes will be on the EU summit, which may reveal what kind of guarantees Europe is willing to grant.

Euro firms as Italy de-escalates; ECB meeting in focus

The single currency advanced yesterday, alongside sterling, and following news that Italy presented the EU with a revised budget that lowers the controversial deficit to 2.0%, in an attempt to appease Brussels and de-escalate the situation.

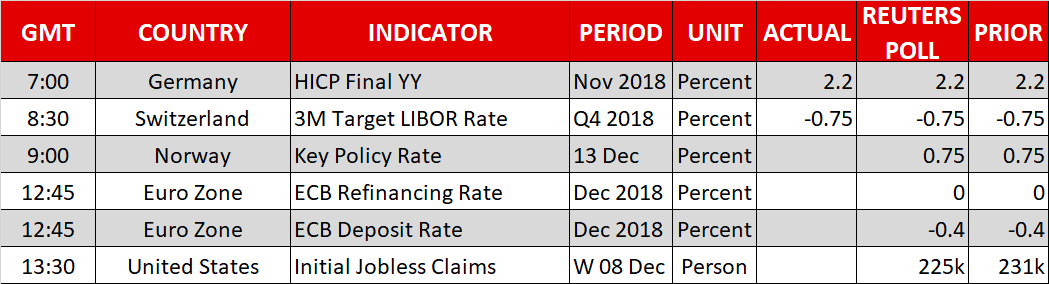

Today, the main event will be the ECB meeting, where the Bank is set to officially end its QE program. Although Eurozone growth indicators have disappointed lately, policymakers have made it clear they have no intention of extending QE. Instead, markets will scrutinize the Bank’s economic forecasts, the assessment of risks, and President Draghi’s press conference, for any signals on whether the ECB is turning more cautious. In other words, does the Bank view the loss of growth momentum as owed to temporary factors that will dissipate soon (euro-positive), or is it starting to worry this may be a prolonged slowdown (euro-negative)?

It’s a close call, but the risks may be tilted towards a slightly upbeat tone from Draghi that allows the ECB to end QE on an optimistic note. He may reiterate the Bank remains committed to its normalization plans, and perhaps downplay the clouded inflation outlook by pointing to strength in wage growth, in essence postponing any potential dovish shift for a later meeting (for more: ECB preview).

SNB meets as well, but no “hawkish bits” yet

The other key event today will be the SNB’s own policy meeting, where the Bank is widely expected to keep its policy rates at record lows. Considering that the Swiss economy contracted in Q3, core inflation rests at a mere 0.2% in yearly terms, and the franc has strengthened lately on the back of global uncertainties, policymakers are unlikely to provide any hawkish signals. Instead, they may reiterate the franc remains “highly valued”, the Bank will continue to intervene in the FX market, and negative rates are still a necessity. Such a dovish tone would argue for a weaker franc over time, absent an escalation of global risks that triggers a “flight to safety”.

Stocks advance, dollar falters as trade reports reinvigorate optimism

Risk sentiment was lifted yesterday by a WSJ report that China is considering delaying its “made in China 2025” plan and increasing access for foreign firms operating in the country. US markets closed somewhat higher, while defensive currencies like the yen and the dollar pulled back. Although this is encouraging, as it shows determination to defuse tensions, the market reaction was lukewarm. Perhaps investors remain skeptical of whether such changes will be material, or merely aesthetic, aimed at striking a short-term deal to buy time and “weather out” the Trump presidency, rather than radically reforming the Chinese economy.

Other highlights today

In Norway, the Norges Bank will also announce its monetary policy decision.

Origin: XM