Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The US dollar is down by a marginal 0.05% against a basket of six major currencies on Monday, largely holding on to the safe-haven gains it recorded in the previous session as concerns regarding an escalation in US-China trade row resurfaced. There was little movement elsewhere in the FX market, with investors appearing somewhat reluctant to initiate new bets with the risk of fresh tariffs being imposed soon hanging in the background.

STOCKS: Wall Street ended practically flat on Friday, with gains early in the session being mostly wiped out following headlines that the US plans to move forward with imposing tariffs on China, despite the US request for negotiations last week. The S&P 500 and the Dow Jones both gained a marginal 0.03%, while the tech-heavy Nasdaq Composite inched down by 0.04%. Anxieties seem to have lingered, as futures suggest a lower open for the S&P, Dow, and Nasdaq 100 today. The same was true in Asia, where most markets closed in the red on Monday. In Hong Kong, the Hang Seng fell by 1.38%, while South Korea’s Kospi 200 dropped by 0.69%. In Japan, markets remained closed for a public holiday. Market sentiment was sour in Europe as well, with futures tracking all the major benchmarks pointing to a significantly lower open today.

COMMODITIES: Oil was slightly higher on Monday, with WTI being up by 0.17% at $69.13 per barrel and Brent trading higher by 0.15% at $78.25 a barrel. The bulls so far seem undeterred by worrisome news on both the supply and the demand fronts. US drillers added two new oil rigs in the previous week according to Baker Hughes data on Friday. Meanwhile, a looming escalation in the US-China trade standoff is increasingly clouding the outlook for future oil consumption, with prices likely to remain sensitive to any updates. In precious metals, dollar-denominated gold is up by nearly 0.20% on Monday at $1195 per ounce, attempting to recover some of the notable losses it posted on Friday as the US currency surged.

The US dollar rebounded sharply on Friday to close the day higher against all its major peers, recovering losses from earlier in the session. The bounce followed US retail sales data for August, which were softer than anticipated, though July’s prints were revised notably higher – helping to paint an overall positive picture for consumer spending. A few hours later, the greenback got another boost, this time from safe-haven inflows after media headlines suggested the US plans to move forward with the $200bn tariffs on Chinese goods it had threatened earlier. Indeed, the WSJ reported over the weekend the US will impose tariffs on $200bn Chinese goods as early as today, but at a reduced level of 10% – much lower than the 25% touted earlier.

To complicate things further, China hinted that if the US does implement levies, it will probably reject the recent US proposal for talks as the nation won’t negotiate “with a gun pointed to its head”. Overall, the relentless pressure from the Trump administration looks unlikely to subside anytime soon, at least not before the looming US midterm elections. At the same time, Chinese officials appear unwilling to “lose face” by caving to US demands, so another escalation in tensions looks all but inevitable. A potential US tariffs announcement today coupled with the typical threats of more to come, could take a toll on risk appetite – triggering a rotation back into haven-perceived assets like the yen and dollar, and out of riskier ones like the aussie or equities. In this sense, aussie/yen may be a good proxy for further trade anxieties.

Elsewhere, the Brexit saga remains as eventful as ever. In a post on Sunday, former UK foreign minister Boris Johnson fired another round of criticism at the government, writing that the UK is headed for a “car crash” under the Chequers plan. The next weeks will be particularly interesting as they could see PM Theresa May’s position being challenged by hardline Brexiteers in her party like Johnson, when the annual Conservative Party conference kicks off on September 30. Hence, sentiment surrounding sterling will likely remain fragile leading up to the event, given the risk that May could be replaced by someone seeking a “clean exit” from the EU.

Trade fears will be in the forefront once again on Monday as sources from the Wall Street Journal reported that the US is preparing to announce additional tariffs against China as soon as Monday. Washington is expected to unleash import tariffs on $200 billion Chinese products, the biggest list in the multi-month trade dispute so far, with analysts anticipating Beijing to take countermeasures as well in the wake of further restrictions. The news come a few days after the US showed some sympathy by proposing to restart negotiations between the nations, with China welcoming the invitation. However, tensions might intensify even more if China refuses to hold talks with the US, potentially leading investors to shift funds from riskier assets to safe-havens, a move that could harm trade-sensitive currencies such as the aussie as well as the volatile emerging markets. Yet the dollar might remain resilient to heightened trade risks, supported by investors’ optimism on the path of the US economy. The size of the tariffs will be closely watched as sources believe it will probably be around 10%, compared to the 25% that was under consideration.

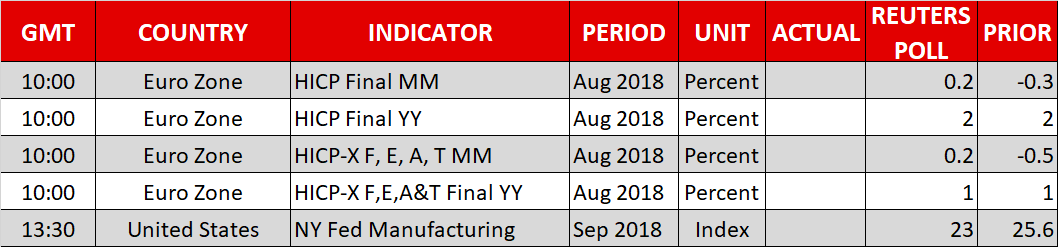

In terms of data releases out of the US, the New York Fed Empire State Manufacturing Index will attract attention at 1230 GMT. The index is said to have eased in September, falling from 25.60 in August to 23.

Earlier at 0900 GMT, the release of the Eurozone Harmonized Consumer Price Index (HCPI) for the month of August will be another event in focus today, though the euro might not react much as those will be the final readings. Eurostat is projected to revise the monthly HCPI, which uses a common methodology across EU countries, up to 0.2% compared to the initial estimate of -0.3%, while in yearly terms, HCPI is expected to come at 2.0% in line with preliminary data. Regarding the core measure, which excludes food, energy, alcohol, and tobacco, this is said to arrive at 0.2% m/m versus the initial forecast of -0.5%, leaving the yearly gauge steady at 1.0%. Should the headline HICP surprise to the upside, indicating that inflation in the eurozone holds above the ECB’s price target of “below but close to 2.0%”, the euro could move north.

As for public appearances scheduled for today, a number of speeches are planned by ECB members. At 0900 GMT, ECB Board Member Benoit Coeure will be making comments at the German Institute for Economic Research in Berlin. Later at 1015 GMT, ECB Executive Board Member Peter Praet will be speaking on “Economic developments in the euro area” at Société Royale d’Economie in Brussels, while at 1200 GMT, ECB Executive Board Member Yves Mersch will step up to the rostrum for the unveiling of the new €100 and €200 banknote at the ECB headquarters in Frankfurt.

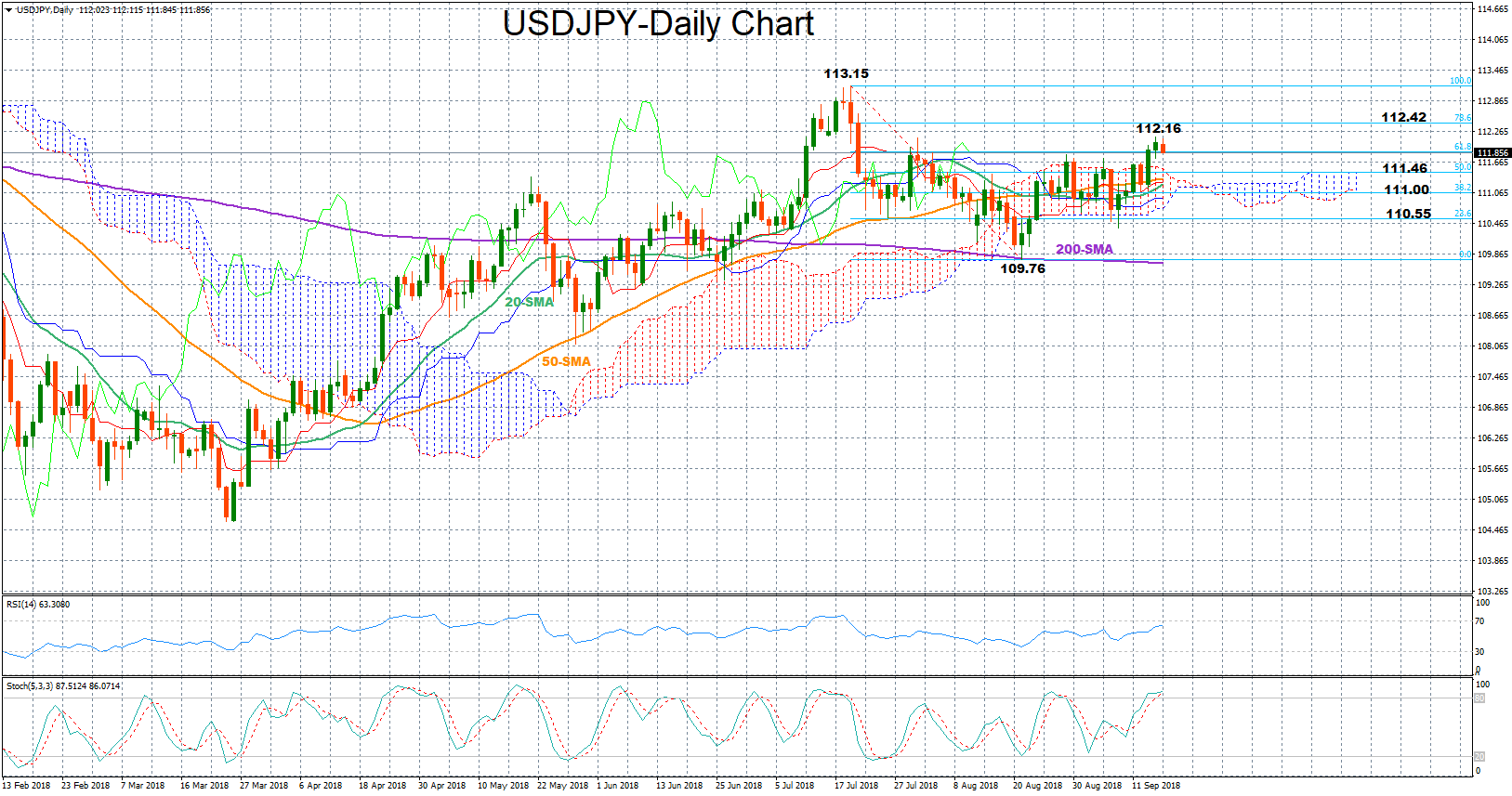

USDJPY started the week on the downside after climbing to as high as 112.16 on Friday, increasing further the distance above the Ichimoku cloud. In the short-term, however, the RSI and the Stochastics suggest that the price might lose positive momentum as both signal that the price moves in overbought territory; the former has risen near 70, while the latter has already entered overbought zone, with the green %K line and the red %D line being ready to post a bearish cross above 80.

Should the downside extend below the 61.8% Fibonacci retracement of the downleg from 113.15 to 109.76, the price might pause around the 50% Fibonacci of 111.46, where the pair stopped in late May and July. Lower than that, the 111 key level, which coincides with the 38.2% Fibonacci could come into view ahead of the 23.6% Fibonacci of 110.55.

Alternatively, a reversal to the upside could retest Thursday’s high of 112.16 before targeting the 78.2% Fibonacci of 112.42. Steeper increases may meet a challenge to break the six-month high of 113.15.

Origin: XM