Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The US dollar index was higher by nearly 0.1% on Monday, staying close to the seven-month high it posted last week. The Canadian dollar was 0.15% higher against its US counterpart, trying to recover some of the oil-induced losses it posted on Friday.

STOCKS: US markets closed lower on Friday in the aftermath of tariff announcements from both the US and China, though the magnitude of the downside moves was relatively small. The Dow Jones led the way lower, shedding 0.34%, while the Nasdaq Composite and S&P 500 fell by 0.19% and 0.10% respectively. Moreover, the slide looks set to extend today, as futures tracking the Dow, S&P, and Nasdaq 100 are all currently signaling a notably lower open for these indices. Indices in Asia were a sea of red on Monday as well. Japan’s Nikkei 225 and the Topix fell by 0.75% and 0.98% correspondingly. Europe was a similar story, with futures pointing to a negative open for all of the major benchmarks today.

COMMODITIES: Oil prices collapsed on Friday, following signals from China that crude oil will be included in the list of products it will impose tariffs on – something likely to curb demand for oil if enacted. Both WTI and Brent crude plunged by around $3 on Friday, to reach a two-week low and a six-week low respectively. The tumble occurred even despite reports that Venezuela, Iraq, and Iran, will seek to veto any production boosts proposed by Saudi Arabia and Russia at this week’s OPEC meeting, which would typically be a bullish signal for oil. In precious metals, gold is marginally higher on Monday, recovering some of the significant losses it posted in the previous session, when it dropped more than $20 to reach a new low for 2018. The metal exited to the downside the sideways range it was trading in even despite heightened risks around global trade, which has turned its technical outlook to negative.

As widely expected, the US announced on Friday it will proceed with slapping 25% import tariffs on $50bn Chinese products, aimed predominantly at protecting US intellectual property. The US administration also made it clear that should China attempt to retaliate, then more measures would be forthcoming. Regardless, China quickly responded it will also introduce 25% levies on $50bn US goods, ranging from food and vehicles to crude oil. Both sides said they would introduce tariffs on $34 billion goods starting July 6, which may be raised by another $16bn in the coming weeks.

The market reaction was mostly muted though, perhaps because both sides had signaled their intentions well in advance and thus their actions were hardly a surprise for investors. US stock indices closed lower, albeit only modestly so. Meanwhile, safe-havens like gold and the yen – which typically see inflows in times of turmoil – dropped instead of rising, indicating that trade concerns were not enough for investors to increase their exposure to such assets. Gold touched a fresh low for the year of $12,75, with its sizeable tumble also appearing like a delayed effect to the US dollar’s surge on Thursday.

The subdued reaction may reflect expectations that these moves are “hardball” US negotiating tactics aimed at generating leverage, and will not produce an actual trade war in the end. It may also be speculation the impact of a trade standoff will be only a “flesh wound” for the major economies, as the size of the announced tariffs is rather small. Or it could be that with July 6 still a few weeks away, markets are hoping a compromise may be reached before then. In any case, the next moves from either side could set the stage for what to expect. The US has threatened to hit China back if it retaliates, and media reports suggest the Commerce Department has already prepared another list of tariffs on $100bn worth of Chinese goods. While markets have been complacent so far, the same may not hold true if the situation escalates materially.

Trade deliberations and Brexit-related developments will be gathering attention on Monday in the absence of important releases out of major economies. In the meantime, the ECB Forum in Sintra, Portugal kicks off today and will feature remarks by influential central bank heads that have the capacity to move markets.

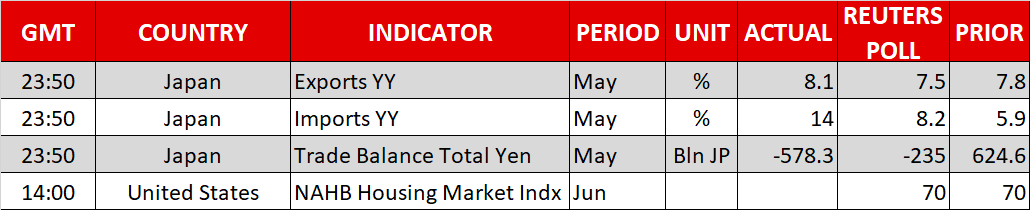

In terms of releases, the National Association of Home Builders (NAHB) housing market index is due out of the US at 1400 GMT and might attract some interest.

In the UK, after the votes in the House of Commons, the House of Lords will now debate the Brexit withdrawal bill that is fueling a rebellion against PM Theresa May by the pro-EU camp within the Tory party. Sterling pairs are expected to be sensitive to developments.

Politics are at play in Germany as well, where issues over migration are posing threats to Chancellor Merkel’s coalition.

On the trade front, the Trump administration’s decision on Friday to come one step closer to the imposition of tariffs on $50 billion in Chinese goods imported to the US, in conjunction with retaliatory actions of similar nature by China, are once again fueling the “trade war” narrative. Developments will be eyed, though it should be said that the market reaction as of late is such that indicates investors anticipate an eventual easing of tensions rather than a full-blown trade war.

Retiring New York Fed President William Dudley will be participating in a panel discussion at 1300 GMT. Starting today, up to now San Francisco Fed President John Williams, will replace him at the NY Fed; Williams will be giving a speech at the same venue as Dudley at 2000 GMT. The NY Fed President holds permanent voting rights within the FOMC. Of more importance in terms of policymakers’ appearances though is expected to be ECB President Mario Draghi’s comments at the ECB Forum on Central Banking in Sintra, Portugal (1900 GMT). In the coming days other important policymakers will be making public appearances at the forum, including Fed chief Jerome Powell and BoJ Governor Haruhiko Kuroda. Meanwhile, comments by Bank of Canada Deputy Governor Lynn Patterson are also on the agenda (1445 GMT).

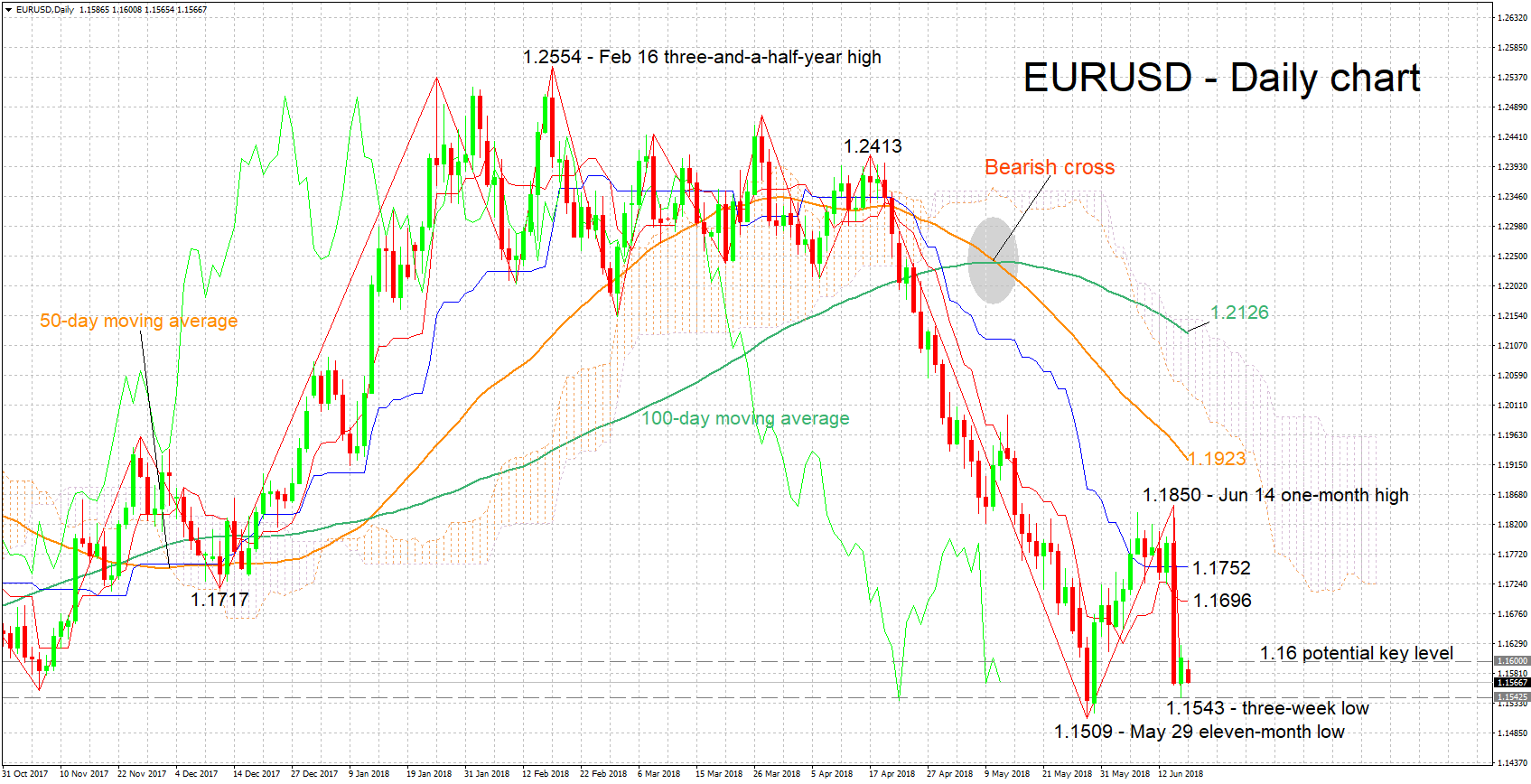

EURUSD is trading not far above Friday’s three-week low of 1.1543. The negatively-aligned Tenkan- and Kijun-sen lines are pointing to the existence of a negative bias in the short-term. The flat Kijun-sen though is an indication that bearish momentum has eased.

Upbeat comments on the eurozone economy by ECB President Mario Draghi at the ECB Forum can lift the pair. Resistance could initially occur at the 1.16 round figure before the attention turns to the area around the current level of the Tenkan-sen at 1.1696.

A cautious tone – as in last week’s ECB meeting – though by the ECB chief is likely to push EURUSD further down. Support could come around last week’s three-week low of 1.1543, with a downside violation increasingly shifting the focus to the region around late May’s 11-month low of 1.1509.

Origin: XM