Here are the latest developments in global markets:

Here are the latest developments in global markets:

FOREX: The dollar was roughly flat versus a basket of currencies on Thursday, though it was losing ground versus the safe-haven perceived yen as risk sentiment was dented on worries over rising trade tensions. Elsewhere, the kiwi came under pressure after New Zealand’s growth numbers fell short of forecasts.

STOCKS: US markets closed lower yesterday, as concerns over the possibility of a trade war with China continued to undermine risk appetite. The Dow Jones tumbled by 1.0%, the S&P 500 fell 0.6%, while the Nasdaq Composite declined by 0.2%. That said, futures tracking the Dow, S&P, and Nasdaq 100 are all pointing to a positive open today. Asian markets were mostly higher, albeit not significantly so. In Japan, the Nikkei 225 gained 0.1%, while the Topix barely closed in the green. In Hong Kong, the Hang Seng climbed by 0.3%. Europe was a more optimistic story, with futures tracking all the major indices being safely in positive territory, signaling that these benchmarks may open higher.

COMMODITIES: In energy markets, oil prices experienced another volatile session yesterday. They initially fell after the weekly EIA data revealed a larger-than-anticipated build in crude inventories, but managed to recover almost all of their losses in the following hours. Both WTI and Brent crude are trading practically unchanged today. In the near-term, prices will likely continue to be driven by any updates around the surge in US production, as well as risk sentiment in general. In precious metals, gold prices are also more or less flat today, last trading near the $1325 per ounce mark. It’s worth noting that the reduction in investors’ risk appetite has done little to support gold in recent days, with traders seemingly favoring the Japanese yen instead as a safe-haven play.

Major movers: Dollar retreats versus yen on trade worries, retail sales also weigh on currency; kiwi records losses as growth numbers disappoint

The dollar index was little changed at 89.73 after adding 0.1% the previous day. The greenback was losing ground versus the yen though, which was attracting safe-haven flows on the back of investors’ angst over a possible escalation of global trade tensions. Dollar/yen was 0.25% down, having fallen to an eight-day low of 105.77 earlier in the day.

US equities came under pressure on Wednesday following weaker-than-expected retail sales data, but also the Trump administration’s intention to impose fresh tariffs on China which weighed on risk appetite. Markets seem to fear tit-for-tat retaliatory actions by China that might push the situation out of control. The aforementioned disappointing retail sales figures also acted to the US currency’s detriment.

Following the narrative that US officials will seek a weak-dollar policy, especially after some comments made earlier in the year by US Treasury Secretary Steven Mnuchin, it is interesting that Larry Kudlow, the incoming director of the White House National Economic Council, supported a strong dollar yesterday, adding that it is important for the health of the US economy. Still, the country’s stance on trade seems to have much greater capacity to drive the currency at the moment than such comments on dollar strength.

Euro/dollar traded higher by less than 0.1% at 1.2371, after being hurt yesterday following some dovish-perceived comments by ECB President Mario Draghi. Meanwhile, pound/dollar traded higher by around 0.2% at 1.3982, not far below yesterday’s two-week high of 1.3996.

The kiwi came under selling pressure earlier in the day as New Zealand Q4 GDP figures surprised to the downside. It is notable though that the currency managed to recover a significant part of earlier losses, with kiwi/dollar trading lower by 0.1% at around 0.7320 at 0731 GMT. Aussie/dollar was 0.15% down at 0.7865. Both the aussie and the kiwi posted three-week highs versus their US counterpart during Wednesday’s trading.

Day ahead: SNB & Norges Bank policy decisions in the spotlight

During the early European session, both the Swiss National Bank (SNB) and Norway’s Norges Bank will announce their rate decisions, at 0830 GMT and 0900 GMT respectively. With regards to the SNB, the forecast is for no change in policy, so investors will likely be looking for signals on whether the Bank is contemplating an eventual exit from its negative interest rates policy. That said, with Swiss inflation still subdued, the Bank is unlikely to provide any such signals, especially since doing so would risk a sharp appreciation in the exchange rate that could make it even harder for inflation to reach its target. A broadly dovish tone on policy and a reiteration that the Swiss franc remains “highly valued”, could bring the currency under renewed selling interest on the news, particularly versus the strong euro.

As for the Norges Bank, it is expected to keep its policy unchanged as well and thus, focus will be on any signals regarding the timing of the first planned rate hike in Norway. The latest projections the Bank provided back in December suggested that the first hike could come in December 2018 and markets will concentrate on whether that timing is brought forward, or pushed backwards. Taking a look at economic data, they suggest that a hawkish revision in the rate path may be more likely, as the unemployment rate has stayed very low, GDP growth is solid, and core inflation surprised to the upside in February. Should the Bank indeed signal that a September rate hike has now become more likely for instance, the NOK could gain on the decision.

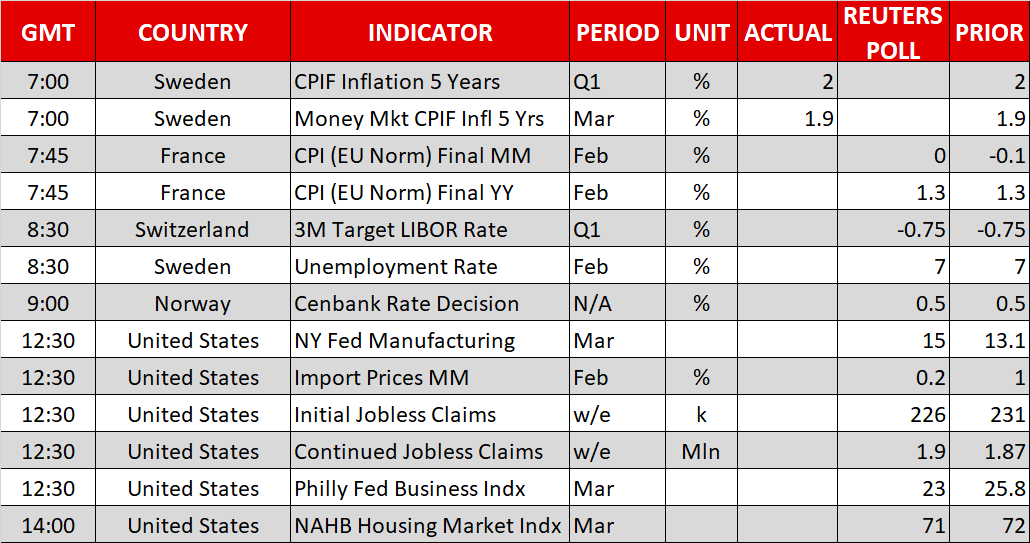

In terms of economic data, the only noteworthy releases will be in the US. Both the New York Fed and the Philly Fed will release their manufacturing surveys for March, at 1230 GMT. While neither of these is usually a major market mover, they could provide some indications of how the manufacturing sector fared in the final month of the first quarter. At the same time, the nation will also release its initial jobless claims for the week ended March 9, while at 1400 GMT, the NAHB housing market index for March is due out.

In equity markets, investors will continue to be on the lookout for updates on the trade front, as they gauge the probability of recent tensions escalating into a full-blown trade war. In particular, any news regarding the tariffs that the US is reportedly preparing against China will be of importance. Note that the newly-appointed director of the National Economic Council, Larry Kudlow, noted yesterday that China has “earned a tough response” on trade.

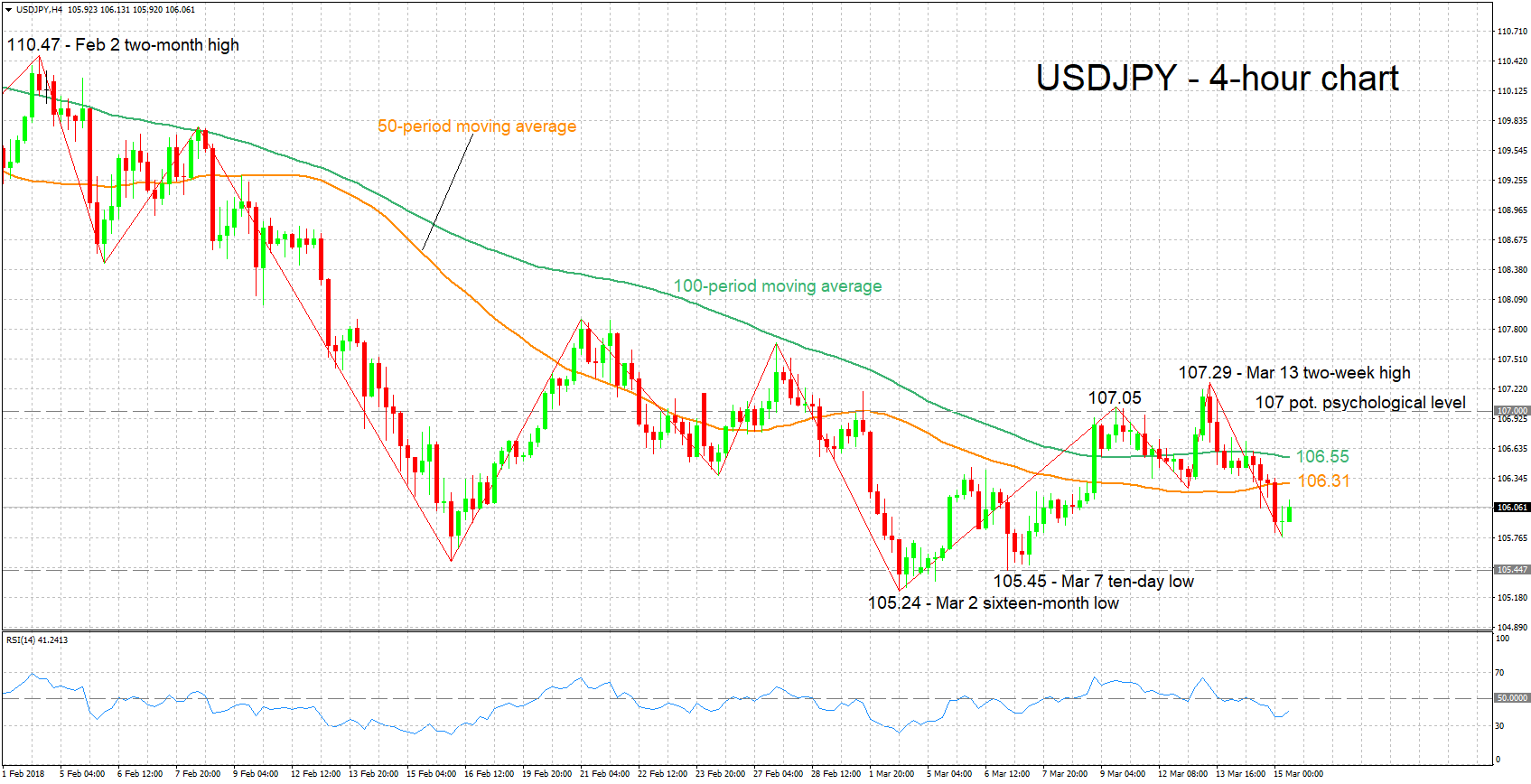

Technical Analysis: USDJPY posts 8-day low; looking bearish in the near-term

USDJPY has declined after reaching a two-week high of 107.29 on March 13. Earlier on Wednesday the pair recorded an eight-day low of 105.77. The RSI has been falling, crossing below the 50 neutral-perceived level and pointing to a bearish short-term picture.

Upbeat data on initial and continued jobless claims due later in the day could see USDJPY heading higher. Resistance in this case could come around the 50- and 100-period moving averages at 106.31 and 106.55 respectively. An additional barrier in case of an upside break might come around the 107 handle, a potential psychological level with the area around it being congested as well as encapsulating a couple of peaks from the recent past.

A data miss might see the pair posting losses. The area around March 7’s ten-day low of 105.45 might offer support, with the sixteen-month low of 105.24 from earlier in the month coming next into view in case of steeper declines.

Risk sentiment – increasingly driven by developments on trade lately – also has the capacity to spur movements in the pair.

Origin: XM