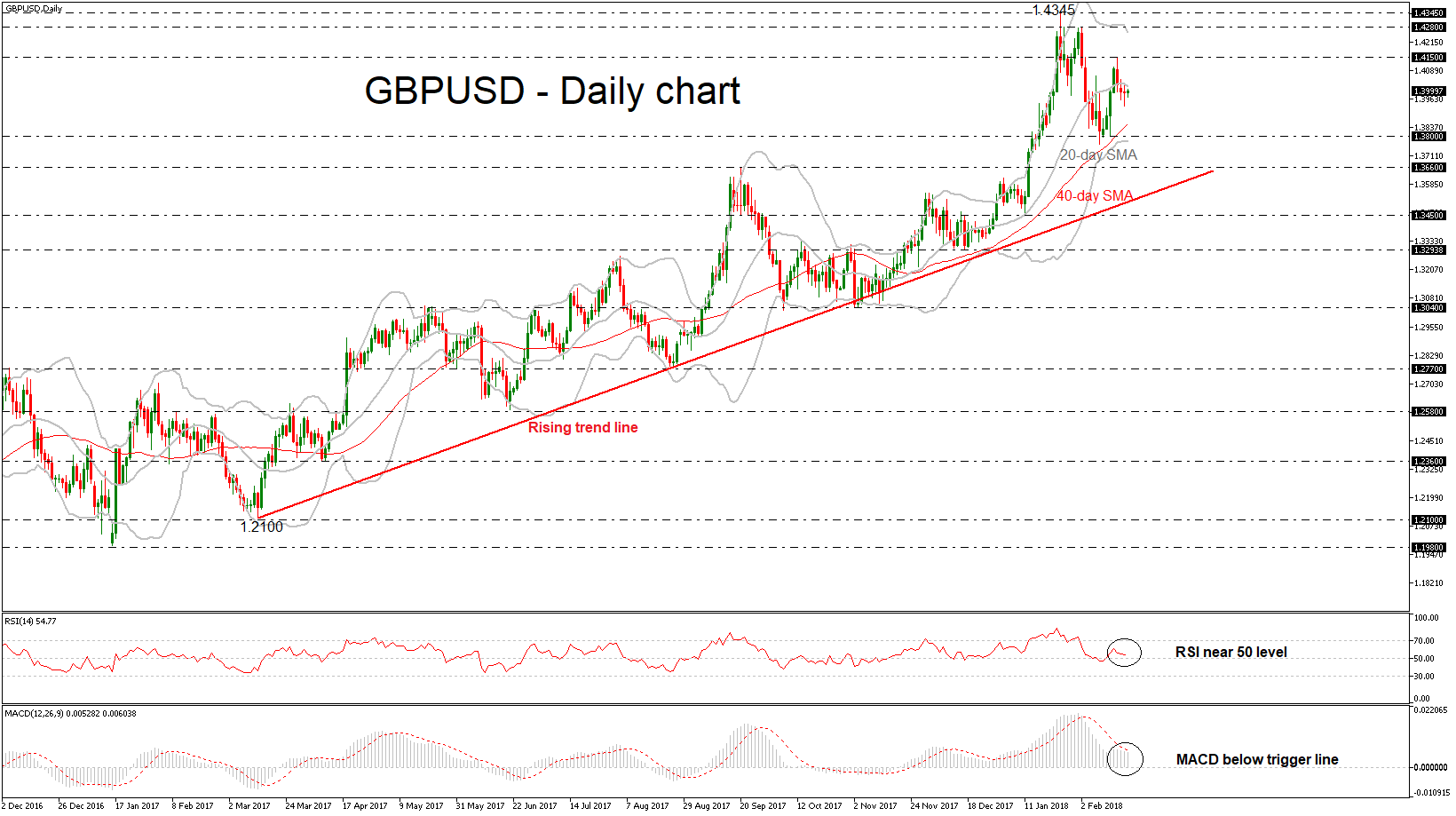

GBPUSD remains under pressure and risk is still to the downside as prices continue to drift lower from the 1.4150 resistance level. The short-term technical indicators are bearish and point to more weakness in the market, while the price capped by the 20-day simple moving average of the Bollinger band.

GBPUSD remains under pressure and risk is still to the downside as prices continue to drift lower from the 1.4150 resistance level. The short-term technical indicators are bearish and point to more weakness in the market, while the price capped by the 20-day simple moving average of the Bollinger band.

Looking at the daily timeframe, the Relative Strength Index (RSI) is moving in the positive territory and is approaching the 50 level. Also, the MACD oscillator is holding below its trigger line, however, is still holding above the zero line.

Remaining in the same timeframe, if price continues the downside retracement and extends its losses, it could open the door for the 1.3800 strong psychological level. If there is a fall below the latter level, there would be scope to test the next immediate support of 1.3770, which is near with the lower Bollinger band.

To the upside, cable could move towards the 1.4150 resistance level, taken from the peak on February 16. A break above the aforementioned obstacle could take the price towards the 1.4280 resistance level, which is standing near the upper Bollinger band.

Origin: XM