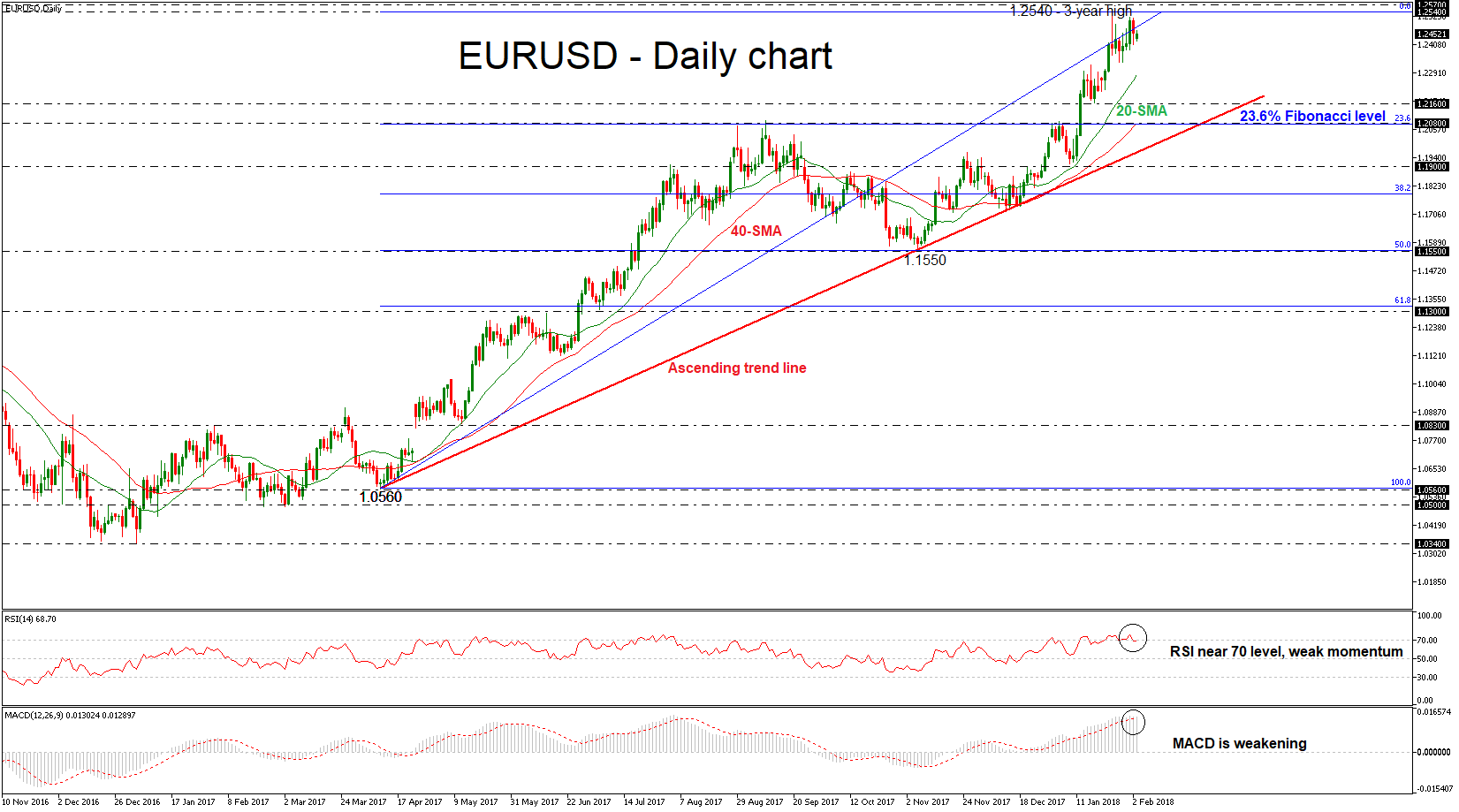

EURUSD posted a strong positive January while this month started with downside pressure. The US dollar strength drove the pair lower on Friday and failed to hit again the three-year high of 1.2540. The short-term technical indicators are flat and point to more weakness in the market.

EURUSD posted a strong positive January while this month started with downside pressure. The US dollar strength drove the pair lower on Friday and failed to hit again the three-year high of 1.2540. The short-term technical indicators are flat and point to more weakness in the market.

Having a look on the daily timeframe, the Relative Strength Index (RSI) dropped slightly lower of the 70-overbought level at 68, suggesting that the latest upswing may be running out of steam and that the risk of a near-term correction is high. Additionally, the MACD oscillator is holding near its trigger line and is ready to create a bearish crossover in the positive territory, indicating further losses.

Should prices reverse lower, immediate support could come near the 1.2280 price level, which is the 20-day simple moving average at the time of writing. Below that, the 1.2160 barrier is another major support, while a drop below this area could take the price closer to 1.2080, which overlaps with the 23.6% Fibonacci retracement level of the up-leg from 1.0560 to 1.2540. Moreover, near 1.2080 the 50-day SMA is holding and is pointing to the upside. So, the aforementioned barrier is acting as a strong obstacle for the bears.

On the flip side, there is immediate resistance at 1.2540, while above it, the next major resistance to watch is 1.2570 taken from the high of December 2014.

Origin: XM