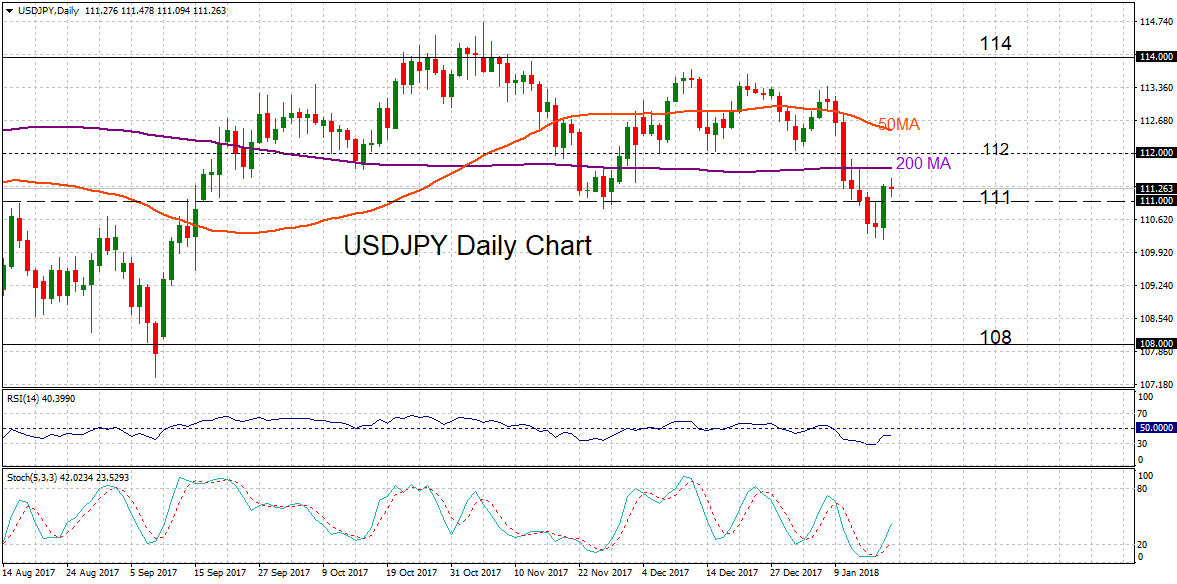

USDJPY has made a recovery to regain the 111 handle but the pair essentially remains in a neutral phase since mid-September. Momentum oscillators have improved and could potentially lead to another leg higher.

USDJPY has made a recovery to regain the 111 handle but the pair essentially remains in a neutral phase since mid-September. Momentum oscillators have improved and could potentially lead to another leg higher.

There is immediate resistance at the 200-day moving average at 111.68. Prices need to at least rise above the 50-day MA (currently at 112.50) to see that USDJPY is moving into a more bullish phase in the near term. However, the top of the range at 114 needs to be breached soon in order to confirm that the market is shifting its underlying trend to bullish from neutral.

To the downside, the 111 level remains a key support level which if breached would place USDJPY under increased pressure and the focus would shift to the 108 area.

In the bigger picture, the market does not have any clear direction and this is indicated by the flat moving averages. USDJPY is expected to consolidate within its established 4-month range between 111 and 114. The near-term risk could tilt back to the downside unless the bulls remain in control to lift the market back above the 200-day MA.

Origin: XM