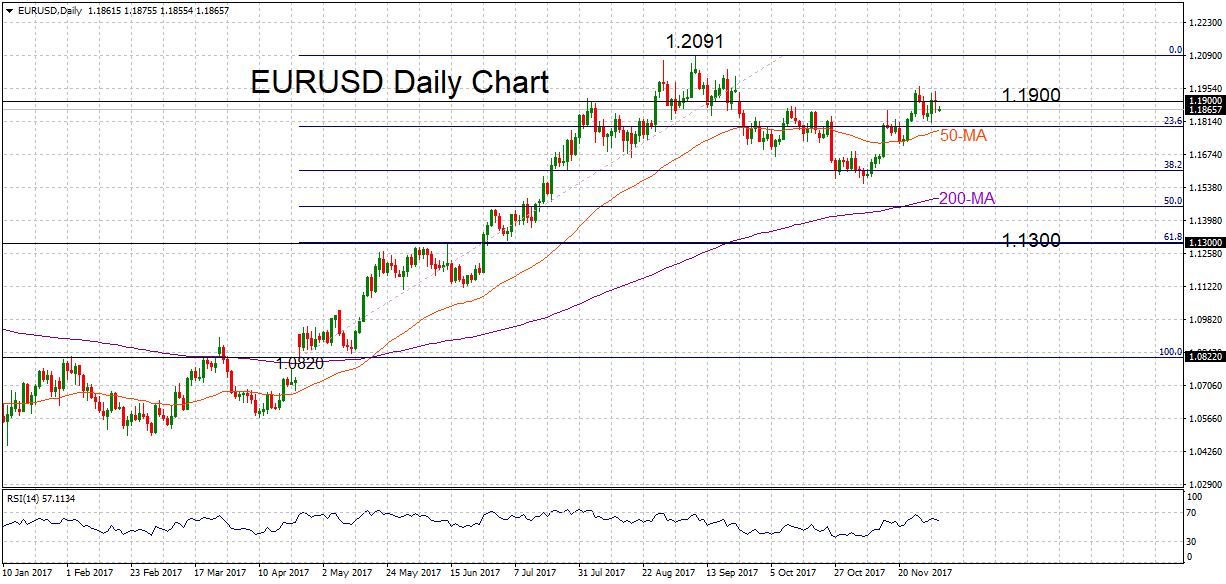

EURUSD is consolidating recent gains after a strong rally from the 1.1600 area to 1.1900. A neutral phase is expected in the near-term as the market became overextended and the daily RSI indicator is indicating momentum has weakened after reaching near overbought levels at 70.

EURUSD is consolidating recent gains after a strong rally from the 1.1600 area to 1.1900. A neutral phase is expected in the near-term as the market became overextended and the daily RSI indicator is indicating momentum has weakened after reaching near overbought levels at 70.

EURUSD is expected to be supported on dips at key Fibonacci levels. The first level is at 1.1790, which is the 23.6% Fibonacci retracement level of the uptrend from 1.0820 to 1.2091. Below this, there is a support zone between 1.1553 (November 7 low) and 1.1606 (38.2% Fibonacci). Any further extension lower would target 1.1455 and the key 1.1300 area. From here the trend would start turning bearish.

The overall bullish undertone is expected to remain strong as long as EURUSD stays above the 50-day moving average (currently at 1.1776). Breaking key resistance at 1.1900 would open the way for a re-test of 1. 2091.This is a level not seen since the end of 2014 and so rising above it would propel the market towards the 1.2600 handle.

The broader uptrend remains in progress with no signs of a reversal. The 50 and 200-day moving averages are positively aligned and supporting the bullish outlook.

Origin: XM