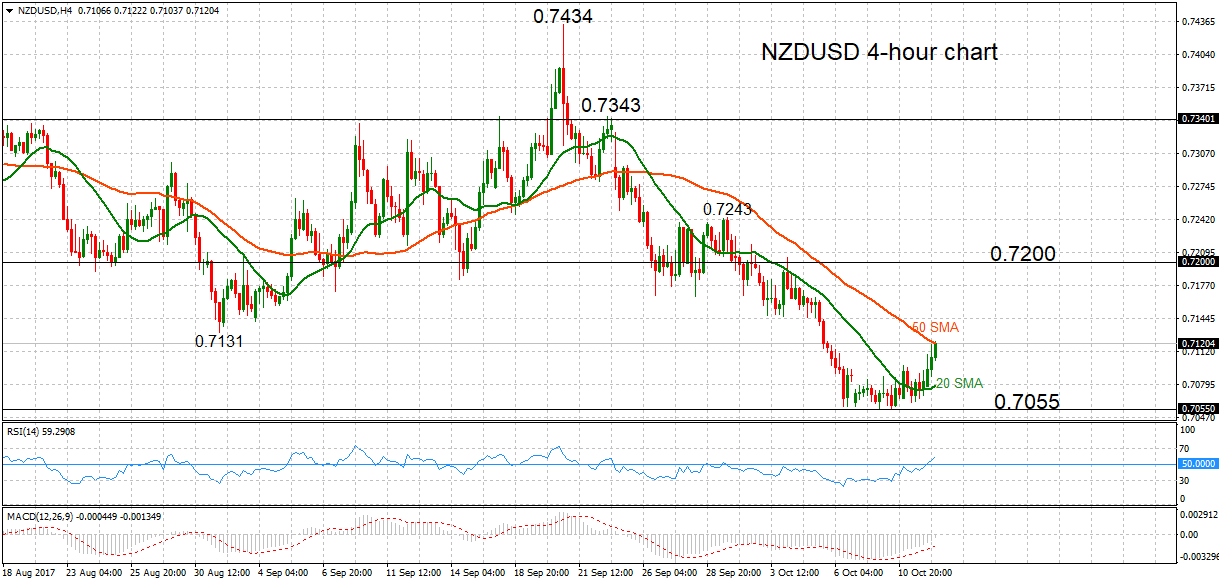

NZDUSD is shifting out of a neutral phase and the bias is tilted to the upside. The 4-hour chart analysis shows that the market was consolidating near 0.7055 and then rallied towards the 50-period moving average where momentum stalled. But there is room for more upside since the RSI indicator is in bullish territory.

NZDUSD is shifting out of a neutral phase and the bias is tilted to the upside. The 4-hour chart analysis shows that the market was consolidating near 0.7055 and then rallied towards the 50-period moving average where momentum stalled. But there is room for more upside since the RSI indicator is in bullish territory.

A valid breakout above 0.7120 could propel prices towards the key 0.7200 psychological level. Further strength in the market would change the September 20 to October 10 bearish trend and shift the focus back to the upside towards important highs at 0.7243 and 0.7343 ahead of the September 20 peak at 0.7434. Rising above this would open the way for an extension to the July peak at 0.7557.

Alternatively, prices could remain capped below the 50-period MA to target the low at 0.7055. A move below this would see a resumption of the recent downtrend with scope to target the major low at 0.6817.

Near-term risk remains to the upside and the recent downtrend is expected to take a pause above 0.7055. But only a move above 0.7200 would indicate the end to the September-October downtrend. The negative alignment of the 20 and 50-period moving averages are keeping the bearish picture in play.

Origin: XM