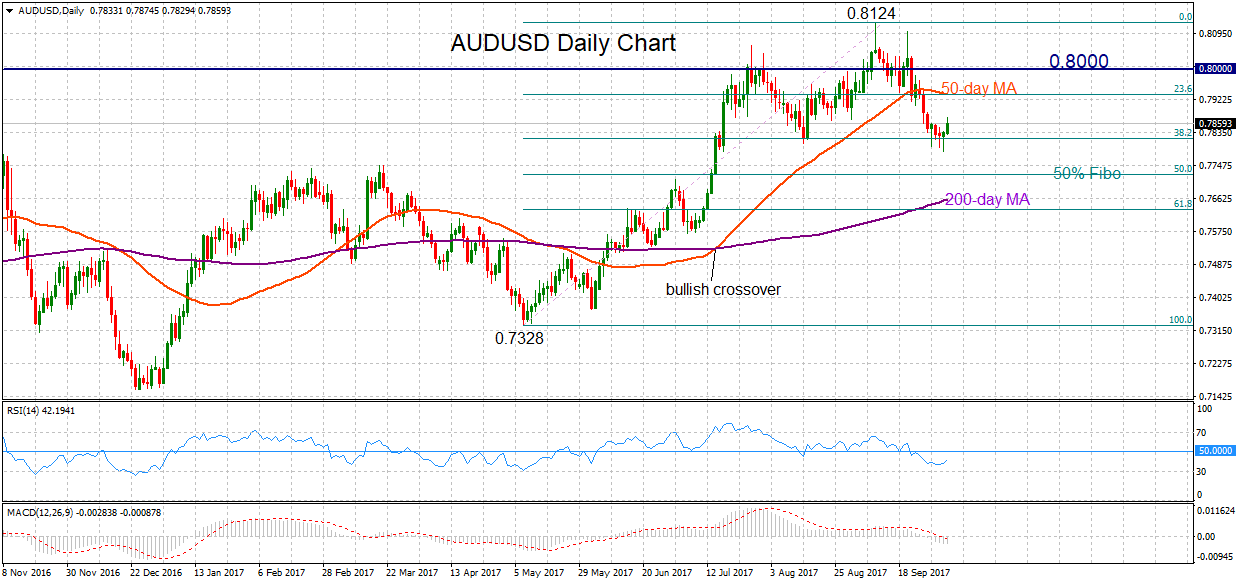

AUDUSD maintains a neutral bias in the medium term and has shown signs of stabilization after a recent decline. The pair has been trading sideways within a range of 0.7817 and 0.8124 since July. The recent bearish phase has stalled and suggests that the decline could be more of a corrective move of the rally to the highest level since May 2015 rather than a change in the broader bullish trend.

AUDUSD maintains a neutral bias in the medium term and has shown signs of stabilization after a recent decline. The pair has been trading sideways within a range of 0.7817 and 0.8124 since July. The recent bearish phase has stalled and suggests that the decline could be more of a corrective move of the rally to the highest level since May 2015 rather than a change in the broader bullish trend.

Strong support was found at 0.7817, which is the 38.2% Fibonacci retracement level of the upleg from 0.7328 to 0.8124. Despite several tests of this level in the past few days, AUDUSD was able to record daily closes above it until a strong rebound today. This indicates that downside pressure has eased for now. This is also evident in the RSI which has stopped falling.

Should prices extend higher, there is resistance at 0.7933, which is the 23.6% Fibonacci and also where the 50-day moving average is converging. Above this, the key psychological 0.8000 level comes into view and from here the odds would increase for a rise towards the 0.8124 high. Clearing this peak would see a resumption of the broader uptrend with scope to extend gains towards 0.8300.

Should support at 0.7817 fail to hold then prices could decline to 0.7723. This is the 50% Fibonacci and breaking below it would increase the risk of reversing the May to September uptrend. Further weakness would push prices to 0.7631 (61.8% Fibonacci) and focus would turn to the 0.7328 low.

Looking at the bigger picture, the broader market structure is neutral to bullish and there are no clear signs of a trend reversal yet. The 50 and 200-day moving averages are still positively aligned although the 50-day MA has stopped rising. This raises caution as AUDUSD is still vulnerable to weakness in the near term since MACD is falling and has dropped below zero. RSI is in bearish territory below 50. The oscillators suggest risk is tilted to the downside in the near term.

Origin: XM