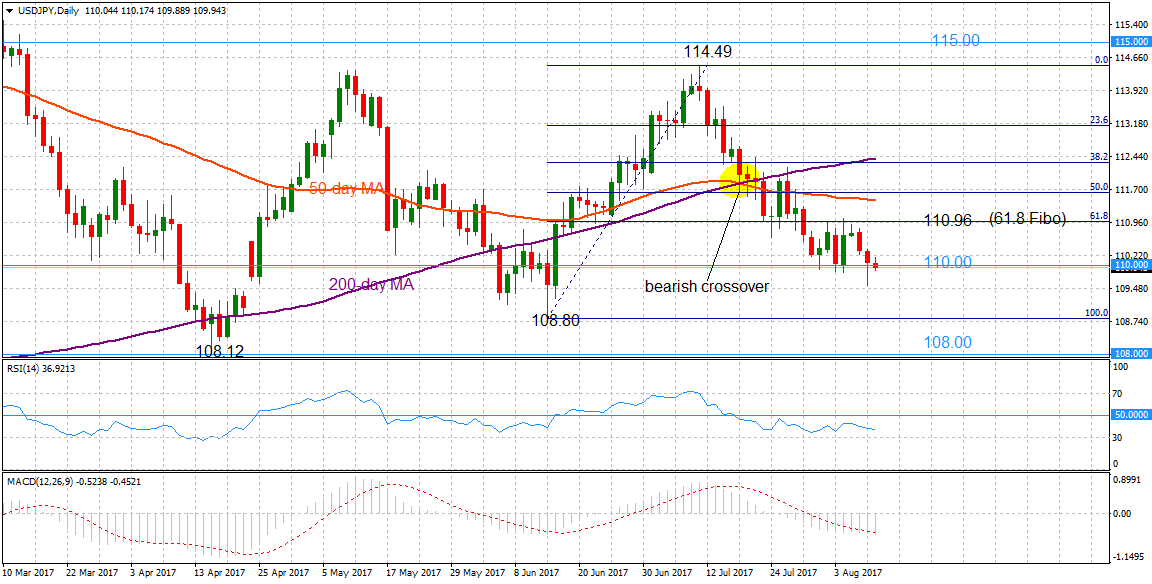

USDJPY maintains risk to the downside as momentum indicators are bearish and not yet oversold, giving scope for further declines. The market has been neutral in the past two months and has not closed below the key 110.00 level since June 14.

USDJPY maintains risk to the downside as momentum indicators are bearish and not yet oversold, giving scope for further declines. The market has been neutral in the past two months and has not closed below the key 110.00 level since June 14.

After dipping to 109.55 yesterday, prices bounced back but a daily close below the critical 110.00 level would increase downside pressure for a move towards the June 14 low of 108.80, bringing a shift to a bearish phase, with scope to target the April 17 low of 108.12.

Only a move back above 110.96 would weaken downside pressure. It would be a challenge to break this level which has acted as strong resistance in the past week. It is the 61.8% Fibonacci retracement level of the rise from 108.80 to 114.49. The next target resistance would be the 50% Fibonacci at 111.60, which is close to the 50-day moving average. A break above the 200-day moving average and a move into the 113.00 handle would improve the odds for a re-test of the June 11 high of 114.49 and bring a resumption of the June to July uptrend.

The bearishly aligned moving averages after the crossover of the 50-day below the 200-day MA on July 17, along with the bearish momentum signals, increase the risk of a shift to a bearish phase from the current neutral one.

Origin: XM