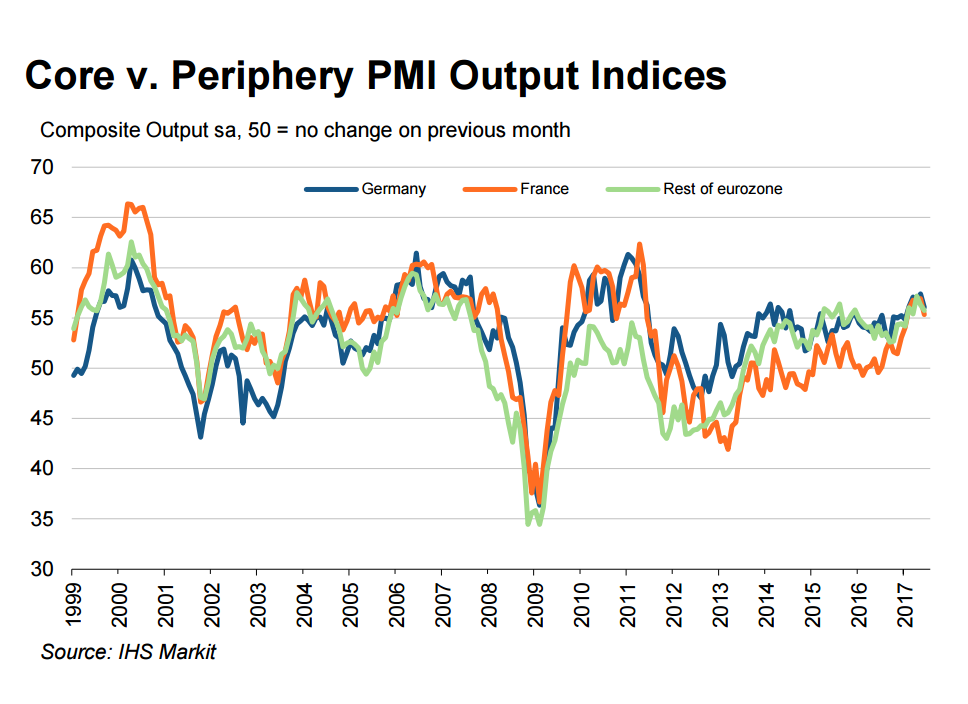

Activity across the Eurozone lost some momentum in June, however the region still managed to enjoy its best quarter in six years according to the latest PMI report from IHS Markit. Weaker growth in the services sector led to a drop in the composite PMI, which fell from 56.8 to 55.7 in June’s flash reading. This was below expectations of 56.6 and the lowest in five months.

Activity across the Eurozone lost some momentum in June, however the region still managed to enjoy its best quarter in six years according to the latest PMI report from IHS Markit. Weaker growth in the services sector led to a drop in the composite PMI, which fell from 56.8 to 55.7 in June’s flash reading. This was below expectations of 56.6 and the lowest in five months.

The services PMI also fell to a 5-month low, declining from 56.3 to 54.7 in June and missing forecasts of 56.2. The manufacturing PMI fared better though as it improved to a more than six-year high of 57.3 from 57.0 in May, which was above expectations of a drop to 56.8. Separate figures for Germany and France showed that manufacturing was also the stronger performing sector in June, with services activity slowing in both countries.

Despite the softer readings though, all the indications are that the Eurozone economy is maintaining its strong momentum since the start of the year. New business orders rose further in June, with manufacturers reporting their best month since February 2011. Employment growth was unchanged but remained near 10-year highs.

In perhaps a worrying sign for the European Central Bank, both input and output prices moderated further in June, supporting the Bank’s view that underlying inflationary pressures have yet to show sustained upside momentum.

The euro, which had already been climbing during Asian trading, hit a four-day high of 1.1187 dollars after the data. However, it quickly fell back to 1.1165 dollars by mid-European session. It also eased against the yen to stand flat on the day at 124.16, while against the pound, it was down at 0.8770 pounds.

Today’s numbers are unlikely to worry policymakers as for the quarter ending in June, the PMI readings imply GDP growth of 0.7%, which would be the highest since 2015. With the ECB in no rush to scale back its asset purchases just yet and with the political uncertainty diminishing sharply, growth prospects in the euro area should continue to improve further for the rest of 2017. Stronger growth should eventually drive core inflation higher and will likely put the ECB on track to begin tightening its accommodative stance in January 2018.

Origin: XM