UK Consumer Price Index (CPI) data for the month of May showed annual inflation climbing to a near four-year high. Sterling experienced volatility as the data hit the markets.

UK Consumer Price Index (CPI) data for the month of May showed annual inflation climbing to a near four-year high. Sterling experienced volatility as the data hit the markets.

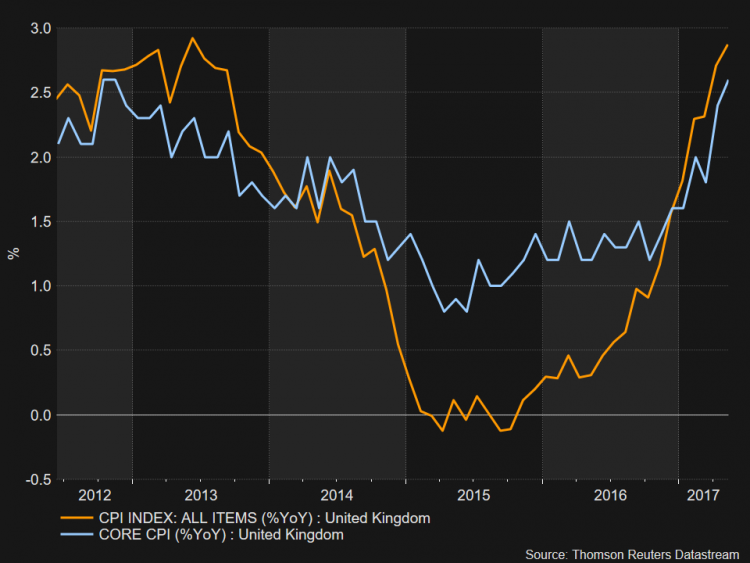

Turning to the numbers, the annual inflation rate for May stood at 2.9%, above expectations and April’s respective rate, both at 2.7%. On a monthly basis, inflation rose 0.3% in May, beating expectations of a 0.2% rise but coming below April’s 0.5%. The core measure of inflation, which excludes volatile components related to energy and food products, recorded a 2.6% rise, beating forecasts of 2.4%.

The main factors contributing to higher inflation for the month were the increased cost of holidays abroad for Brits who have to pay more for their euros and dollars due to the weakening pound, as well as computer games and equipment which faced added inflationary pressure from the falling pound as they’re typically imported.

Higher inflation rates are likely starting to feed into consumers’ spending habits who are seeing their purchasing power getting diminished as wage growth doesn’t seem to be keeping up with inflation. Reduced consumer spending is affecting the nation’s overall growth. Adding to that the political uncertainty following the latest elections and the Conservatives’ failure to gather a majority in parliament, and a negative backdrop seems to have formed for the British economy. Moreover, Prime Minister Theresa May’s Brexit-strategy is now put into question.

In terms of market reaction, the pound was volatile against the dollar and the euro upon release of the numbers. In European trading hours, the British currency stands higher relative to both the greenback and the euro following significant backtracking in the previous days. Pound/dollar last traded at 1.2730 and euro/pound at 0.8804.

Despite the elevated inflation, the Bank of England is expected to announce that it has maintained its key rate at the record low 0.25% on Thursday’s Monetary Policy Committee (MPC) announcement. In the past, the Bank said that it will tolerate inflation in excess of its 2% target because at the moment there’s no indication of a longer-lasting inflation problem being formed. Some analysts have expressed the view that the BoE might even postpone its rate normalization plans if the British economy faces additional setbacks as a result of the added layer of political uncertainty following the elections.

Origin: XM