Do you want to get all in one? Do you want to find a perfect liquidity provider who will give you quality at good price? Now it’s possible, as B2Broker provides liquidity at terms that may satisfy the pickiest broker.

Here you can find the direct access to the largest ECN platform. Such a technology allows to aggregate liquidity from different banks, liquidity providers and dark pool.

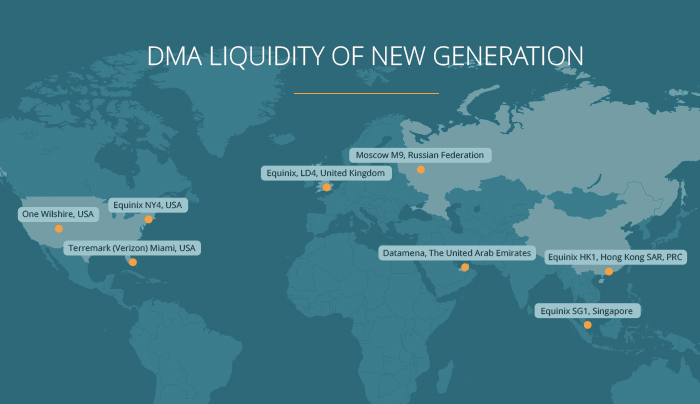

B2Broker uses DMA (Direct Market Access) technology. It means that each order gets into market depth directly and “creates” the market.

Moreover, you get the access to 20 levels of market depth with possibility to place orders at any level of the book. This way every broker becomes a price-maker. Order routing sends an order to the liquidity provider offering the best price.

We also need to say some words about the asset range. B2Broker gives an access to 9 assets classes including more than 1.5K of trading instruments. Besides Forex market, here you will find metals, indices, energy, commodities, stocks, cryptocurrencies, ETF and futures.

B2Broker offers several options of liquidity linkup – any broker can find the best way that suits him most. For example, DMA Liquidity via FIX API will offer you the thickest market depth. And this means the best spread and quoting for its traders.

You can choose access through Cloud B2Bridge which will allow a broker to manage its risks easily switching the accounts and account groups between A-Book and B-Book models.

For brokers just starting its business White label may become the best choice, as you may focus your attention solely on customer acquisition, and B2Broker manages all the rest. You will not need to take care of platform customization, trading terms, instruments offering and the direct process of liquidity provision.

B2Broker may offer you the best environment for successful business.

COO of B2Broker, Evgeniya Mikulyak