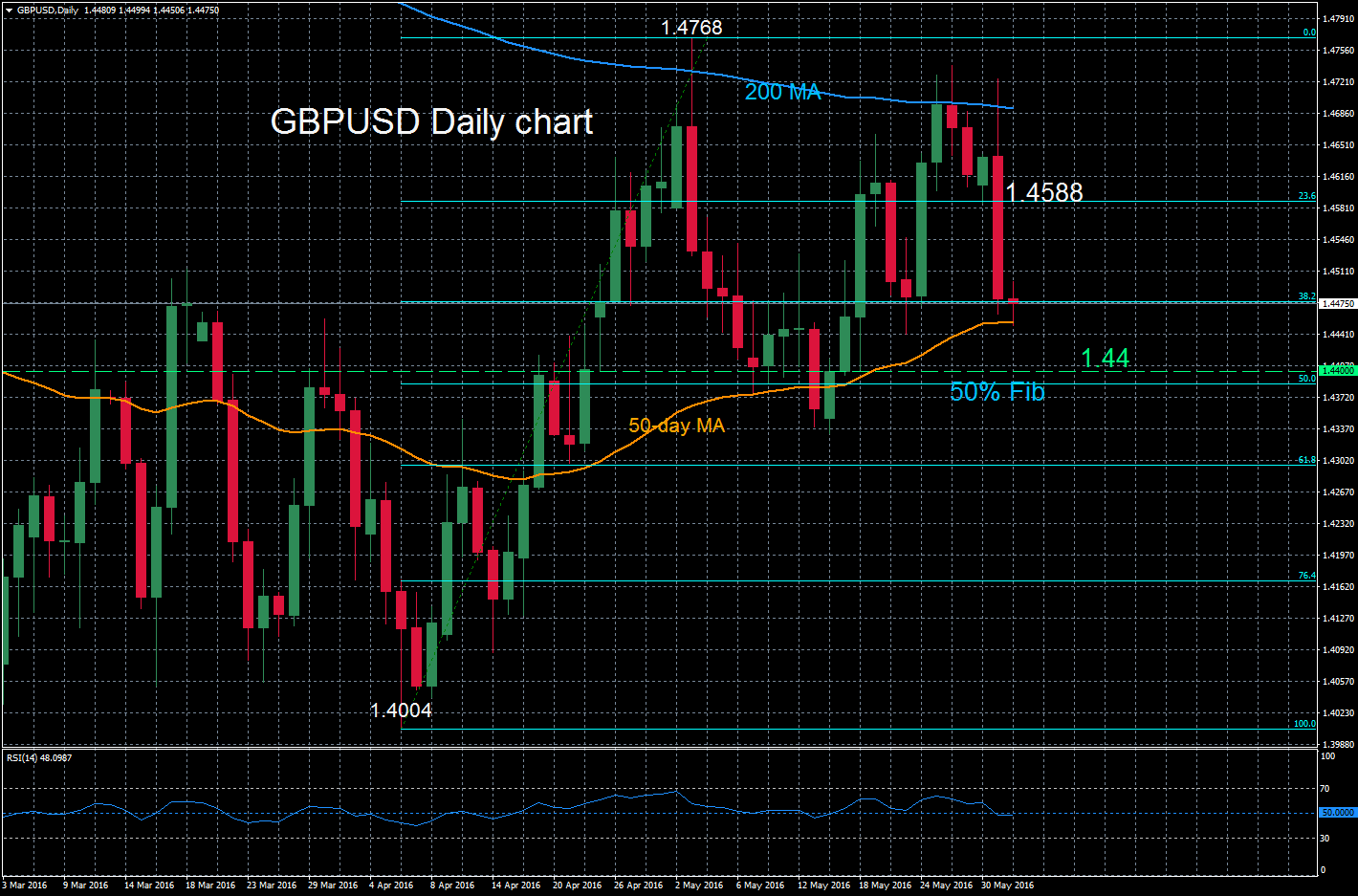

GBPUSD is now forming a neutral bias after the bullish move from 1.4004 to 1.4768 stalled and the market is consolidating just above the 50% Fibonacci of this upleg from April to May. This Fibonacci level lies just below the key psychological 1.44 level at 1.4386.

GBPUSD is now forming a neutral bias after the bullish move from 1.4004 to 1.4768 stalled and the market is consolidating just above the 50% Fibonacci of this upleg from April to May. This Fibonacci level lies just below the key psychological 1.44 level at 1.4386.

The high of 1.4768 is the extent of the bullish phase and the short term bias has shifted to neutral as long as the market remains above the 50% Fibonacci.

Immediate support is provided by the 50-day moving average at 1.4453. To the upside resistance is at the 200-day moving average at 1.4691.

Momentum has turned bearish as the RSI has dipped below 50, suggesting the risk of further downside. If the 50-day moving average fails to support the market, then a break below it would target the 1.44 level and the 50% Fibonacci.

Then a break below this would accelerate a decline towards the 61.8% Fibonacci at 1.4296. Such a move would indicate that the market has shifted to a bearish trend.

Origin: XM